Mt. Gox transfers $172M Bitcoin to new wallets as BTC hovers near $107K

|

Mt. Gox, a long-bankrupt crypto exchange, transferred about $172.5 million worth of Bitcoin to an unknown wallet less than 24 hours after the cryptocurrency hit a new high of almost $108,000.

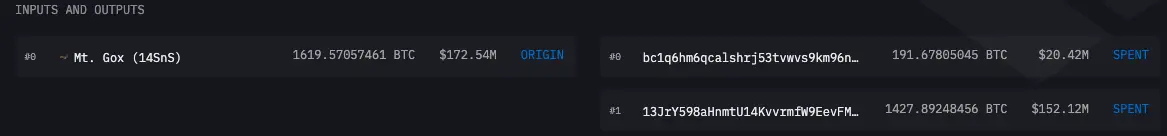

Arkham Intelligence shows the exchange moved 1,619.6 Bitcoin BTC $106,718 to two untagged addresses on Dec. 17, split between a 1427.9 BTC and a 191.7 BTC transfer.

A portion of the 1427.9 BTC transfer ended up in a wallet starting with “1DeY” after moving through another, less about 108 BTC.

The 108 BTC and the 191.7 BTC then cycled through several wallets before ending up at a wallet starting with “1KLr,” which currently holds 300 BTC.

It’s unclear why Mt. Gox moved the funds. The exchange fell into bankruptcy in early 2014, and past movements of its Bitcoin holdings have been followed by creditor payouts.

A Mt. Gox wallet moved about 1619.6 BTC to two addresses before a portion was cycled through other wallets. Source: Arkham Intelligence

The latest moves come after Mt. Gox on Dec. 5 shuffled over 24,000 Bitcoin, worth nearly $2.5 billion at the time, to an unknown address just 12 minutes after the cryptocurrency crossed $100,000 for the first time.

Arkham data shows the historic exchange still holds about 36,085 BTC worth $3.86 billion across wallets it controls. Mt. Gox creditors can receive their payouts in Bitcoin if preferred.

Bitcoin has traded above $100,000 since Friday, Dec. 13, and Mt. Gox’s latest move — usually seen as bearish — seemed to have no effect as BTC has traded flat on the day at around $106,500 after hitting a fresh high of $107,857 late on Dec. 16, per TradingView.

In October, the trustee in charge of the bankrupt exchange’s Bitcoin stack pushed the deadline for creditor repayments by a full year to Oct. 31, 2025.

It said many of those it owed “still have not received their repayments because they have not completed the necessary procedures for receiving repayments.”

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.