Ethereum plunges further as Genesis Trading begins repayment of creditors

|

- Ethereum ETF net inflows could begin to affect ETH's price as Grayscale outflows slow down.

- Genesis Trading's headwind could outweigh ETH ETF impact in the coming weeks.

- Ethereum could form a W chart pattern if it bounces around key support.

Ethereum (ETH) is down 2.5% on Friday following Genesis Trading ETH's transfer to several addresses in preparation for repayment of creditors. Meanwhile, ETH ETFs saw net inflows for the second time this week as Grayscale outflows slowed.

Daily digest market movers: ETH ETF inflows, Genesis headwinds

Ethereum ETFs recorded their second day of net inflows on Thursday with a total net flow of $26.7 million, according to data from Farside Investment. For the first time since their launch, inflows in BlackRock's iShares Ethereum ETF (ETHA) outweighed outflows in Grayscale Ethereum Trust (ETHE).

Total Ethereum ETFs and their flows:

TOTAL NET FLOW: 26.7

ETHA: 89.6

FETH: 11.7

ETHW: 3.4

CETH: 0

ETHV: 0

QETH: 0

EZET: 0

ETHE: -78

ETH: 0

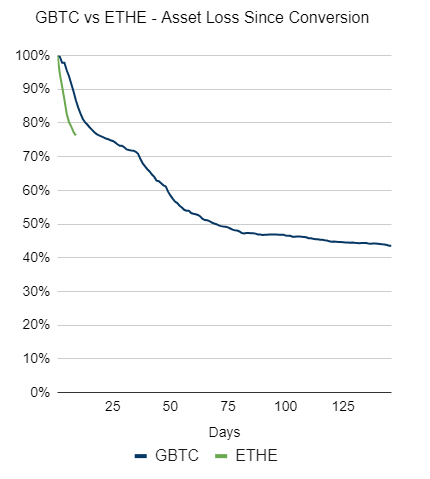

The bearish pressure from ETHE outflows is slowing down after the heavy asset loss it recorded in the first week of ETH ETF launches. As a result, the ETF effect could begin playing out on ETH's price in the coming weeks.

GBTC/ETHE Asset Loss since conversion

However, several headwinds on the horizon in the crypto market could affect ETH's chance of a rally in August.

Potential bearish pressure from Mt. Gox BTC repayment could trickle down and affect the entire crypto market, including Ethereum.

Genesis Trading has transferred about 32,256 BTC and 256,775 ETH worth $2.1 billion and $838 million to several addresses in the past three days as the company is undergoing bankruptcy proceedings to begin repayment of creditors, according to data from Arkham Intelligence.

The company filed for bankruptcy in January 2023 after mismanaging investors' funds through the Gemini Earn program. In May, it received court approval to return $3 billion worth of customer assets in a bankruptcy liquidation plan.

Mark Cuban just received $19.9M ETH from the Genesis Bankruptcy.

— Arkham (@ArkhamIntel) August 2, 2024

Creditors are finally getting their money back

Address:https://t.co/M9eT0wSoar pic.twitter.com/Mty7oAn9in

Mark Cuban just received $19.9M ETH from the Genesis Bankruptcy.

— Arkham (@ArkhamIntel) August 2, 2024

Creditors are finally getting their money back

Address:https://t.co/M9eT0wSoar pic.twitter.com/Mty7oAn9in

Despite declining prices and potential headwinds in sight, a smart money wallet with a 100% win rate bought 4,000 ETH at an average price of $12.58 million in the past few hours. The wallet has purchased 17,012 ETH worth $61 million at an average price of $3,587 since May 29 and is currently holding an unrealized loss of $7.6 million.

This is typical of most large ETH holders in 2024, as they have shown strong demand around the $2,800-$3,000 price range since the beginning of the year.

ETH technical analysis: Ethereum could take a W shape as it approaches key support

Ethereum is trading around $3,037, down 2.5% on the day. The downward move triggered $76.43 million in liquidations in the past 24 hours, with long and short liquidations accounting for $63.20 million and $13.23 million, respectively, according to Coinglass data.

Prior to the price drop, ETH posted about three small-bodied candlesticks, indicating indecision among traders. However, with the Federal Reserve's decision to hold interest rates steady and Genesis Trading's recent repayment of creditors, bears have begun outweighing bulls. This is evidenced in ETH's Long/Short Ratio, which has dropped to 0.89 in the past 24 hours.

ETH/USDT Daily chart

ETH may attempt to take a W shape if it bounces the key support ranging from $2,852 to $2,803. Considering buyers have defended this level several times in the past four months, ETH could find support here and bounce to tackle the resistance at $3,731. However, ETH has to first face the battle of tackling the $3,357 level.

The 50-day Simple Moving Average (SMA) is above ETH's price in the daily chart and could serve as a resistance of around $3,357.

A move below the $2,803 support will invalidate the bullish thesis.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. Since its inception, a total of 19,445,656 BTCs have been mined, which is the circulating supply of Bitcoin. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value. For Bitcoin, the market capitalization at the beginning of August 2023 is above $570 billion, which is the result of the more than 19 million BTC in circulation multiplied by the Bitcoin price around $29,600.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.