Ethereum short sellers are looking to profit at $1,700

|

- Ethereum price is being controlled by short-sellers.

- The global rout in cryptocurrencies is not halting amid another weekly loss.

- A trend line and flat bottom are setting up ETH for another leg lower.

Ethereum price cannot escape from the global rout currently present throughout the cryptocurrency sector, a few exceptions notwithstanding. Short sellers are still searching for areas where they can take profits, and buyers continue prospecting for the best entries to long ETH.

Ethereum price has a few handover levels ready where buyers can take over

Ethereum price has been on a rampage the past few days. Whipsaw price action happens when sellers repeatedly take over from buyers at very logical entry levels.

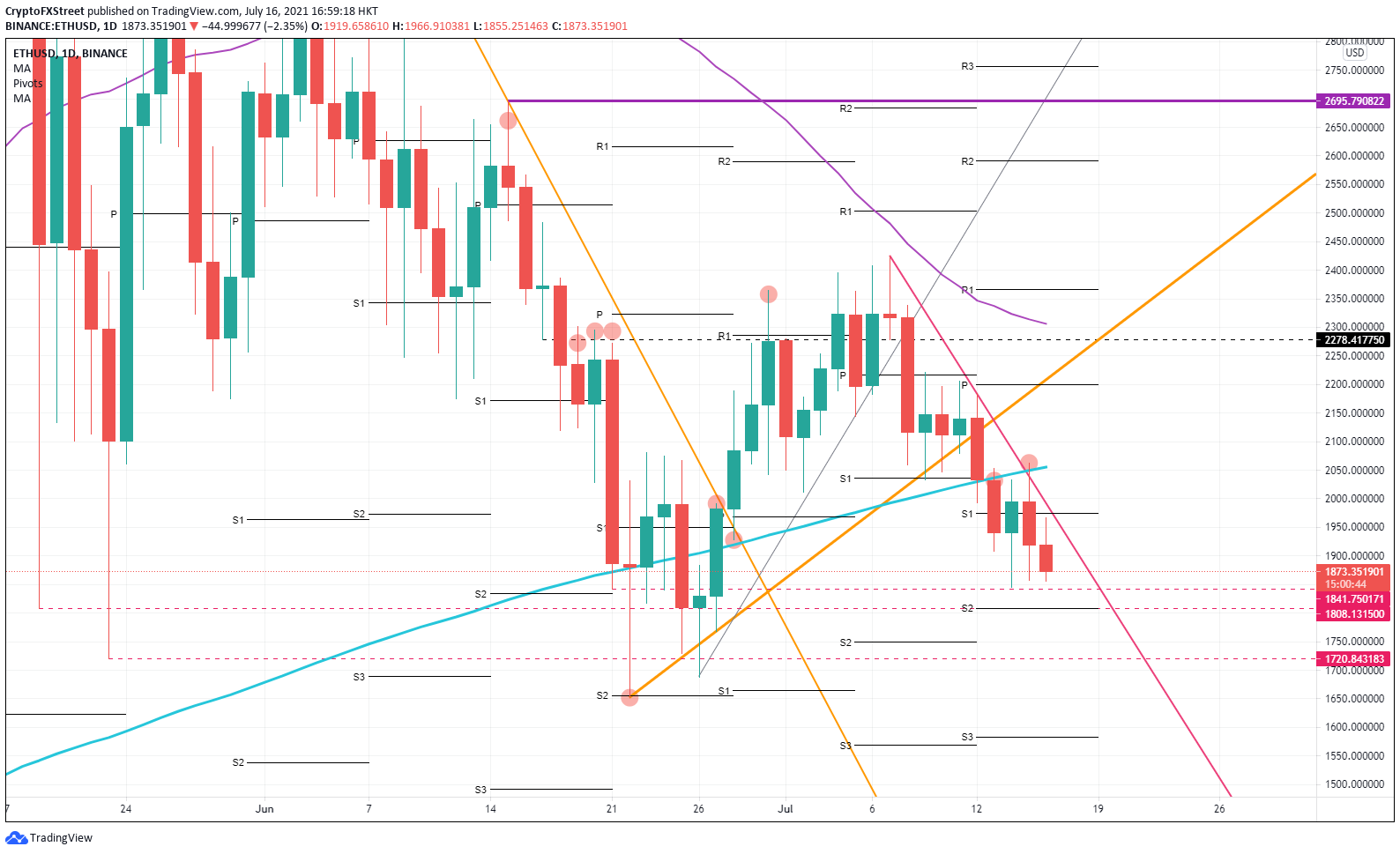

On Monday, June 12, a first test of the red descending trend line was the queue for shorts to start selling ETH. They were able to push Ethereum price below the past week's S1 support pivot. In the meantime, the 200-day Simple Moving Average came in to act as resistance, making sure that for the rest of the week ETH could not recover above it.

On Wednesday, buyers in ETH attempted an outbreak but got squeezed out of their longs on Thursday when sellers returned with a large volume just above the 200-day SMA.

Today, Ethereum price is set to stay below the S1 support pivot and is looking for a retest of Wednesday's low at $1,841.75. Just below that level, ETH has the S2 support pivot at $1,808.13, so expect some profit-taking here from short sellers.

If in the next couple of days a break higher fails on that red descending trendline, expect more sellers to come in and try to push the price towards $1720.84. That level has already been tested on May 23 and June 23.

These levels should be an excellent handover from sellers to buyers. If cryptocurrencies could get some favorable tailwind, a retest and break higher of the red descending trendline would be successful.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.