Ethereum price breaks critical resistance, bulls target $500 in the short-term

|

- Ethereum price has broken above a critical resistance barrier at $463.

- There seems to be almost no resistance for Ethereum until $500.

Ethereum price topped out at $468 on November 7 and seemed to form a potential double top on November 11 after hitting $466, followed by a slight rejection. However, in the past four hours, the digital asset has seen a notable breakout towards $474, negating the possible double top pattern.

ETH bulls face very little opposition to the upside

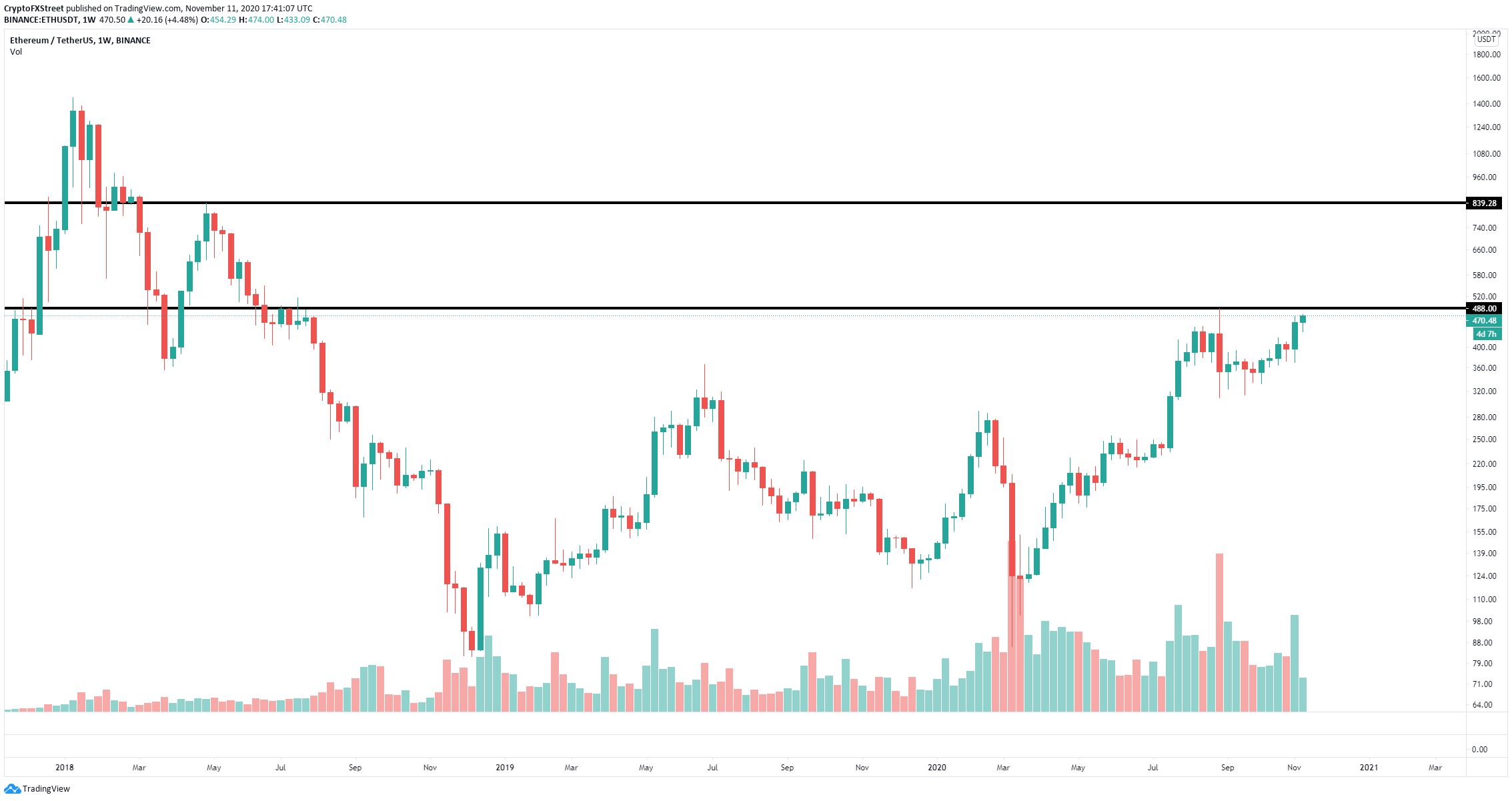

The next significant barrier seems to be established on the weekly chart at $488, which is the 2020 high formed on September 1. A breakout above this point could easily drive Ethereum towards $841.

ETH/USD weekly chart

Ethereum price is inside a weekly uptrend, just like on the lower time frames. On the 4-hour chart, ETH broke out of a symmetrical triangle pattern, which gives a price target of $488, precisely the high of 2020.

ETH/USD 4-hour chart

The MACD has also turned bullish for the first time since November 4, which was followed by a 20% price explosion. A similar move would create a price target at $546, especially if Ethereum price can break $488.

However, rejection from the critical resistance barrier at $488 would form a potential double top and would likely drive Ethereum price towards $450 to re-test the upper boundary of the triangle pattern on the 4-hour chart.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.