Ethereum price is on the cusp of undoing the death cross

|

- Ethereum price saw a fierce rally this week that made new highs against last week.

- ETH price sees technical indicator tilting higher, pointing to the end of the technical death cross.

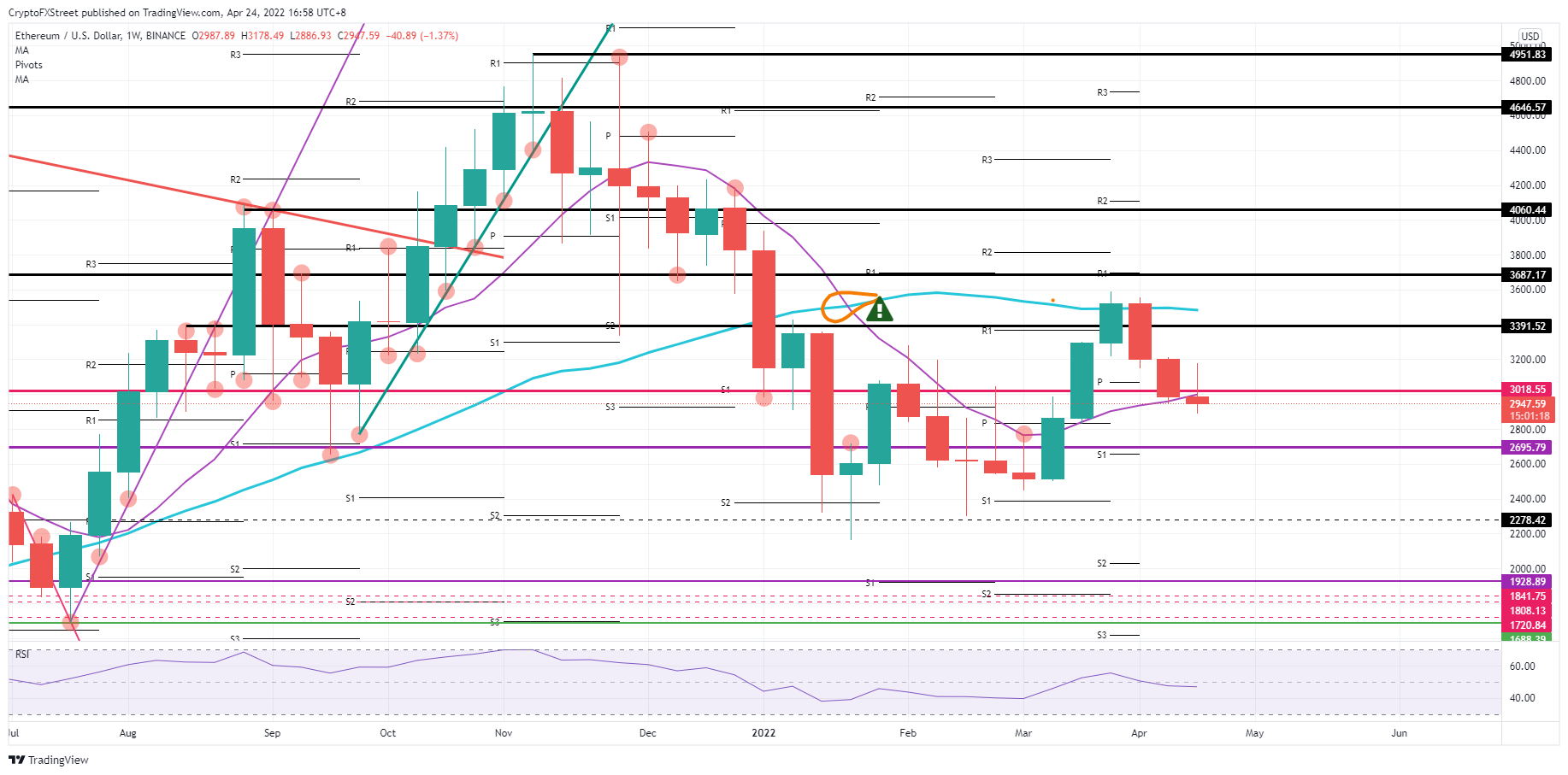

- Expect to see a pop higher into next week, with ETH first hitting $3,391.52 before trying to punch above $3,687.17.

Ethereum (ETH) price was in the danger zone after price traded below the 55-day Simple Moving Average (SMA) near $2,986.86. But bulls stepped in and used the area between the 55-day SMA and $2,900.00 as a fade-in level before ramping price action up above $3,000.00. Next week, some silence from the central banks will help investors in ETH book some solid gains as a lot of noise will fade to the background in global markets.

ETH price entering calm waters next week, setting sail to 25% gains

Ethereum price needs some calmness, which is just around the corner next week. A significant tail risk event will know its outcome on Sunday with the French elections, but FED speakers are going into their blackout period, which means no disturbances from Powell until the FED meeting at the beginning of March. Past few days, several assets in global markets got thrown left and right by FED speakers' comments, earnings, polls on French elections, news on Ukraine and much more side headlines, all that needed to be filtered and priced.

ETH price will thus start a calm Monday trading week, with minor disturbance and more room for pure technical trading. The 55-day SMA is uptilted; it is nearing the 200-day SMA, around $3,500. Although still quite some way to go, a steady rally could bring the 55-day closed to the 200-day SMA and possibly by the first week of May, the feared death cross can be undone, opening up much more room to the upside; For ETH price that would mean $3,687.17 with the monthly R1 and a historic pivotal level as a barrier.

ETH/USD weekly chart

With bulls performing that fade-in trade, the lack of bears could be a wrong assessment of the trading environment. In case of price, action can not close above $3,000.00, bears will further defend and refrain ETH price from reclaiming that area. With that, pressure will mount on those positions from the fade-in trade going nowhere and little by little get cut short, triggering a drop back to $2,695.79.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.