Ethereum price moves out of no-trade zone but faces massive supply barrier ahead

|

- ETH/USD is positioned to retest the $680-$700 area once $620 is cleared.

- On the downside, Ethereum's critical support comes at $550.

ETH/USD has settled above $600 and extended the recovery towards $611 on Thursday after a period of range-bound trading. The second-largest digital asset has hit the intraday high at $615 and gained over 2% in the past 24 hours. On a week-to-week basis, the coin has gained over 18%.

ETH leaves a no-trade zone as bulls have the upper hand

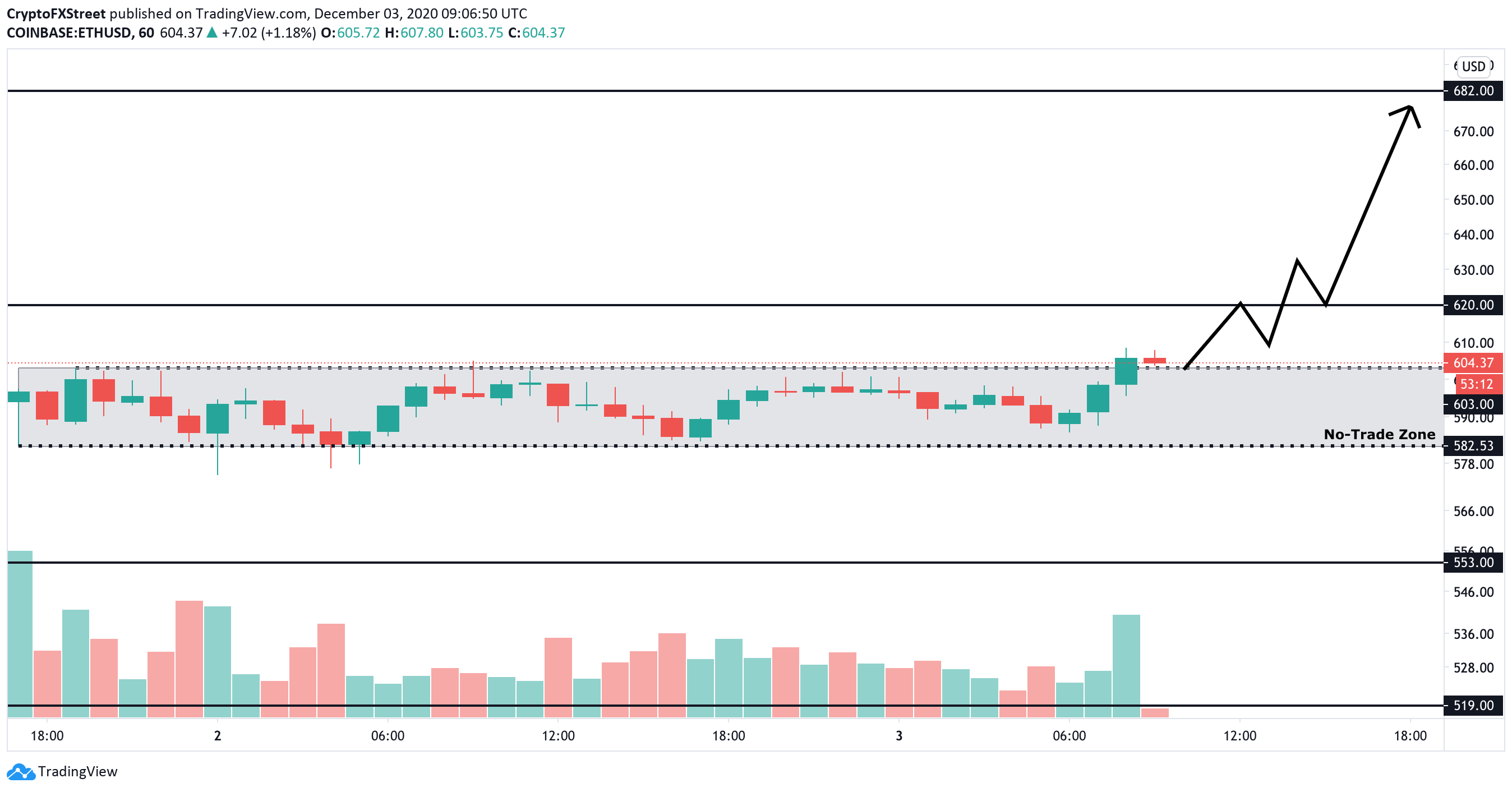

On the hourly chart, ETH has broken out of a no-trade zone. If the upside momentum is sustained, Ethereum's price may continue the recovery towards the next primary bullish target of $680 and the psychological $700. A sustainable move above $620 is needed to confirm the bullish scenario.

ETH/USD 1-hour chart

Intotheblock's data on In/Out of the Money Around Price signals a local hurdle on approach to $620 as nearly 315,00 addresses holding over 726,00 coins there. Once it is cleared, the upside momentum will gain traction with little-to-no resistance on the way.

Ethereum: IOMP data

On the other hand, failing to settle above this barrier will attract more sellers to the market and push the channel support price below $580. If this is the case, the sell-off may be extended to $550, where the IOMAP shows stable support with nearly 290,000 addresses holding 8.6 million coins. If this level gives way, $520 will come into focus.

ETH/USD 1-hour chart

On December 1, Ethereum developers successfully produced the Beacon Chain's genesis block and thus launched the transition to Ethereum 2.0. ETH/USD has been rallying ahead of the event and hit the recent top at $636. The downside correction triggered by the "sell the fact" scenario, pushed the price to $563.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.