Ethereum shows signs of life as holders move ETH off exchanges: Santiment

|

Ethereum prices have outperformed the broader crypto market over the past 24 hours in a rare move that resulted in a 12-day high, indicating “mild signs” of a rebound, according to Santiment.

“Ethereum has shown mild signs of a rebound … and outpacing most altcoins to start the week,” crypto analysts at Santiment wrote on Feb. 18.

Ether (ETH $2,667) hit an intraday and 12-day high of $2,832 on Feb. 17 but failed to maintain that momentum, falling back to $2,720 in early trading on Feb. 18. ETH has gained 2% on the day, whereas the wider crypto market has retreated 2.4% in terms of total capitalization.

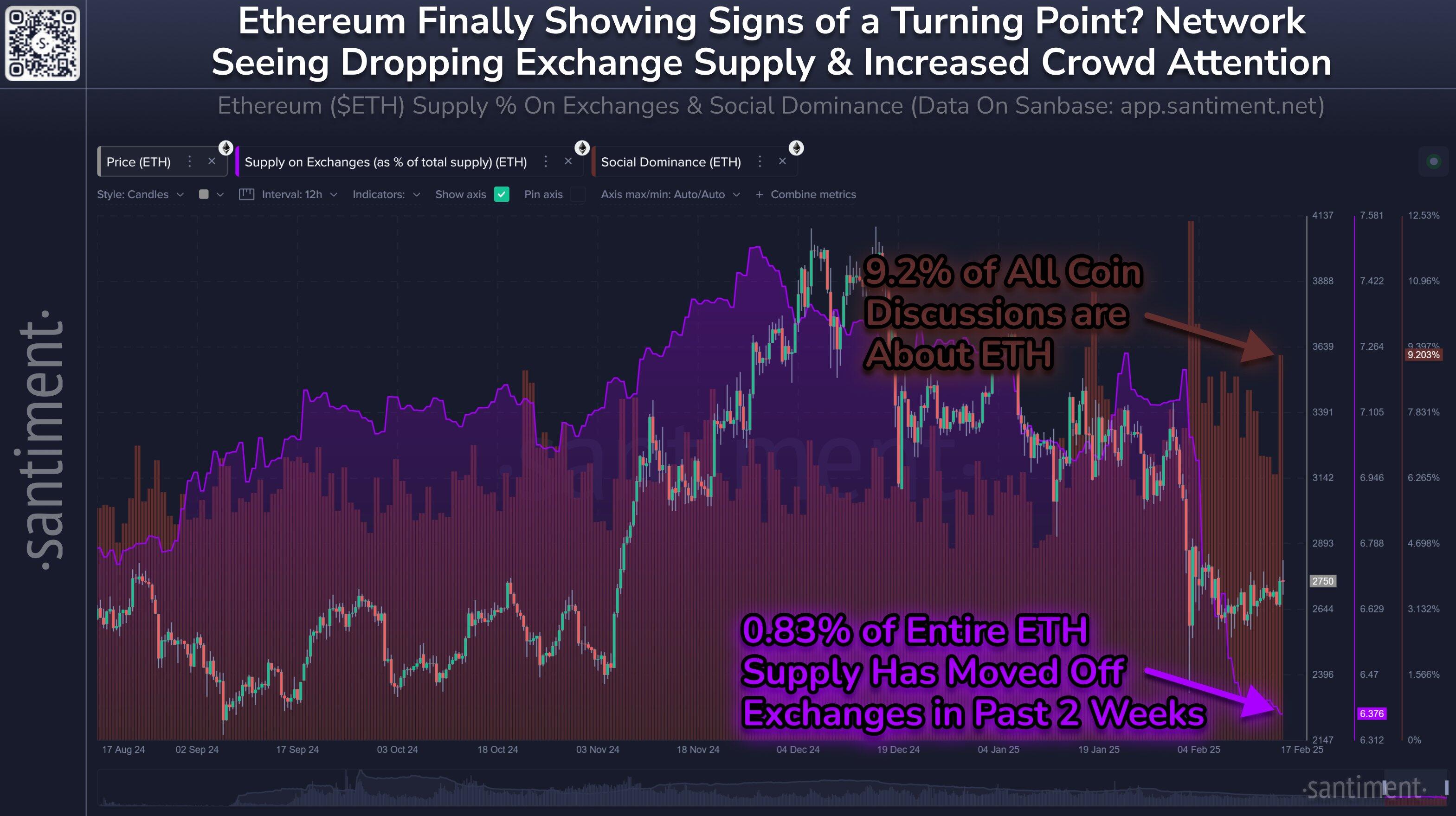

Santiment added that from a long-term perspective, “ETH continues to move off of exchanges and into cold wallets at a shocking pace,” with just 6.38% of the available supply remaining on exchanges.

When crypto assets move off centralized exchanges, it is usually a signal that investors are hodling. It “decreases the probability of a major upcoming sell-off. But it should be considered a long-term metric, rather than one to react to on a swing trading basis,” said Santiment.

The analysts also commented that the community has been showing some renewed interest in Ethereum in February following prolonged lackluster performance.

After being a major under-performer relative to other large caps in 2024, there has been some anticipation of a rebound when market-wide recoveries begin to take place.

Ether exchange supply and social sentiment. Source: Santiment

Not all were convinced, however, with crypto YouTuber Lark Davis quipping that “Ethereum pumps a few percent, and then markets dump five minutes later.”

The move has also improved the ETH/BTC ratio slightly, which is a measure of the price of Ether in terms of Bitcoin (BTC $95,458). This metric has been at multi-year lows as ETH has lost ground to BTC since mid-2022.

The ratio improved by 7% on Feb. 17 to reach 0.029, but it has remained close to its weakest levels since December 2020, according to TradingView.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.