Ethereum market update: ETH/USD hovers above $300 in a slightly bearish market

|

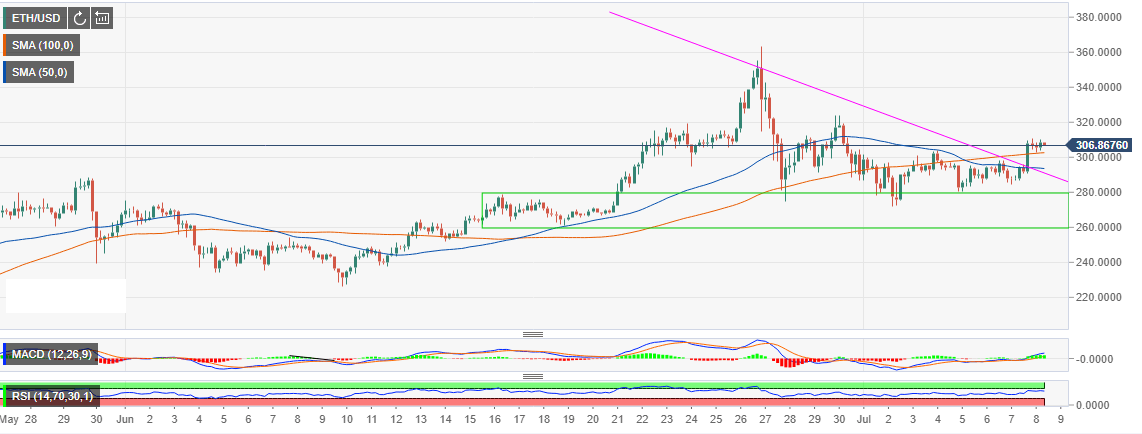

- ETH/USD stepped above $310 before retracing to levels towards $300 support.

- Ethereum path of least resistance is upwards sideways according to the technical picture.

Ethereum appreciated in value over the last weekend. The gains on the weekend emanated from the support that had been formed between $270 - $280. Prior to the brief correction, Ethereum spent most of last week seeking balance following the losses that had it tumbling from the yearly highs.

Consolidation under $300 took the center stage last week but the break above both the trendline resistance and the 50 Simple Moving Average (SMA) at $294.43 paved the way for gains spiking above. Unlike the previous break that failed to sustain gains, ETH/USD stepped above $310 before retracing to levels towards $300 support.

For now, the price is exchanging hands at $307 and holding onto shallow intraday gains. The 100 SMA is providing the much-needed support at $302. $300 is the next support target but the buyers must have $290 and $270 - $280 support areas under their radar.

The technical picture for ETH/USD has a bullish bias. The Relative Strength Index (RSI) is moving horizontally at 60 show that the price has the power to stay above $300. The Moving Average Convergence Divergence has recovered into the positive. The indicators divergence is increasing to show that the momentum is in favor of the bulls in the near-term.

ETH/USD 1-h chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.