Ethereum price prediction: ETH/USD tested key support near $ 307, what next?

|

- Reverses half the recovery seen on Saturday.

- The significant confluence support near 307.50 holds for now.

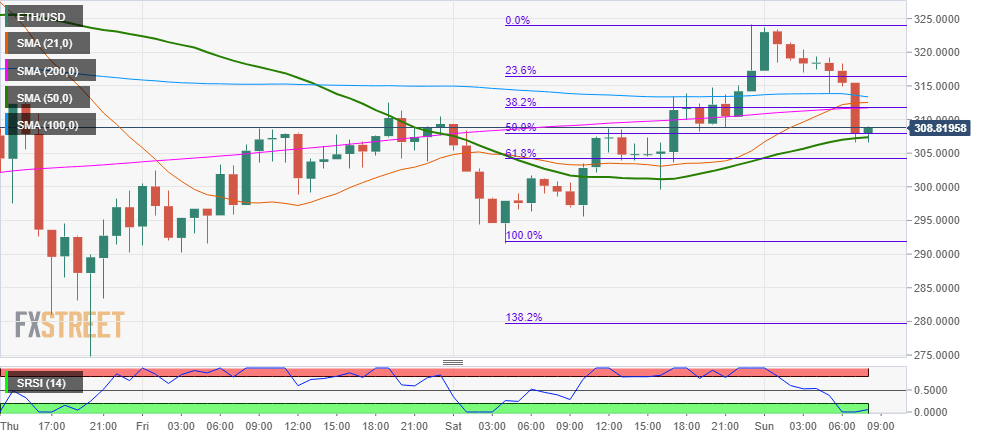

The second most favorite cryptocurrency, Ethereum, fell sharply from the daily high of $ 323. and reversed 50% of Saturday’s recovery to reach daily lows at 307.60, breaching the 200-hourly Simple Moving Average (SMA) at $ 311.51. Over the last hour, the cryptocurrency is seen struggling to extend the bounce above the 200-hourly SMA amid a fresh round selling across the crypto board.

The coin risks a break below the key support near the 307.50 level, where the 50% Fibonacci Retracement Level of the latest rise and upward sloping 50-hourly SMA coincide. A break below the last, the 61.80% Fib at 304.16 could offer some respite to the buyers. A test of the 300 mark remains inevitable on failure to hold the 61.80% support. The bears are seen fighting for control, despite the hourly Relative Strength Index hovering the oversold territory.

Any bullish move will get validated only above the 323-325 levels, allowing the buyers to aim for the next target at 329.63 (daily classic R1). At the press time, ETH/USD trades near 308.80 region, up 2.25% over the last 24 hours and with a market capitalization of $ 32 billion.

ETH/USD, 1-hour chart

Levels to Watch

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.