Lido Finance, Rocket Pool tokens rally as traders stake $180 million in Ethereum within 48 hours

|

- Liquid staking tokens Lido Finance and Rocket Pool rallied in response to a spike in staked Ether.

- Ethereum tokens worth $180 million have been staked within a 48-hour time period.

- Daily activity on liquid staking platforms increased alongside rising interest in Ethereum staking.

Ethereum staked in the deposit contract is on the rise in June, supporting a rally in liquid staking tokens. User activity on liquid staking platforms climbed alongside price rallies in their governance/ protocol tokens.

Also read: Avalanche DeFi head warns of mounting risk on Ethereum blockchain, reveals AVAX endgame

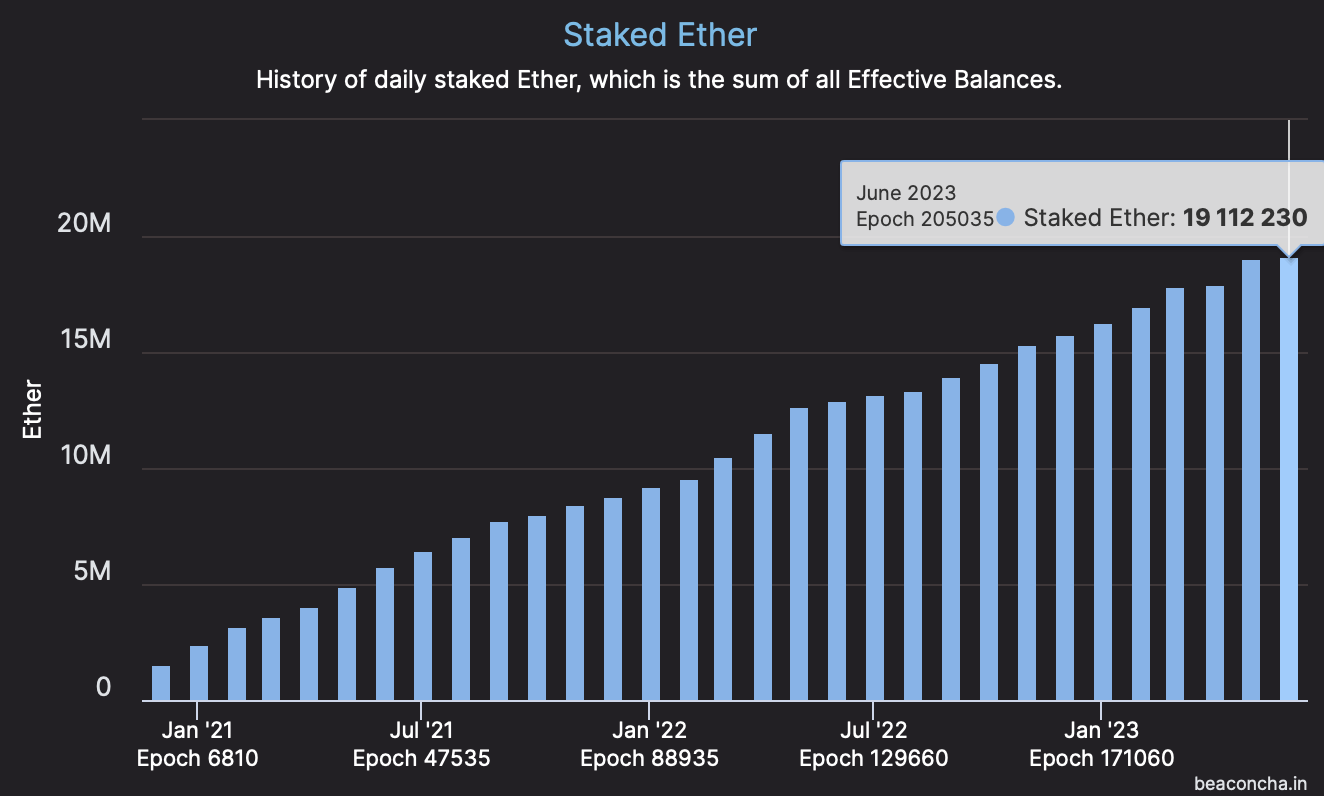

Ethereum staked in the Beacon chain contract climbs by $180 million

The Ethereum deposit contract on Beacon chain added 95,008 Ether in the past 48 hours. Market participants staked $180 million in Ethereum within the first two days of June, based on data from beaconcha.in.

Staked Ether from https://beaconcha.in/charts

A rise in the volume of staked Ethereum is typically a bullish sign as it pulls ETH tokens out of circulation and reduces the selling pressure on the asset across cryptocurrency exchange platforms.

The second-largest asset by market capitalization yielded 4.8% gains over the past week based on CoinGecko data. Moreover, the increase in volume of staked Ether has resulted in a surge of activity in the liquid staking protocol tokens Lido DAO (LDO) and Rocket Pool (RPL).

LDO and RPL prices rally alongside daily activity increase

LDO price appreciated by 10.1% and RPL by 5.7% within the past seven days. At the time of writing, LDO and RPL are changing hands at $2.15 and $49.11, respectively. The two liquid staking governance/protocol tokens are rallying in response to a rise in interest among market participants.

Traders are participating in staking on Lido Finance’s platform while maintaining liquidity through the tokenized representation of Lido Staked Ether (STETH). The spike in staking on liquid staking protocols has contributed to higher revenue, while prices of governance/protocol tokens are yet to catch up.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.