FTX liquidity gap widens to $8 billion, here’s what this means for the future of crypto

|

- FTX bankruptcy advisors estimated that FTX exchange’s liquidity gap is currently $8 billion.

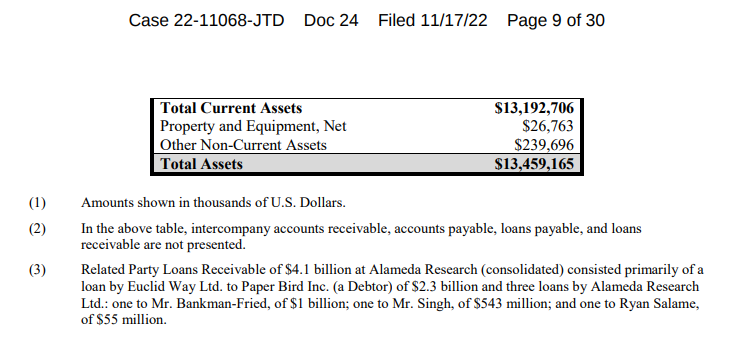

- According to the bankruptcy filing, Alameda Research loaned upwards of $1.5 billion directly to Samuel Bankman-Fried and his associates.

- Some crypto analysts believe Bitcoin price could be close to its bottom.

FTX’s bankruptcy advisors noted that the exchange’s liquidity gap is currently $8 billion. FTX chief restructuring officer John Ray III said that Sam Bankman-Fried received $1 billion in loans from FTX-related companies. Following FTX’s collapse, Bitcoin and altcoin prices crumbled under selling pressure from investors pulling out of risk assets.

Also read: Here’s why cryptocurrency prices could plummet further in the FTX-crash induced bloodbath

FTX exchange liquidity gap widens, hits $8 billion

Former FTX CEO Samuel Bankman-Fried (SBF) received a $1 billion personal loan from a company deeply involved in the exchange’s collapse according to John Ray III, the new FTX CEO, who revealed details of misappropriation of funds by Bankman-Fried.

According to the Chapter 11 bankruptcy filing, Alameda Research, SBF’s trading firm loaned $1 billion directly to Samuel Bankman-Fried. At the same time, FTX director of engineering Nishad Singh had also received a $543 million loan from the company and Ryan Salame received $55 million.

Bankruptcy filings reveal personal loans from Alameda Research to FTX employees

Ray III described FTX’s bankruptcy filing as a “complete failure of corporate controls” and an absence of trustworthy financial information. Ray III said:

From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.

Ray III noted that there are hosts of businesses that made up the FTX Group. The FTX CEO describes them as four silos. The “WRS” silo includes subsidiaries of West Realm Shires Inc., which features FTX US, LedgerX, FTX US Derivatives, FTX US Capital Markets and Embed Clearing.

“Alameda Research” is a standalone silo in the filing with its own subsidiaries, while Clifton Bay Investments LLC and Ltd, Island Bay Ventures Inc. and Debtor FTX Ventures Ltd fall under the “Ventures” silo. The “Dotcom” silo includes FTX Trading Ltd and exchanges doing business under the FTX.com umbrella.

The widening liquidity gap could increase selling pressure on cryptocurrencies as investors pull capital out of the market. The $8 billion liquidity gap could therefore fuel further decline in overall crypto market capitalization and cryptocurrency prices.

Crypto custody of FTX and its subsidiaries is in disarray

According to the Chapter 11 filing, there were inadequate records in place for FTX Group’s digital assets. Bankman-Fried controlled access to the cryptocurrency holdings of the main businesses within the group. There were several unacceptable practices like unsecured group email accounts to access confidential private keys and critically sensitive data for the global network of companies.

The FTX group and silos failed to carry out reconciliation of their holdings and exempted Alameda Research from certain aspects of FTX.com’s auto-liquidation protocol. The bankruptcy proceedings secured only a fraction of the digital assets that the FTX group and subsidiaries held in user funds. The bankruptcy filing revealed only $740 million in cryptocurrencies stored in cold wallets were found.

What does this mean for Bitcoin price?

The FTX collapse triggered a meltdown in cryptocurrencies. Bitcoin price plummeted nearly 20% within 10 days. BTC price recovered from its decline to $15,900 to the $16,500 level. Analysts evaluated the Bitcoin price chart and predicted that BTC is close to its bottom.

Toni Ghinea, a crypto analyst, believes Bitcoin price could plummet to the zone between $10,000 to $14,000 soon.

BraveNewCoin Liquid Index for Bitcoin

The analyst believes after Bitcoin price hits bottom, a run-up to the $28,000 to $30,000 level is likely.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.