Ripple bears triumph over the bulls: XRP/USD Plunges under $0.38 support

|

- Ripple corrects below key support ahead of the weekend session.

- The technical picture for XRP/USD has a bearish bias in the near-term.

Ripple bears are gaining traction on Friday ahead of the weekend trading. Just at the time investors were beginning to get used to the consolidation above $0.38 support, XRP/USD dives below the support to trade at $0.3767 at the time of writing.

The correction is not unique to Ripple, as Bitcoin has also dived below $11,000 after staying above the same level since the recovery from the lows under $10,000. Bitcoin cash has also corrected below $400 level while Litecoin continues to explore the levels below $120.

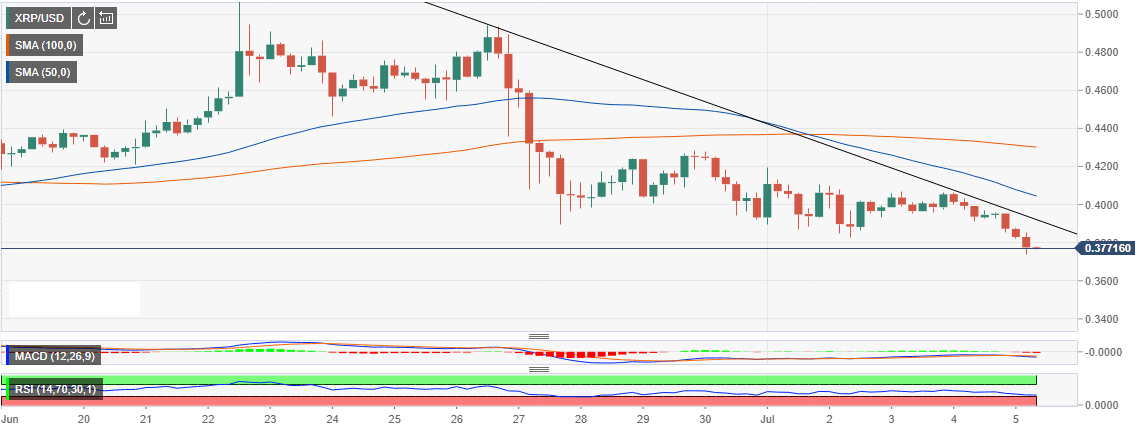

The technical picture shows XRP having a strong bearish bias in the short-term. The price is not only exchanging hands below the moving averages but also the 50 Simple Moving Average (SMA) is increasing the gap below the 100 SMA 4-h. The Relative Strength Index (RSI) is grinding closer to the oversold while the Moving Average Convergence Divergence (MACD) divergence continues to increase inside the negative region.

XRP/USD 4-h chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.