Near Protocol Price Forecast: NEAR bulls to catalyze 13% move

|

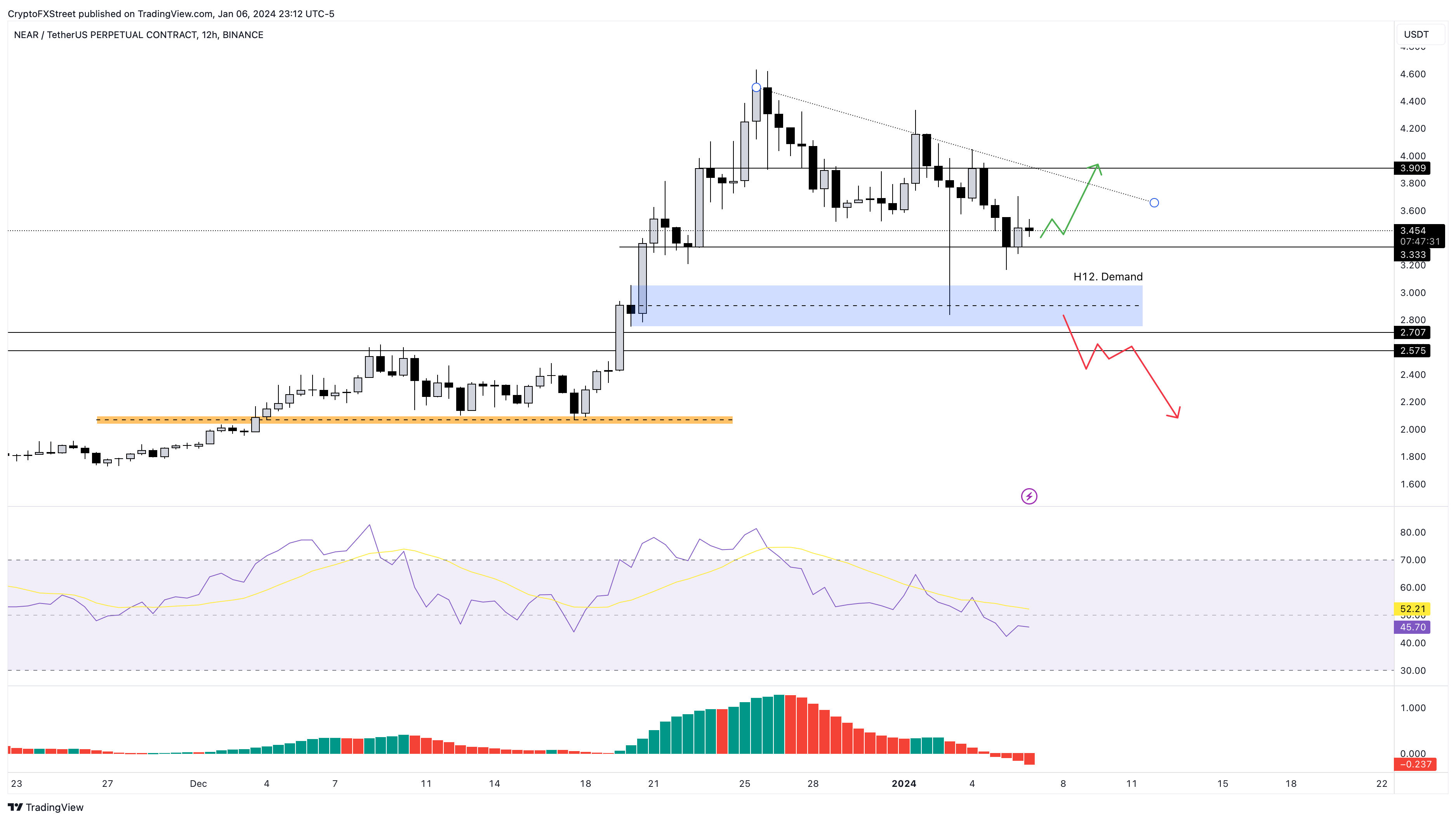

- Near Protocol price has bounced off a key support level at $3.33 and eyes a potential bounce.

- Investors can expect NEAR to inflate by 13% and tag the $3.90 resistance confluence.

- A better buying opportunity would be a retest of the 12-hour demand zone, extending from $2.75 to $3.05.

- A daily candlestick close below the $2.57 support level would invalidate the bullish thesis.

Near Protocol (NEAR) price is bouncing off a relatively stable support level, which could evolve into a quick pullback rally. NEAR holders need to be patient if this plan does not work out as it could lead to an even better buying opportunity.

Also Read: Bitcoin spot ETF approval could come as soon as Tuesday, new filings hint

Near Protocol price at crossroads

Near Protocol price is attempting to kickstart a recovery rally as it bounces off the $3.33 support level. Investors can expect a quick 13% upswing to $3.90 from where it currently trades at $3.45.

The reasoning behind this bullish idea comes after Near Protocol price swept the December 22, 2023, low at $3.20 and produced a bullish swing failure pattern that closed above the $3.33 support level.

Going forward, if NEAR bulls manage to hold above this level, it could lead to a quick 13% gain. In some cases, the altcoin might touch the $4.0 psychological level, bringing the total gain to roughly 16%.

This bullish outlook is a quick in/out trade as it involves the risk of the breakdown of the $3.33 support level. In such a case, Near Protocol price could slide down into the 12-hour demand zone, extending from $2.75 to $3.05.

This is another key area where sidelined buyers are likely to get interested in bidding, which could kickstart another recovery rally to $4.0.

NEAR/USDT 12-hour chart

Also read: BlackRock might be on track to create history with $2 billion inflows in spot Bitcoin ETF in a week

While the recovery rally outlook is a short-term play for intraday traders, NEAR price could slide lower on the daily timeframe. As mentioned above, investors can expect another 20% drawdown before the sidelined buyers are interested. But if the Near Protocol price produces a daily candlestick close below the $2.57 support level, it would create a lower low on a high timeframe and invalidate the bullish thesis.

In such a case, NEAR could slide 19% and encounter a support level at $2.06.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.