Neo Price Analysis: NEO/USD bulls aim to conquer the $13 psychological level, but bearish correction may be around the corner

|

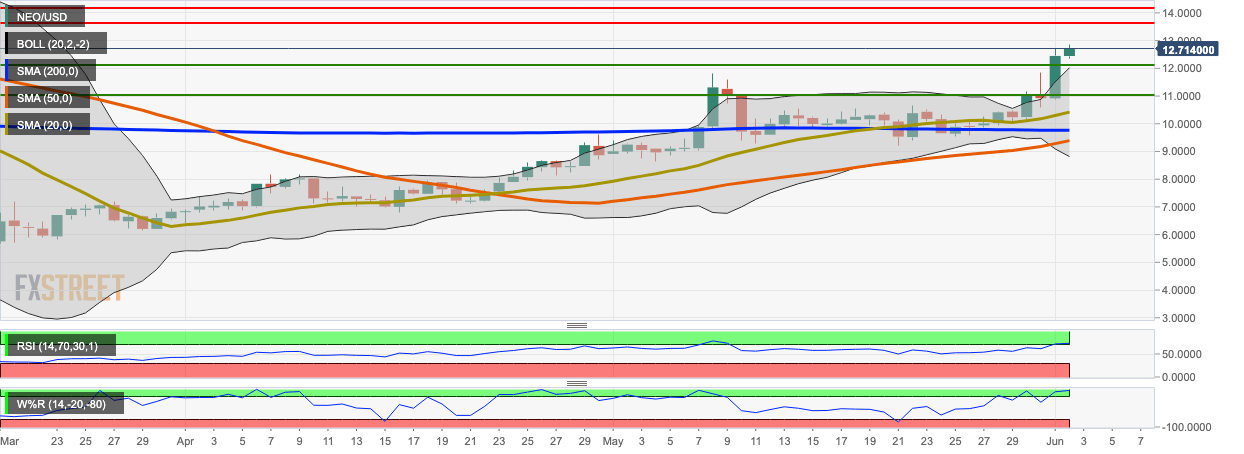

- NEO/USD bulls have pushed the price above the 20-day Bollinger Band, showing that it’s presently overvalued.

- The RSI indicator and William’s %R are both trending inside the overbought zone.

NEO/USD daily chart

NEO/USD went up from $12.45 to $12.72 in the early hours of Tuesday as the bulls stayed in control for the second straight day. The price has jumped above the 20-day Bollinger Band, indicating that it’s presently overvalued. Both the RSI indicator and William’s %R are trending inside the overbought zone, so a bearish correction is around the corner.

Support and Resistance

NEO/USD faces stiff resistance at $13.64 and $14.21. On the downside, healthy resistance lies at $12.15, $11, SMA 20, SMA 200 and SMA 50.

Key levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.