Litecoin prepares for Mimblewimble privacy launch, but investors raise concerns

|

- The Mimblewimble-fueled privacy launch of Litecoin was announced to launch on September 30 as a testnet.

- There are several issues raised by investors about the upcoming privacy feature.

Mimblewimble is a protocol designed to achieve various improvements like greater scalability or privacy. The founder of Litecoin, Charlie Lee, has been designing a Mimblewimble add-on block for quite some time. The initial testnet launch was set for September 30. David Burkett, the developer of the privacy coin Grin, stated:

What makes Mimblewimble great at scalability and many things is that you can delete a coin when you spend it. So they all stay in the chain. You no longer need to remember and know that money. So when you do your first synchronization, you can’t even get that coin… You don’t know anything about it. You don’t even know if it exists or not. You only get the unspent output named UTXO

However, the most controversial feature of the new protocol is privacy. Charlie Lee has mentioned several times his intentions with Litecoin stating:

My ultimate goal is financial privacy for everyone, and I would love nothing more than to see mimblewimble on Bitcoin itself. Getting MW added to Litecoin seemed like the obvious next step.

If Litecoin truly becomes a privacy coin, there is a risk that many exchanges start delisting the digital asset due to regulatory concerns. Nonetheless, many privacy coins have succeeded already, like Monero and Zcash.

How is Litecoin doing right now?

It seems that the start of the month was positive for most cryptos, especially Litecoin, which is up more than 3% in the past 24 hours.

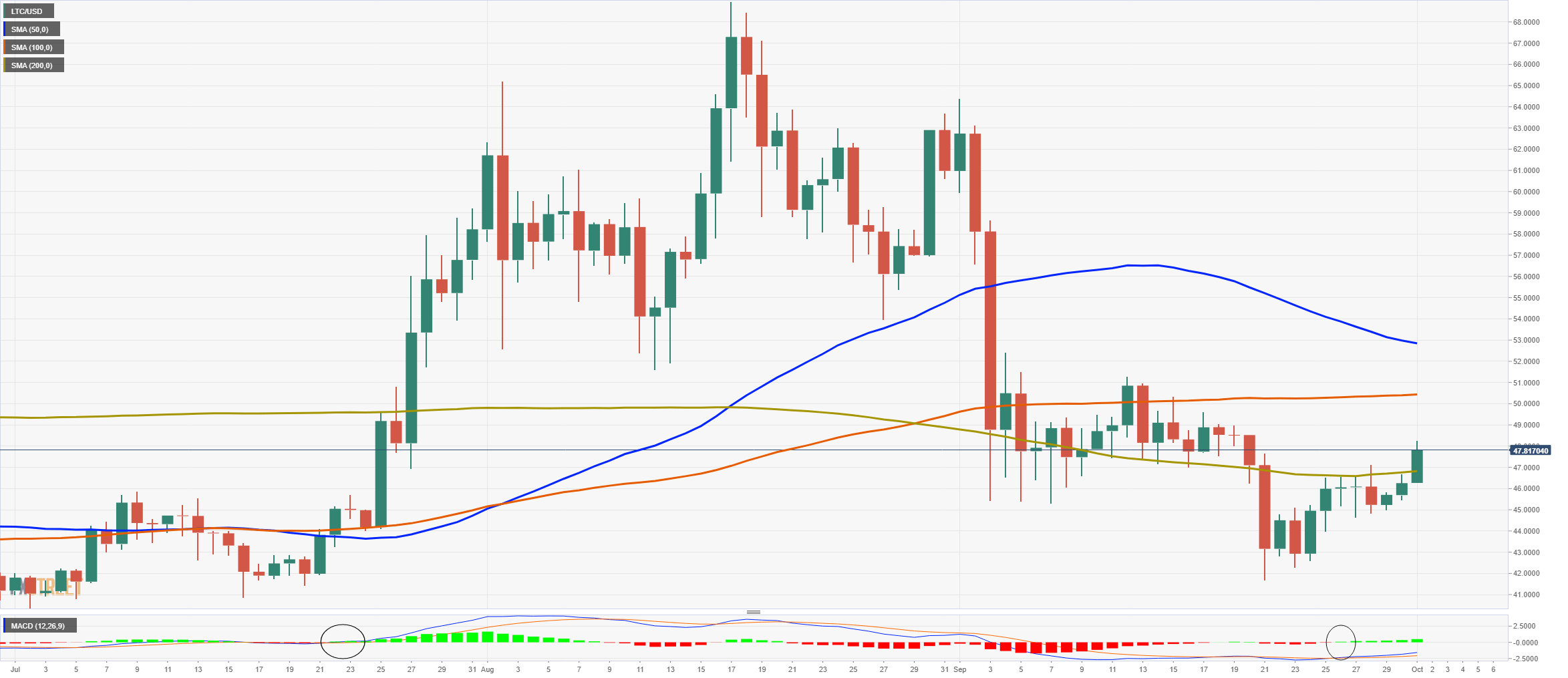

LTC/USD daily chart

On the daily chart, the price of Litecoin has just climbed above the 200-SMA, which was acting as a strong resistance level for the past week. The next resistance point is at the 100-MA, close to $50. The MACD has turned bullish for longer than five days. The last time this happened was on July 22 when LTC rallied 60%.

LTC IOMAP Chart

The In/Out of the Money Around Price chart by IntoTheBlock shows a lot of support on the way down, especially between $44 and $46, where 132,000 addresses bought more than 3.4 million LTC. If bulls can defend the 200-MA on the daily chart and turn it into support, a small rally towards $50 is likely.

LTC New Addresses

Furthermore, looking at the number of new addresses joining the network, we can see a significant growth starting on September 13 from a low of 39,000 to 62,000 currently. The uptrend has slowed down in the past few days, but overall remains strong and shows great interest from newcomers in Litecoin.

LTC/USD 4-hour chart

Although Litecoin has managed to confirm an uptrend on the 4-hour chart with higher highs and higher lows, it is currently facing strong resistance at $49. Another leg up until $49 is likely; however, the IOMAP chart shows a good amount of resistance at this level, where 1.8 million LTC were bought.

A rejection from $49 will push LTC down to the 100-MA at $46, and speculation about whether the digital asset will be delisted from exchanges will also increase selling pressure.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.