ImmutableX price falls sharply as holders sell IMX ahead of $101 million token unlock

|

- ImmutableX will unlock 34.19 million IMX tokens worth $101 million on Friday.

- IMX price declined 27% in the weekly time frame.

- IMX supply on exchanges has slightly increased in March, while network growth and active addresses declined.

ImmutableX (IMX) price is declining sharply despite the rising relevance of gaming and meme coin tokens among traders. The decrease can be attributed to traders positioning ahead of the upcoming token unlock on Friday, which is likely to increase the selling pressure on the gaming token and result in a steeper correction.

ImmutableX is an Ethereum scaling solution, a Layer 2 chain that powers Web3 games and supports NFT minting. ImmutableX aims to attract Web3 gamers and developers to the blockchain. The protocol generates revenue by charging users for the sale of primary assets, NFTs.

Also read: ImmutableX Price Prediction: Another buy opportunity for IMX before next leg up

ImmutableX on-chain metrics signal further correction ahead

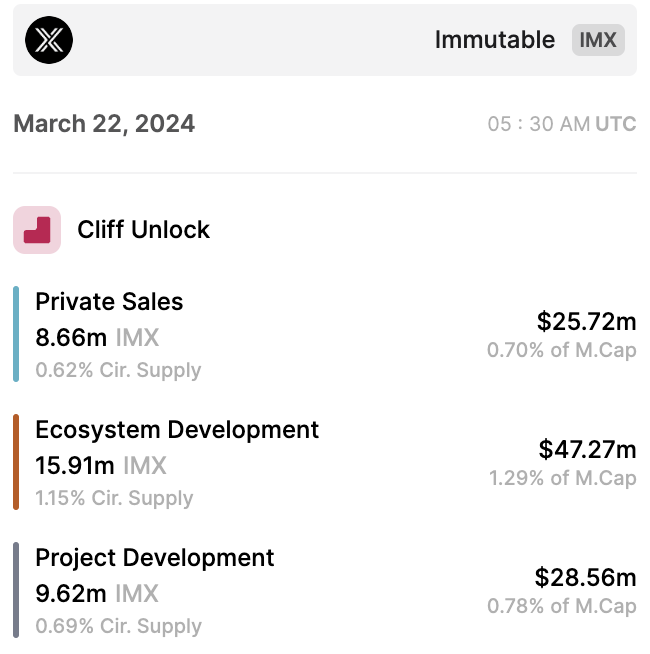

IMX is heading to a market-moving event, a scheduled token unlock set to occur on Friday. The event will release 34.19 million IMX tokens worth $101.55 million. The unlocked IMX tokens will be distributed to private sales participants and used for ecosystem and project development, according to data from Tokenunlocks.

IMX token unlock. Source:Tokenunlocks

It is likely that $67.39 million worth of IMX (the value of tokens set to be used for project and ecosystem development) enter circulation. This rise in supply could increase the selling pressure on IMX and worsen the recent losses for the gaming token.

Three on-chain metrics support the bearish thesis for the IMX price. Active Addresses, a metric used to track blockchain activity and market participants' demand, showed a drop throughout March.

Active Addresses in IMX declined consistently, as seen in the Santiment chart below. At the same time, Network Growth – which tracks the number of new addresses created – also decreased.

A downward trend in both Active Addresses and Network Growth signals IMX is losing relevance among market participants.

IMX Active Addresses and Network Growth. Source: Santiment

The above findings are complemented with a rising Supply on Exchanges. In March, IMX supply on exchanges climbed to 75.91 million, up from 75.03 million at the beginning of the month. Typically, rising supply is a sign of higher IMX exchange reserves, which, in turn, increases the likelihood that holders shed these tokens.

IMX price and Supply on Exchanges. Source: Santiment

ImmutableX price uptrend in jeopardy

IMX has been in a downward spiral since the gaming token hit its year-to-date peak at $3.76 on March 12. IMX price is trading close to support at $2.45, the March 5 low. Further decline could see IMX price drop to the secondary support at $2.09, represented by the 127.2% Fibonacci extension level of the rally to the year-to-date high.

The Awesome Oscillator (AO) supports IMX further price declines. The cross below zero confirms that a downtrend has formed. Meanwhile, the RSI is at 37.17, inching closer to the oversold zone at 30.

IMX/USDT 1-day chart

To invalidate the bearish thesis, IMX price would need a daily candlestick close above $2.73, the 78.6% Fibonacci retracement level. Once this level is reached, IMX price is likely to regain lost ground, rallying towards resistance at $3.10, the 50% Fibonacci retracement.

If IMX price flips $3.10 resistance to support, it will effectively break out of its decline and rally towards the $3.76, which aligns with the year-to-date peak.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.