Ethereum Price Forecast: Buyers aim for $3,000 as more than $52 billion worth of ETH locked away

|

- Ethereum price aims for new all-time highs with weak resistance ahead.

- Around $52.2 billion worth of Ethereum is locked in DeFi currently.

- Several indicators show that ETH bulls have the upper hand in the short and long terms.

Ethereum price has been under consolidation for the past week after a run to its new all-time high of $2,151. The digital asset faces weak resistance ahead according to various on-chain metrics while bulls target $3,000.

Ethereum price becomes scarcer and targets $3,000

One of the main strengths of Ethereum is the significant number of coins locked away from exchanges. At current prices, there is over $52 billion worth of Ethereum locked in DeFi protocols.

ETH locked in DeFi

Additionally, the ETH2 deposit contract also holds 3.75 million ETH worth around $7.7 billion, which means that close to $60 billion worth of Ethereum is out of exchanges.

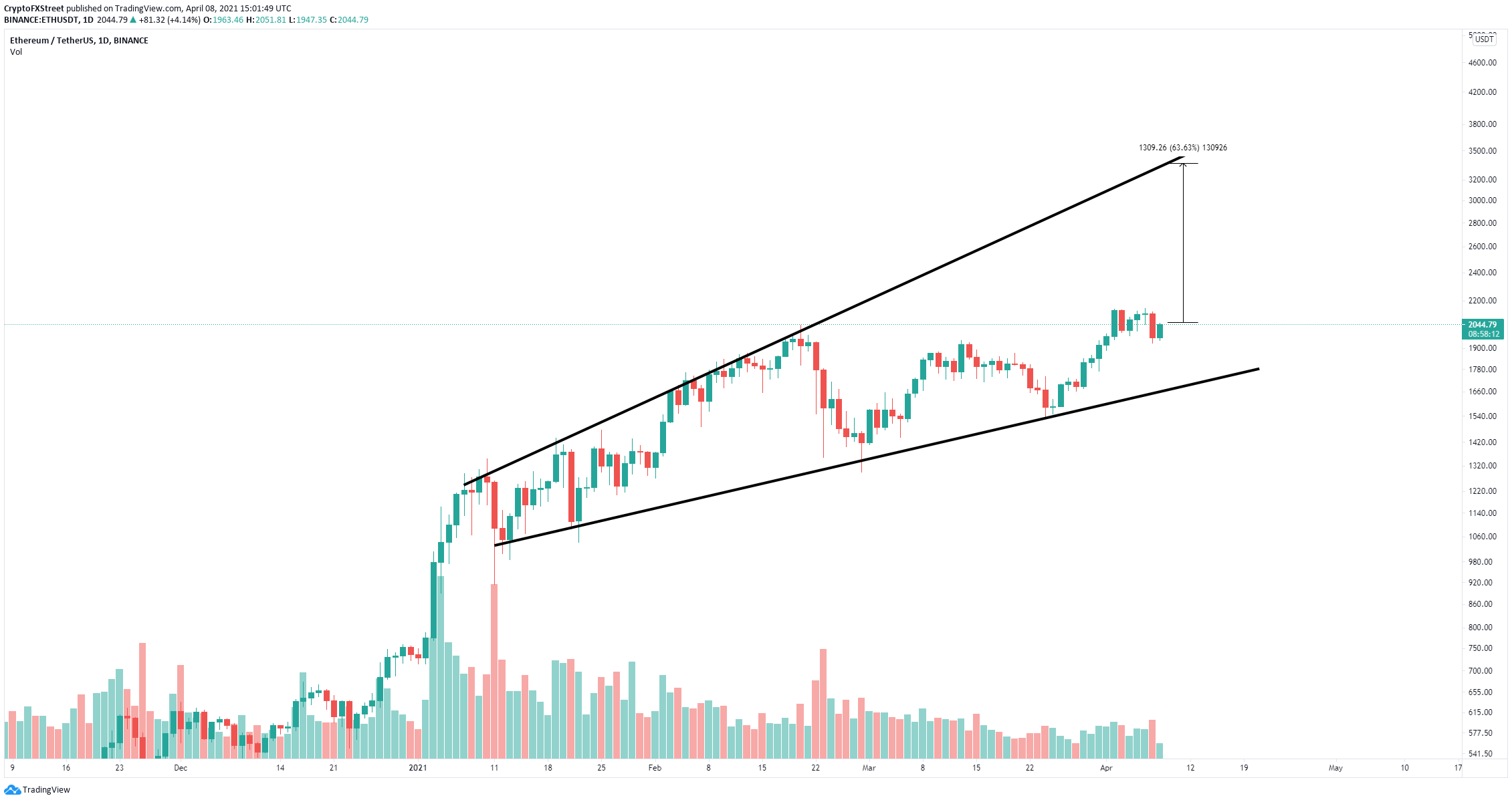

ETH/USD daily chart

Ethereum has formed an ascending broadening wedge pattern on the daily chart. This pattern can be drawn connecting the higher highs and higher lows with two trendlines. A breakout above the previous all-time high has a price target of $3,000 at the top of the pattern.

ETH IOMAP chart

The In/Out of the Money Around Price (IOMAP) chart indicates practically no resistance above $2,000. The strongest area is between $2,056 and $2,066 where 143,000 addresses purchased almost 1 million ETH.

However, losing a critical support area between $1,982 and $2,043 where 332,000 addresses bought over 9.2 million ETH would be devastating for the bulls. This breakdown can easily lead Ethereum price towards the lower boundary of the pattern at $1,700.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

%20[17.03.51,%2008%20Apr,%202021]-637534975562179848.png)