Ethereum Price Outlook: ETH/USD ready to crack $250 thanks to these crucial metrics

|

- ETH/USD is attempting to climb above the daily 12-EMA and the 26-EMA.

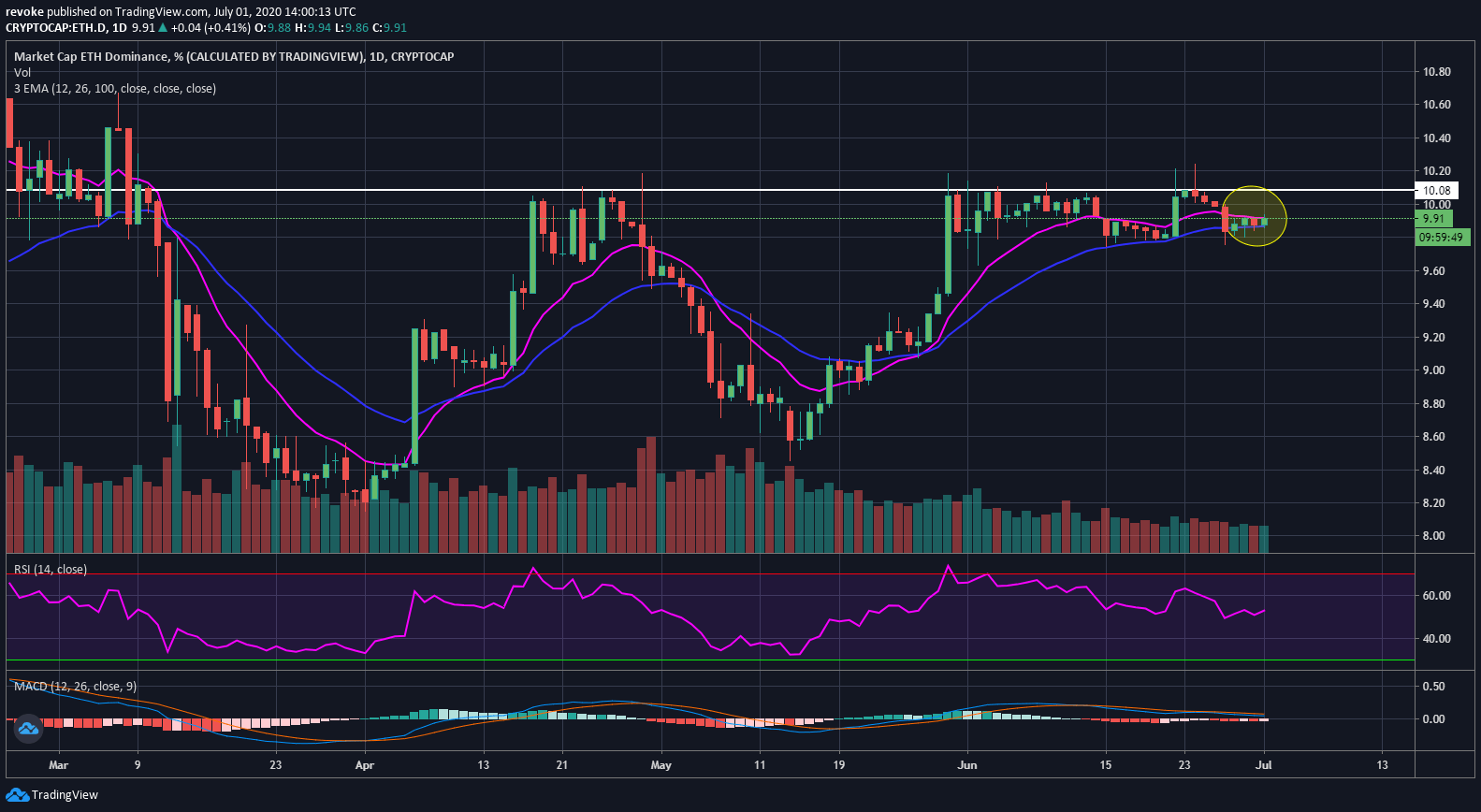

- Ethereum market cap dominance is close to a breakout.

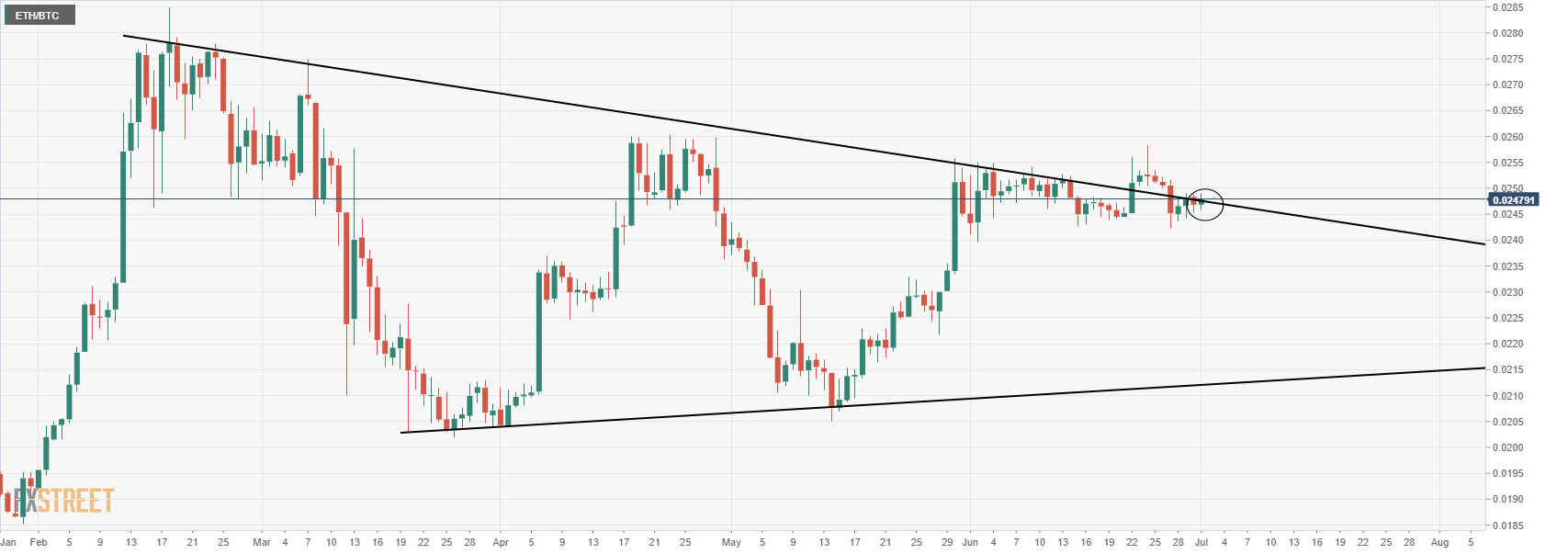

- ETH/BTC is also in favor of ETH and near a critical trendline.

We know that Ethereum outperformed Bitcoin during May by quite a lot. The digital asset was one of the few top coins to see a significant bull rally while everyone else was sleeping. ETH/USD managed to peak at $253.47 before entering a consolidation period. While Ethereum has been trading sideways for the past few weeks, the pair against Bitcoin has remained fairly strong.

These indicators and metrics can push Ethereum above $250 again

On the ETH/BTC pair, one significant factor has been present for the past two weeks. Bulls have defended the 26-EMA several days in a row, and they are currently attempting to climb above the 12-EMA. While this is not the first attempt to crack the upper trendline, the last rejection on June 24 was clearly not powerful enough to push Ethereum down to the lower trendline. This factor indicates that bulls are strong and bears are weak.

The dominance chart is fairly similar to the ETH/BTC chart. Ethereum is also trying to push for a clear breakout above 10%. Ethereum is close to two simultaneous breakouts which would also mean a crack of the daily 12-EMA and the 26-EMA on Ethereum’s daily chart.

Of course, we also have Ethereum 2.0 coming up, an event that will certainly help Ethereum’s price, however, no one truly knows when the actual upgrade will be live. We know Bitcoin and Ethereum balances on exchanges are going down significantly in the past two to three months. This clearly indicates an interest in holding both cryptocurrencies instead of selling them.

Another important metric that is exploding is the number of addresses with a balance of 1 or more Ethereum coins. Right before March, the number was 971,000 addresses compared to 1.046 million on June 1.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.