JP Morgan, Well Fargo, Bank of America potentially exposed to Samuel Bankman-Fried’s FTX exchange

|

- JP Morgan Chase, Wells Fargo, Bank of America and Silvergate Bank were potentially exposed to FTX exchange before its liquidity crisis.

- FTX contagion spreads wider as new revelation from the bankruptcy filing lists banking giants and institutions exposed to the exchange.

- FTX exchange’s native token FTT’s price stabilized at the $1.55 level after yielding nearly 30% losses over the past week.

FTX exchange’s bankruptcy filing with the federal court shows the platform retained Kroll Restructuring Administration as a claims and noticing agent. The filing shared details of institutions and entities affected by FTX’s collapse, including celebrities and investors.

FTX exchange’s native token FTT is exchanging hands at $1.55, and started its recovery.

Also read: Here’s why cryptocurrency prices could plummet further in the FTX-crash induced bloodbath

FTX contagion spreads to US banking giants

FTX exchange is navigating the federal bankruptcy process with the help of Kroll Restructuring Administration as its agent. Kroll is often assigned as the agent to cases where creditors are in excess of 1,000 parties. Kroll will also liaise between entities in legal proceedings and serve related notices.

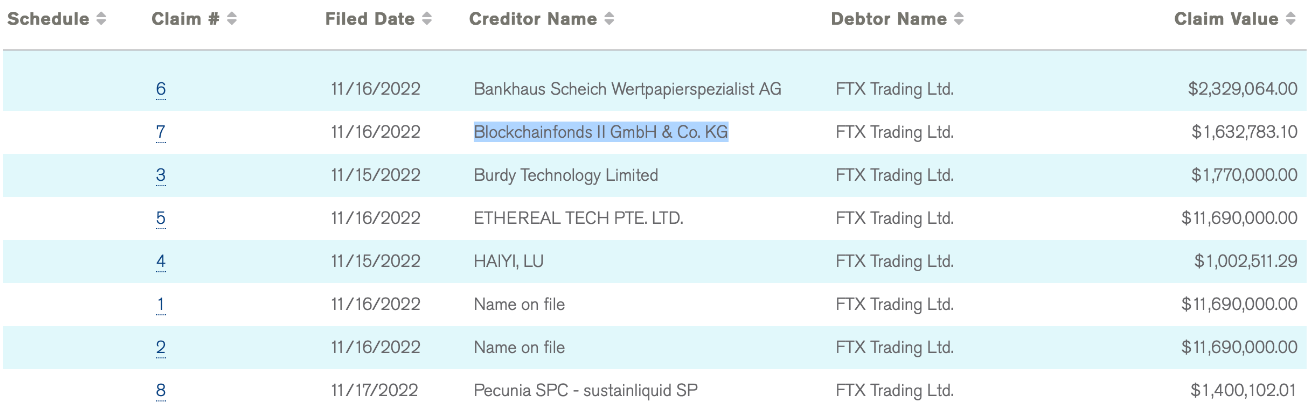

After filing Chapter 11 bankruptcy on November 11 in the US Bankruptcy Court for the District of Delaware, FTX Group announced that related documents are available for access. The documents detail a preliminary list of claims depicting millions of dollars in outstanding debt to Bankhaus Scheich Wertpapierspezialist, Blockchain Fonds, Ethereal Tech, as well as entities whose names remain “on file.”

List of FTX debtors

The document revealed negligent accounting practices, regular deletion of corporate communications, secret loans from corporate accounts, substandard key security, and other instances of mismanagement by FTX.

The document lists 102 debtors, including numerous entities associated with Samuel Bankman-Fried’s trading firm Alameda Research. The extent of each entity's involvement with FTX exchange remains to be known. Each individual or organization in the list ranges from equity holders of 5% or more.

A selection of the persons of interest includes FTX employees Samuel Bankman-Fried, Nishad Singh and Zixiao Wang. List of banking giants includes Bank of America, Circle, JP Morgan Chase Bank, Wells Fargo, Silvergate Bank and celebrities Kevin O’Leart, Stephen Curry and Tom Brady among others.

FTX witnessed a failure in corporate control

John J Ray III, CEO of FTX shed light on lack of management controls and nefarious activities taking place at the now bankrupt exchange platform. Ray noted several counts of poor record-keeping, fraud and malpractice at FTX. In his opening statement, Ray was quoted as saying:

Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.

Post FTX exchange’s bankruptcy announcement, Ray took over and Samuel Bankman-Fried resigned from his position as CEO. Ray is clear that he has never seen a company in such poor shape as FTX.

In his 30-page document, Ray wrote:

From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.

Indonesian Regulators ordered crypto exchanges to discontinue FTT token trading

Indonesia’s Commodity Futures Trading Regulatory Agency has instructed crypto exchanges to stop trading the FTX exchange token, FTT.

Didid Noordiatmoko, acting head of the Indonesian Commodity Futures Trading Regulatory Agency told Antara news agency that after a massive withdrawal of FTX exchange’s token FTT price continued to drop dramatically. The FTX exchange token FTT is among 383 crypto assets mentioned in regulation issued by the regulator in 2022.

The regulator is responsible for a close supervision of exchanges facilitating the trading of FTT tokens. Indonesian regulators have urged cryptocurrency exchanges to monitor to analyze the developments with FTX exchange’s token FTT.

Between January and October 2022, FTT accounted for less than 0.04% of the total crypto trade volume in Indonesia. However, amid the current situation the regulator intends to review the full list of registered crypto assets being traded in Indonesia.

FTT price sustains above the $1.55 level

FTX exchange’s native token FTT yielded nearly 30% losses over the past week. FTX exchange’s crash and the bankruptcy pushed FTT price down from $22 to $2 in less than 48 hours. The exchange’s native token has sustained above the $1.55 level for nearly 24-hours now.

Despite FTX exchange token’s delisting on Indonesian exchanges, FTT exchanged hands at $1.55.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.