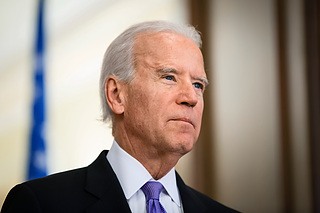

President Biden threatens crypto with possible veto of Bitcoin custody among trusted custodians

|

- Joe Biden could veto legislation that would allow regulated financial institutions to custody Bitcoin and crypto.

- Biden administration’s stance would disrupt US SEC’s work to protect crypto market investors and efforts to safeguard broader financial system.

- Standard Chartered and ex-SEC official John Reed Stark have previously said a Republican administration would be good for crypto industry.

There is expectation of a better environment for Bitcoin and cryptocurrency in general once a Republican administration is in office. For now, however, the current regime led by President Joe Biden’s Democratic Party, is constraining things for digital assets in a bold attempt to limit the ability of the US Securities & Exchange Commission (SEC) to ensure appropriate guardrails are in place to protect players in the crypto space.

President Biden threatens to veto crypto legislation

In a Statement of Administration Policy, US President Joe Biden has threatened to reject legislation that would allow highly-regulated financial firms to custody Bitcoin and crypto in general. Notably, these regulated firms are in fact the trusted custodians.

Statement of administration policy

Specifically, the Biden administration says, “If the president were presented with H.J. Res. 109, he would veto it.” H.J. Res. 109 refers to House Joint Resolution 109 in the United States Congress. Joint resolutions are legislative measures that require approval from the House of Representatives and the Senate, as well as the President's signature, to become law.

Politicians in support of H.J. Res. 109

US Congressman Patrick McHenry, Chairman of the House Financial Services Committee, expressed support for overturning the SEC's SAB 121. He stated, “Staff Accounting Bulletin, or SAB, 121 is one of the most glaring examples of the regulatory overreach that has defined Gary Gensler’s tenure at the SEC.” In his opinion, the Commission is trying to dictate how financial institutions and firms safeguard Americans’ digital assets under the guise of so-called staff guidance.

#WATCH: Chairman @PatrickMcHenry delivers remarks in support of H.J.Res. 109 to nullify SAB 121:

— Financial Services GOP (@FinancialCmte) May 8, 2024

"This bipartisan resolution is an essential effort to protect consumers and foster innovation in digital asset markets."

Read more https://t.co/jnIBJFHIPj

Watch pic.twitter.com/fOxOh8DtWH

#WATCH: Chairman @PatrickMcHenry delivers remarks in support of H.J.Res. 109 to nullify SAB 121:

— Financial Services GOP (@FinancialCmte) May 8, 2024

"This bipartisan resolution is an essential effort to protect consumers and foster innovation in digital asset markets."

Read more https://t.co/jnIBJFHIPj

Watch pic.twitter.com/fOxOh8DtWH

Another politician that has supported the policy is US Congressman French Hill, saying, "Holding reserves against the assets held in custody is NOT standard financial services practice. The Biden Admin's SAB 121 is misguided and should be nullified."

Holding reserves against the assets held in custody is NOT standard financial services practice.

— French Hill (@RepFrenchHill) May 8, 2024

The Biden Admin's SAB 121 is misguided and should be nullified. I thank @USRepMikeFlood for his excellent work in leading a CRA resolution to roll back the SEC's failure in their… pic.twitter.com/jwaTYWxhXs

Holding reserves against the assets held in custody is NOT standard financial services practice.

— French Hill (@RepFrenchHill) May 8, 2024

The Biden Admin's SAB 121 is misguided and should be nullified. I thank @USRepMikeFlood for his excellent work in leading a CRA resolution to roll back the SEC's failure in their… pic.twitter.com/jwaTYWxhXs

Politicians against H.J. Res. 109

Cody Carbone, Chief Policy Officer at The Chamber of Digital Commerce, an American advocacy group that promotes the Bitcoin industry in DC, is among those against this administration’s stance.

The general sentiment is that Bitcoin and crypto would be in better hands with a Republican president in office. Multinational bank Standard Chartered recently made this assertion, citing looser regulations and approvals for exchange-traded funds (ETFs).

In August 2023, ex-SEC official John Reed Stark had said the same thing, only in reference to ETFs, highlighting that crypto would have better prospects with a Republican president in office as this would mean a pro-crypto official such as Hester Pierce would lead the SEC.

Will the SEC Approve Any Of The Recent Bitcoin Spot ETF Applications?

— John Reed Stark (@JohnReedStark) August 13, 2023

People often ask for my opinion on whether the SEC will approve any of the recent spate of bitcoin spot ETF applications, which is an interesting and important question.

My take is that the current SEC will… pic.twitter.com/lPXebl03Y4

Will the SEC Approve Any Of The Recent Bitcoin Spot ETF Applications?

— John Reed Stark (@JohnReedStark) August 13, 2023

People often ask for my opinion on whether the SEC will approve any of the recent spate of bitcoin spot ETF applications, which is an interesting and important question.

My take is that the current SEC will… pic.twitter.com/lPXebl03Y4

Under the joint resolution, the SEC would be able to oversee the accounting obligations of some companies in an effort to safeguard crypto-asset investors. This entails technological, legal and regulatory risks that would otherwise prove financially harmful to consumers if they went unchecked. One of the ways the SEC has been doing this is ensuring that there are guardrails in place to address emerging issues relating to crypto assets, such as financial stability and registration.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.