Grayscale Bitcoin Trust premium rises as demand among institutional investors increases

|

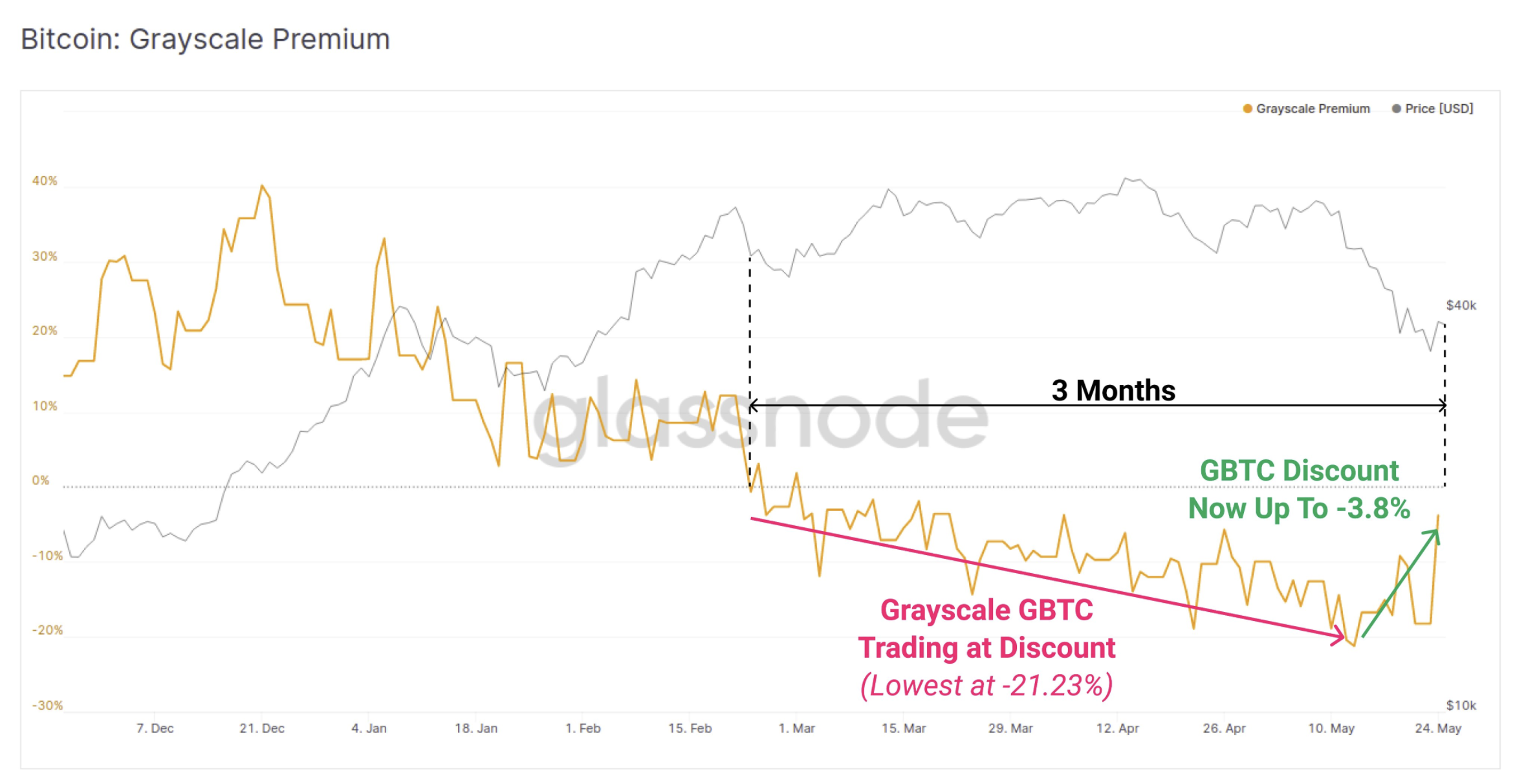

- While the Grayscale Bitcoin Trust has traded at a discount to its net asset value since February, it has recently rebounded.

- The premium on GBTC and the Ethereum trust has climbed considerably.

- A majority of institutional investors would be allowed to sell their positions in June, relieving the fund from the recent downward pressure.

Grayscale’s Bitcoin and Ethereum shares have risen sharply this week, reflecting an upswing in demand among institutional investors.

Grayscale Bitcoin Trust on track to return to positive

Since late February, Grayscale Bitcoin Trust has been trading below BTC price – at a discount relative to the leading cryptocurrency. The trust offers large investors to gain exposure to the pioneer digital asset without holding the actual currency.

Historically, GBTC has always traded at a premium to Bitcoin. While people can buy shares that cost more than the underlying asset, it also allowed them to cash out at a premium. Accredited investors can borrow Bitcoin to subscribe to GBTC shares, followed by a six-month lock-up.

Institutional investors had to accept GBTC’s high management fees and long redemption periods due to a lack of options in the market.

Once the lock-up expires, they can sell shares on the secondary market to retail investors, ideally for a premium. The proceeds they receive would be used to pay back the lender for borrowed coins, pocketing the difference.

The premium evaporated in the past few months due to retail demand flowing into cheaper products, including Canada’s approved Bitcoin exchange-traded funds (ETFs). Since the trust has been trading at a discount, long-term shareholders have been faced with a huge disadvantage.

On May 13, Glassnode data showed that GBTC premium to net asset value dipped to -21.73%, the lowest point in the fund’s history.

Grayscale premium

The launch of Simply US Equity PLUS GBTC ETF, which invests 15% of the portfolio in Bitcoin through the trust, has lifted its premium out of the dangerously high discounted territory.

This week, the Grayscale GBTC discount climbed to -3.8% from -18.2%. Unlocking of new shares toward the end of June could foresee another rise in premiums. Historically. Unlocking periods have been bullish for Bitcoin for those who are involved in arbitrage trading.

The digital asset manager previously announced its plans to convert GBTC to an ETF when regulations allow in the US. Grayscale ETHER premium has jumped from a negative 11.3% to 12.3%, reaching a two-month high.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.