LUNA Price Prediction: A 100% recovery rally in the cards

|

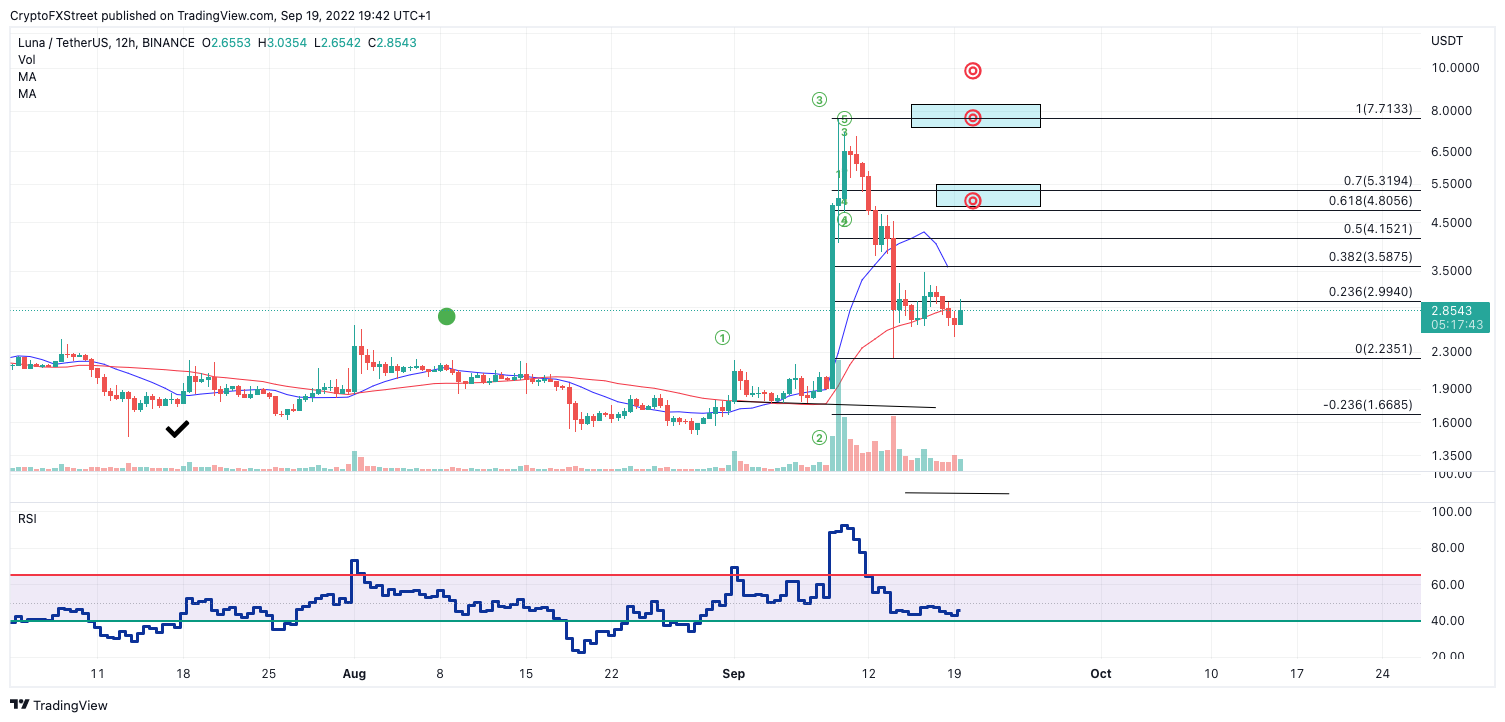

- Terra’s LUNA price has lost 60% of market value since rallying 300% last week.

- LUNA's recent descent comes under relatively low volume.

- Invalidation of the bullish thesis is a breach below the origin point of the previous run at $1.50.

LUNA price could provide many profitable opportunities for day traders in the coming days.

Terra’s LUNA price could rally up to 160%

LUNA price should be on every day-traders' watch list this week. Since the shocking 300% bull run that occurred last week, the LUNA price has lost 60% of market value The decline has created a wide trading range and could become a volatile market with great trade opportunities.

LUNA price currently auctions at $2.85. A Fibonacci Retracement tool surrounding the $7.71 peak and the recent swing low at $2.35 has a 61.8% level at $4.80. A pullback into this zone would recover 80% of lost market value.

ADA USDT 12-Hour Chart

At the current time, the RSI is not showing the divergence needed for an early entry. However, there are divergences between the previous Wave 2 and the current decline, which suggests that a $10 target could unfold if Wave 1 at $2.21 remains unbreached. The Volume Profile Indicator confounds the idea of an additional rally as the current decline comes under relatively low volume.

Still, the safest invalidation of the uptrend scenario is a breach of the previous rally's origin point at $1.50. Under no circumstance should the LUNA price retest this level, in doing so, the entire uptrend would be void, and LUNA could fall an additional 80% to tag a previous intraday Volume Point of Control (VPOC) mentioned in previous outlooks.

In the following video, our analysts deep dive into the price action of LUNA, analyzing key levels of interest in the market. -FXStreet Team

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.