Ethereum Price Forecast: ETH overcomes key hurdle as ETF and staking inflows improve

|

Ethereum price today: $3,820

- Ethereum ETFs have averaged $100M in net inflows per day in the past eight days amid signs of increased basis trade.

- Increased staking inflows suggest a bias toward long-term holding among investors.

- Ethereum overcame a key trendline resistance that has lasted for the past three years.

Ethereum (ETH) is down 1% on Thursday despite rallying in the European session to overcome a key descending trendline resistance that has lasted for three years. The top altcoin has seen increased bullish sentiment across staking protocols and ETH ETFs. However, Chicago Mercantile Exchange (CME) data reveals that the ETH basis trade may have fueled the high ETF inflows.

Ethereum ETF flows suggest high basis trade, staking inflows improve

Ethereum ETFs stretched their inflows streak to eight consecutive days after recording net inflows of $167.7 million on Wednesday. In the past eight days, the products have averaged about $100 million inflows per day. This signals that institutional investors are gradually getting bullish on the top altcoin.

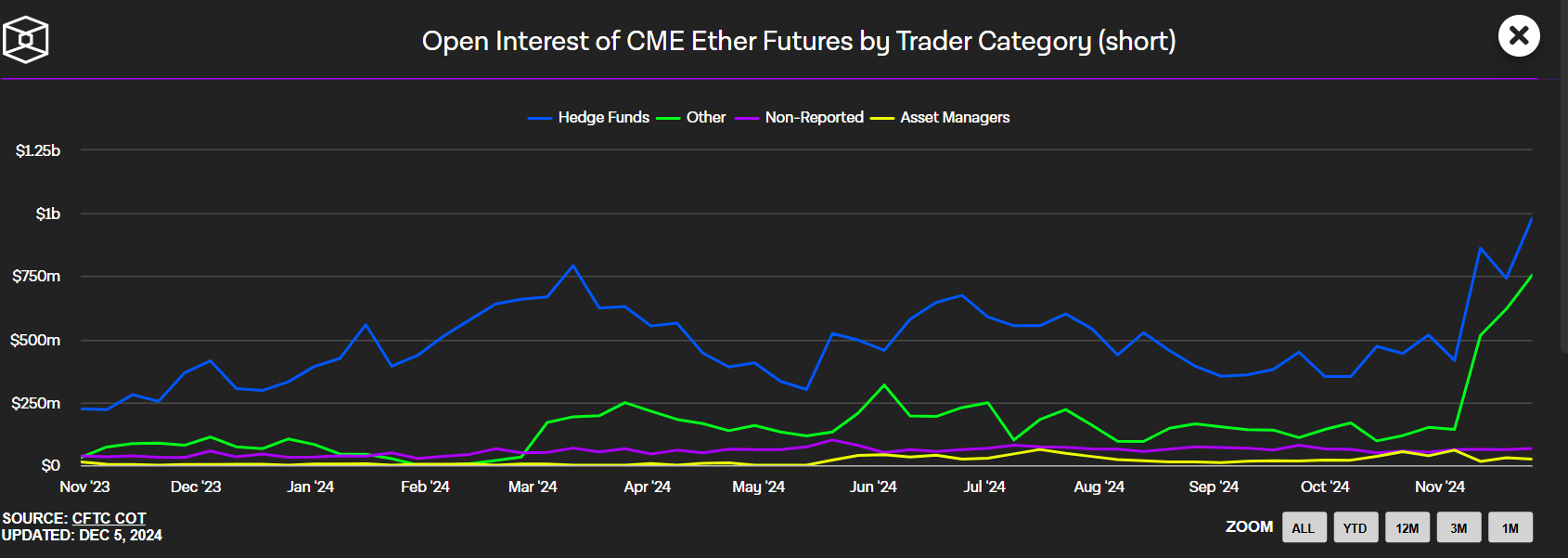

On the other hand, some crypto community members suggest that the high inflows into ETH ETFs could be due to increased basis trade among institutional investors. This is evidenced by the large number of short positions dominating the ETH CME futures market despite high bullish sentiment in the global ETH spot market.

CME Open Interest ETH Futures (Short) | The Block

The basis trade process involves investors going long on ETH by owning shares of Ethereum ETFs and simultaneously holding equivalent short positions in the futures market. The aim is to earn yields from the funding fees that short positions receive during bull markets.

Meanwhile, Ethereum has been seeing high net inflows across staking protocols after they recorded over 113K ETH net inflows in the past two days. The rising staking flows indicate a bias toward long-term holding even as ETH maintains its uptrend.

ETH Staking Flows | IntotheBlock

Ethereum Price Forecast: ETH overcomes three-year descending trendline resistance

Ethereum decreased by 1% after experiencing over $76 million in liquidations within the past 24 hours, according to Coinglass data. The liquidated long positions totaled $46.58 million, while short positions amounted to $29.91 million.

The top altcoin broke above a key descending trendline resistance extending from its all-time high in November 2021. If ETH sustains a daily candlestick close above this trendline, it could break its yearly high resistance of $4,093.

ETH/USDT daily chart

A move above its yearly high resistance may see ETH test its all-time high resistance of $4,898 to reach the profit target of a rounded bottom pattern.

The Relative Strength Index (RSI) is in the overbought region, indicating prices are getting overheated and could see a correction.

A daily candlestick close below the $3,400 support level will invalidate the thesis and send ETH toward the $2,817 key level.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.