MATIC price trend turns bearish with nearly $20 million worth of token transfers to exchanges

|

- FTX exchange and two wallets from Polygon Ecosystem Growth deposited a total of 28 million MATIC tokens to exchanges.

- The Polygon wallet transferred 217 million MATIC tokens to 70 different wallets on November 15.

- MATIC price trend turned bearish, yielding 10% weekly losses to holders.

Polygon’s native token MATIC observed a spike in inflow to exchanges, increasing the selling pressure on the asset. MATIC price yielded double-digit losses for holders in the past week. The Ethereum scaling token’s on-chain metrics present a bearish outlook on MATIC price.

Also read: Bitcoin funds see over $311 million weekly inflows in anticipation of spot BTC ETF approval

MATIC inflow to exchanges

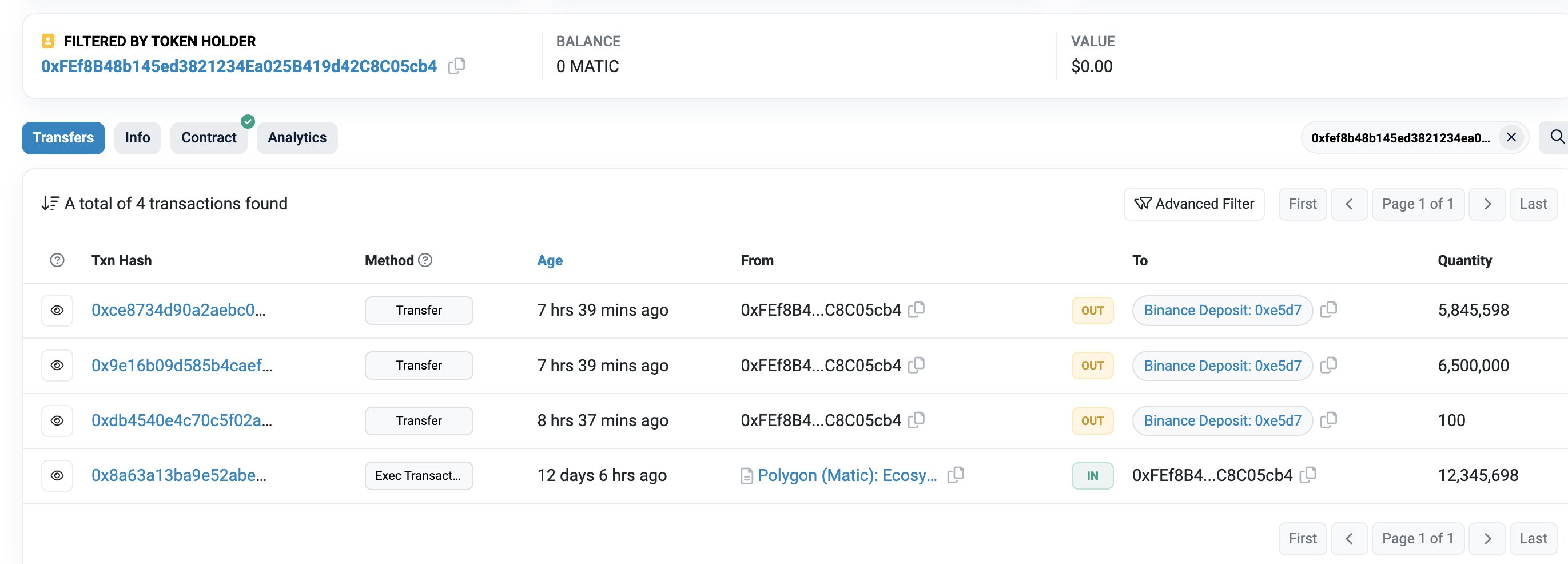

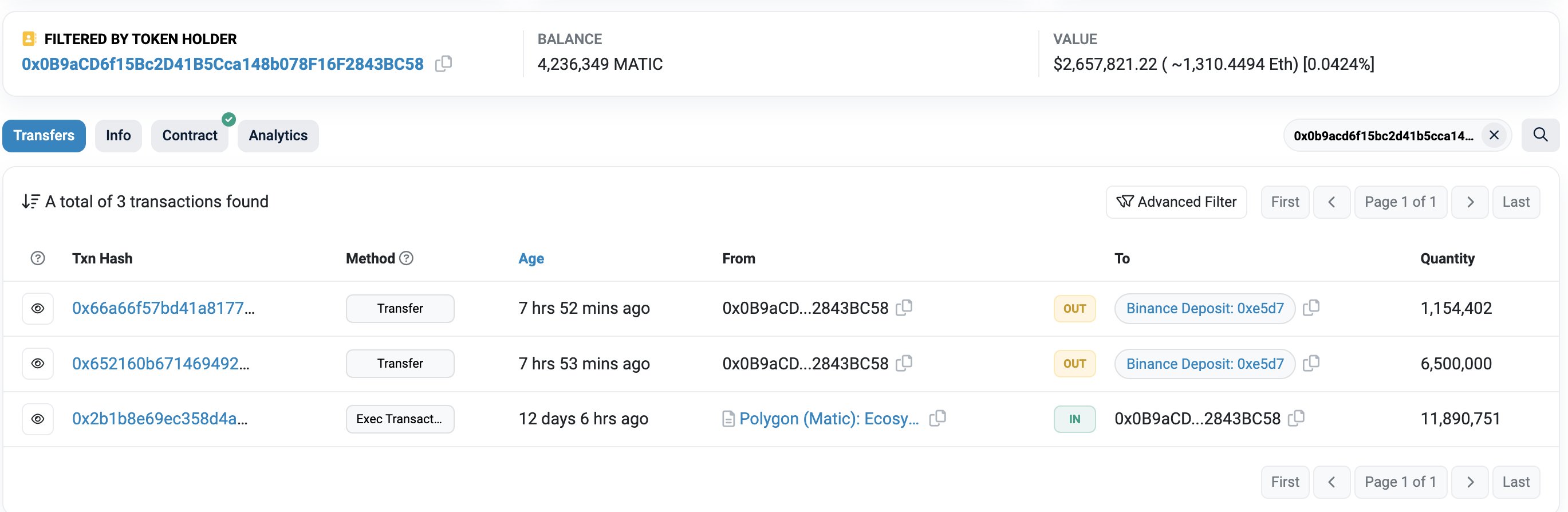

Based on data from crypto intelligence tracker, Lookonchain, the bankrupt FTX exchange transferred 8 million MATIC tokens worth $5.95 million to OKX exchange. Further, two wallets that received MATIC from the Polygon Ecosystem Growth wallet address, deposited 20 million MATIC tokens worth $14.86 million to Binance.

MATIC deposited to exchanges

All the above mentioned transactions took place early on Tuesday, a total of 28 million MATIC tokens flooded centralized exchanges, contributing to the rising selling pressure on MATIC.

MATIC’s on-chain metrics acted as bearish catalysts for the altcoin’s price.

On-chain metrics present bearish outlook

The Supply on Exchanges and Exchange Flow Balance metrics can be used to identify the selling pressure on an asset and the likely direction of its price trend. MATIC Supply on Exchanges has climbed from 7.99% to 9.05% of the total supply, between November 11 and 28. Exchange Flow Balance shows spikes in inflow in the days leading up to MATIC price decline, in the past week, seen in the chart below:

MATIC Supply on Exchanges and Exchange Flow Balance

Another key metric, Network Realized Profit/Loss (NPL) shows spikes in profit-taking by MATIC holders. Large spikes indicate that large number of holders have engaged in booking profits, contributing to the selling pressure on the scaling token. This indicator presents a bearish outlook on MATIC.

Network Realized Profit/Loss

At the time of writing, MATIC price is $0.7347 on Binance. The Ethereum scaling token yielded nearly 10% losses in the past week.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.