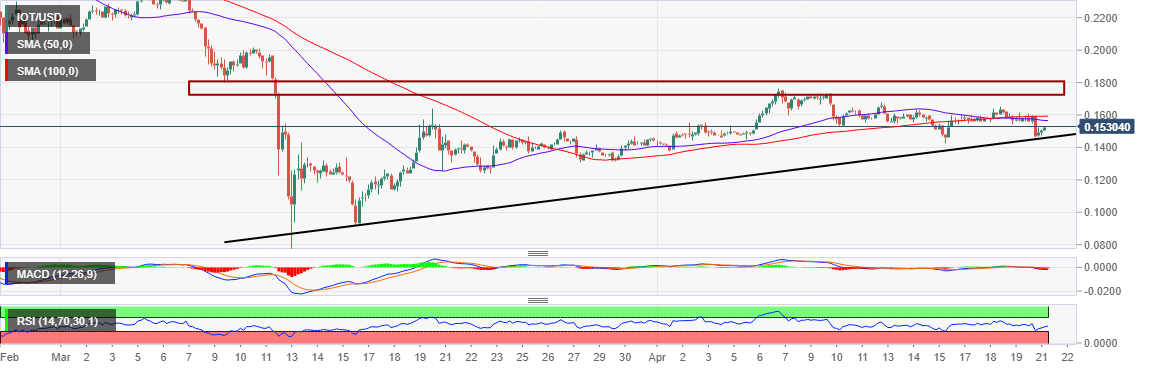

IOTA Market Update: IOT/USD grinds to the pivotal $0.16 level, targets $0.18

|

- IOTA price bullish action lags under $0.16 pivotal in spite of the 2% gain on the day.

- The technical picture remains bullish following a bounce from the ascending trendline.

IOTA is among the most improved cryptocurrencies on Tuesday following a retreat from the current pivotal level at $0.16. The month of April has been kind to the digital asset as the bulls pull away from the lows hit in March around $0.0766.

At the time of writing IOT/USD is trading at $0.1517 following over 2% accrued in gains on the day. Contributing to the bullish momentum is the ascending trendline support. However, the price is trading below the 50 SMA and the 100 SMA. If the ongoing price action rises above the moving averages, there is a chance that IOTA could gain traction to test $0.18 resistance.

Technically the buyers have the upper hand as the RSI climbs towards the average after bouncing off support at 30. Therefore, continues upward motion will encourage more buying entries among the traders. It is also vital to note that selling influence is not non-existent especially with the MACD stuck in the negative region. In other words, watch out for higher volume and a confirmed breakout above the 50 SMA and the 100 SMA.

IOT/USD 4-hour chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.