Litecoin Price Analysis: LTC bulls are not ready to regain initiative

|

- Litecoin has been losing ground amid global cryptocurrency market correction.

- LTC/USD is vulnerable to further losses as the daily RSI points to the South.

Litecoin, the 7th largest digital coin with the current market value of $3.6 billion, lost over 6.5% in the recent 24 hours amid global correction on the cryptocurrency market. At the time of writing, LTC/USD is changing hands at $57.20, off the recent high registered at $63.17 on January 17.

Currently, the coin is moving sideways in sync with the market. As there are no clear fundamental factors that might have influenced Litecoin's price movements, the coin is affected mostly by speculative sentiments and technical factors. Namely, a retreat below the psychological $60.00 attracted new speculative sellers to the market and increased the short-term bearish pressure.

LTC/USD: technical picture

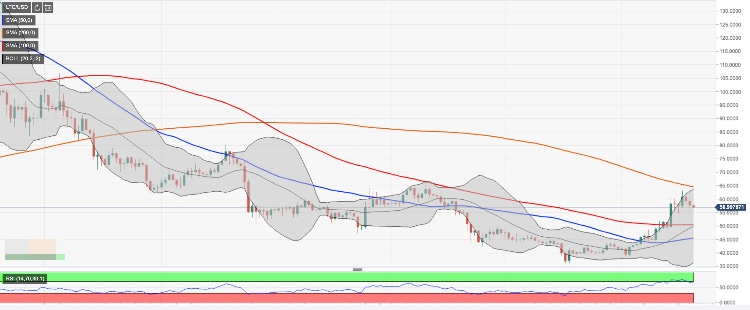

LTC/USD touched an area above $63.00, however, the upside momentum proved to be unsustainable at this stage. A wide-spread downside correction on the market pushed the coin towards $57.00 with the next local support created by SMA50 4-hour on approach to $56.00. Once it is broken, the sell-off may be extended towards $51.00 (SMA100 4-hour) and $50.50 (a combination of SMA100 daily and the middle line of the daily Bollinger Band.

This area is likely to slow down the correction and serve as a jumping-off ground for another recovery attempt; however, if it is out of the way, SMA50 daily a $5.50 will come into focus.

On the upside, the initial resistance is created by the middle line of the 4-hour Bollinger Band at $59.00. We will need to see a sustainable move above this level to retest $60.00 and the recent high of $63.17. The ultimate bulls' goal is created by SMA200 daily at $64.54.

Considering that the daily RSI points to the downside, LTC/USD may be well-positioned for an extended bearish correction before another bull's wave.

LTC/USD daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.