MATIC price awaits bulls to return it to $1.00

|

- MATIC price action continues to recover from its most recent collapse.

- Polygon bulls are struggling to create the same amount of gains seen by its peers.

- A rare and powerful bullish entry setup is confirmed on MATIC's Point and Figure chart.

MATIC price has bounced over 43% from yesterday's new 2022 lows. Further upside potential is likely to continue, but downside risks remain a concern.

MATIC price poised to retest $1

MATIC price is setting up for a strong retracement on its daily and weekly Ichimoku charts. As a result, bulls should have a relatively clear path to test the critical $0.80 value area before testing $1.

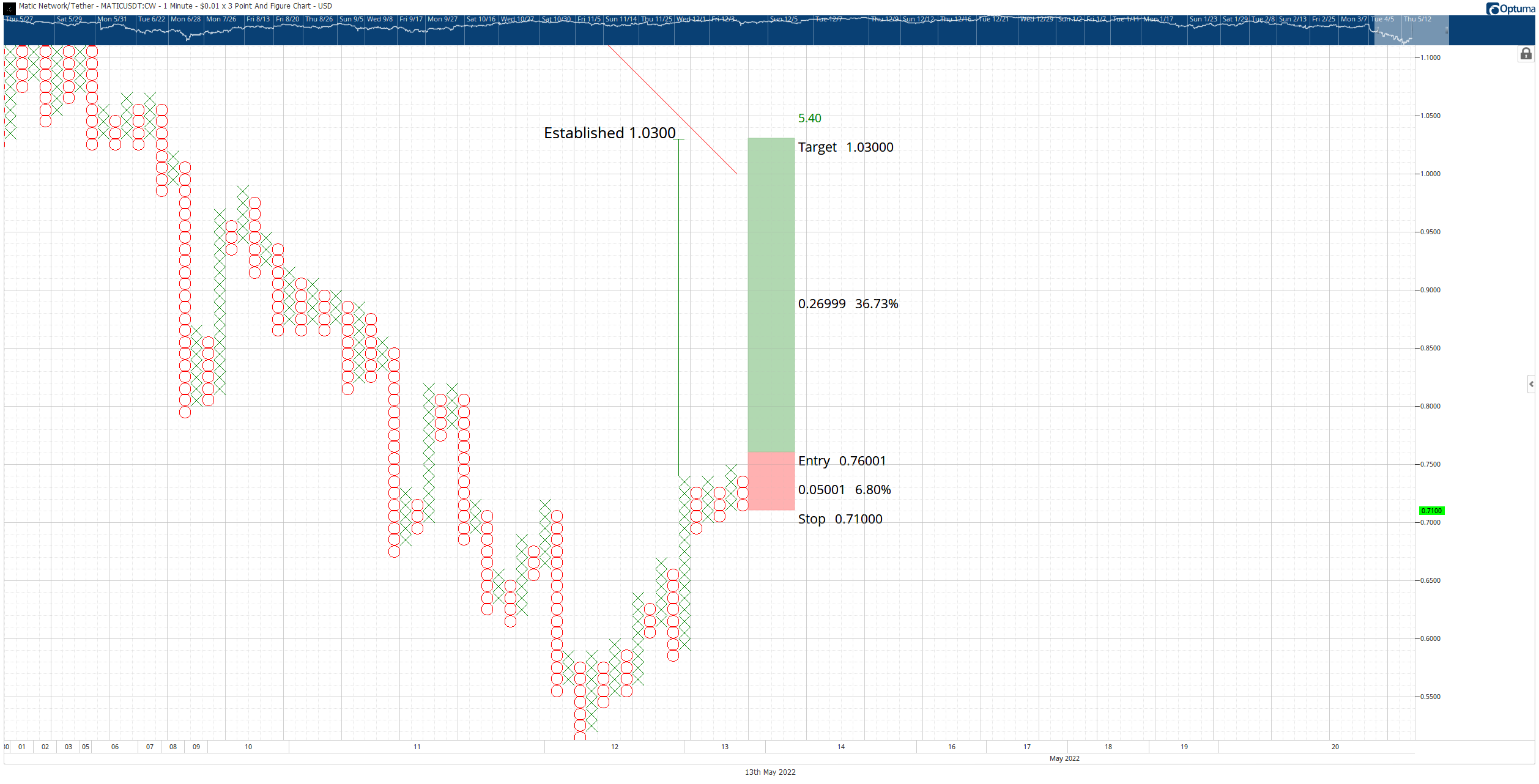

A theoretical long opportunity for MATIC exists with a buy stop order at $0.76, a stop loss at $0.71, and a profit target at $1.03. The trade idea represents a 5.4:1 reward for the risk. Because of the range between the entry and the projected profit target, a three-box trailing stop would help protect any profit made post entry.

MATIC/USDT $0.01/3-box Reversal Point and Figure Chart

The long setup is based on the most powerful and bullish pattern in Point and Figure Analysis: the Bullish Catapult. It's powerful because of specific criteria for its construction and how it creates a false sense of hope for short-sellers.

First, there must be a breakout above a triple-top – a very bullish significant event. However, the breakout can not exceed three boxes above the triple-top. Next, price action must reverse from the breakout and form another column of Os – but this column of Os can't break below the prior O-column. Finally, the last column of Xs forms, and the entry is on the breakout above the double-top.

What makes this pattern powerful is how it affects short sellers. Short sellers who see a rally fizzle out after breaking out from a substantial resistance level have a good reason to open new short positions or add to existing ones. The fall collects more MATIC price short-sellers who anticipate a breakdown. Instead, buyers trickle back in and trap the short-sellers. Additionally, the entry brings in many conservative traders waiting to enter on the sidelines.

Downside risks do exist. The immediate threat for MATIC price is a continuation move south to the next high volume node in the 2021 Volume Profile at $0.38.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.