Ethereum Price Prediction: Teasing inverse head and shoulders, eyes on $215

|

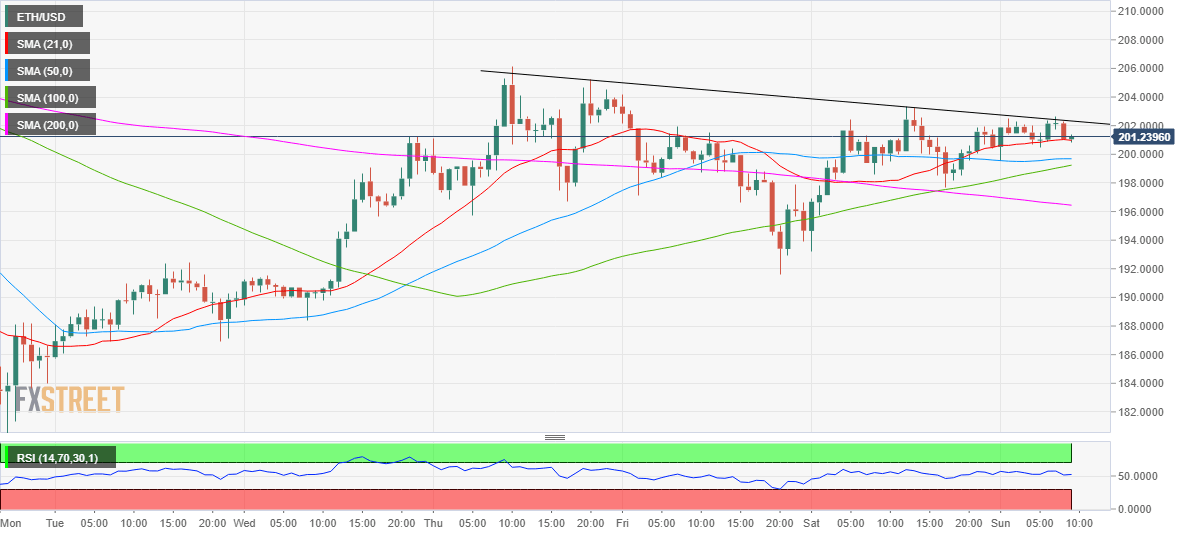

- ETH/USD consolidates for the next push higher.

- Potential inverse head and shoulders on the hourly chart.

- Buyers to aim for $215 on a bullish breakout.

Ethereum (ETH/USD) is consolidating Saturday’s rebound below 203 levels on a quiet Sunday trading. The spot wavers in a $5 range, having bounced-off a brief dip below 200 mark in early trades. The second-most traded cryptocurrency is yearning for a sustained break higher over the last hours, with the downside cushioned by a stack of healthy support levels. The coin hit a daily high of 202.67 before easing slightly to now trade at 201.35, still up 0.50% on the day. The spot enjoys a market capitalization of about $ 22.39 billion, set to settle the week with a 7% weekly gain.

Short-term technical outlook

Looking at the hourly sticks, the no. 2 coin is teasing an inverse head and shoulders breakout. The buyers remain hopeful, as a breakout at the 202.32 neckline could trigger a sharp rally towards the pattern target of 214.86. The immediate resistance awaits at 206.17 (May 14 high) while the next one is seen around 210 (round number/May 10 high). A lack of significant resistances combined with the hourly Relative Strength Index (RSI) holding above the midline suggest the upbeat momentum to be unchallenged.

To the downside, the 21-hourly Simple Moving Average (HMA) should offer some support to the bulls. However, the 199.60/30 region will be tested on a failure to defend the 21-HMA. That demand area is the confluence of the 50 and 100-HMAs. The next support on the sellers’ radar is at the downward sloping 200-HMA of 196.44.

ETH/USD 1–hour chart

ETH/USD key levels to consider

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.