Litecoin favors a 20% upswing while LTC bulls remain elusive

|

- Litecoin price achieves one of the most sought-after bullish entry conditions within the Ichimoku Kinko Hyo system.

- Markey awaits buyers to capitalize on the bullish technical conditions.

- Failure by bulls to step in and rally Litecoin could signal imminent selling pressure.

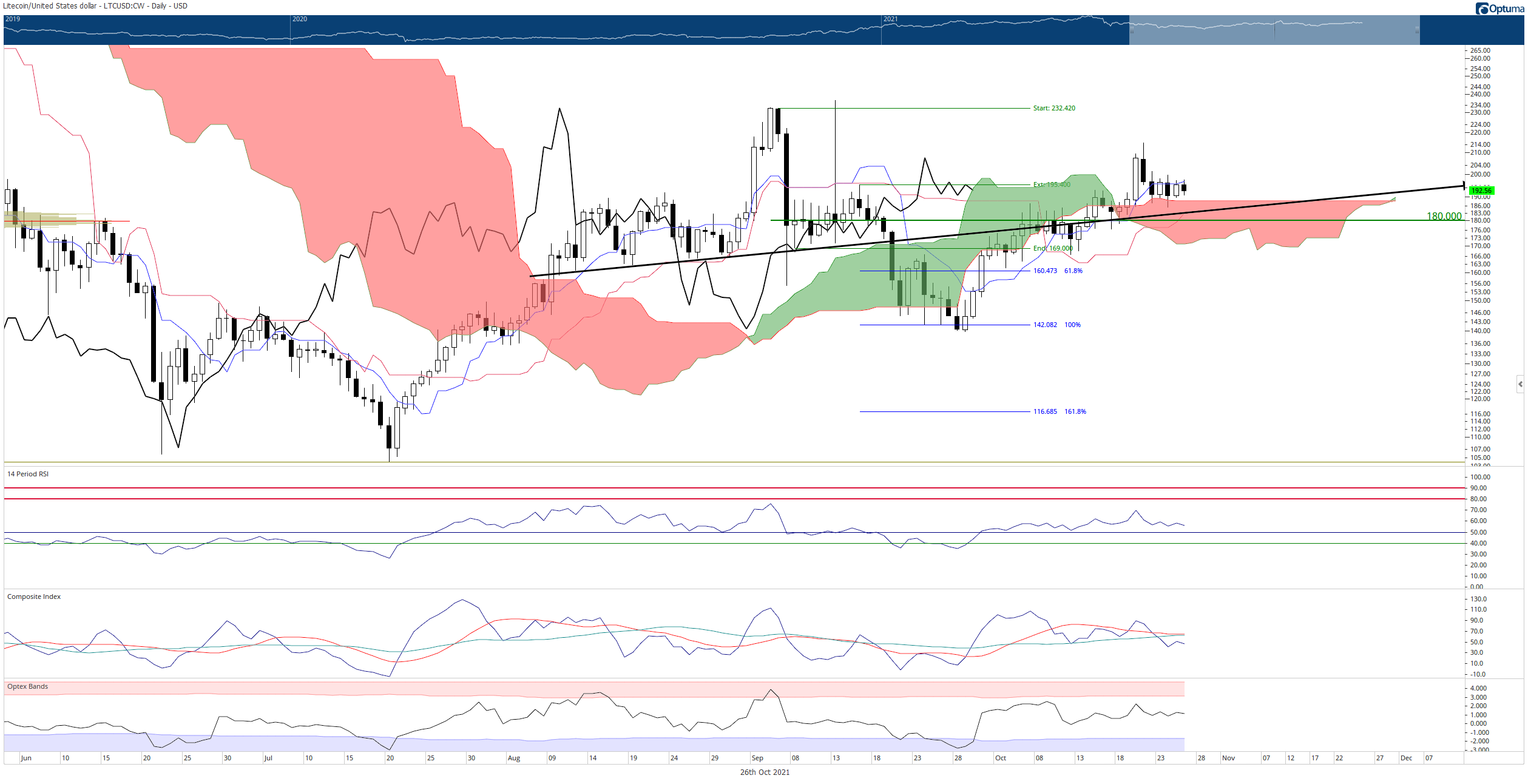

Litecoin price has entered a tight congestion zone since the initial spike above the Cloud on October 20th. The trading range has been limited to the Tenkan-Sen at $196 above and Senkou Span B at $188 below. Thus, Litecoin has prime conditions for a bullish expansion move to occur, but bulls are unable or unwilling to make that happen.

Litecoin price pauses after reaching bullish breakout conditions

Litecoin price has been a source of frustration and anxiety for the bulls. The Ideal Bull Ichimoku Breakout entry generated on Litecoin on October 20th has failed to produce any further upside momentum. The recent consolidation could be seen as a sign of weakness and evidence of a developing bull trap.

The technical continue to favor the long side of the market for Litecoin price. Buyers may come back in to push Litecoin higher when there is a daily close at or above the $200 level. From there, the projected profit zone is at $240. The oscillators favor a bullish breakout as they are all in neutral territory and not at any overbought extremes.

LTC/USD Daily Ichimoku Chart

However, the failure or inability of bulls to create positive momentum could be a precursor to some selling pressure. A daily close below the Cloud at $170 would likely trigger renewed selling pressure towards the $100 value area.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.