Ethereum Classic price is setting up for a sharp rally to $33, here's what traders

|

-

Ethereum Classic price is set to print a subtle hammer at the bottom of the downtrend.

-

The volume profile shows a persistent tapered look amidst the downtrend.

-

Invalidation of the bullish reversal thesis is a breach at $24.90.

Ethereum classic could make a surprise move to the upside if market conditions persist.

Ethereum Classic price has potential

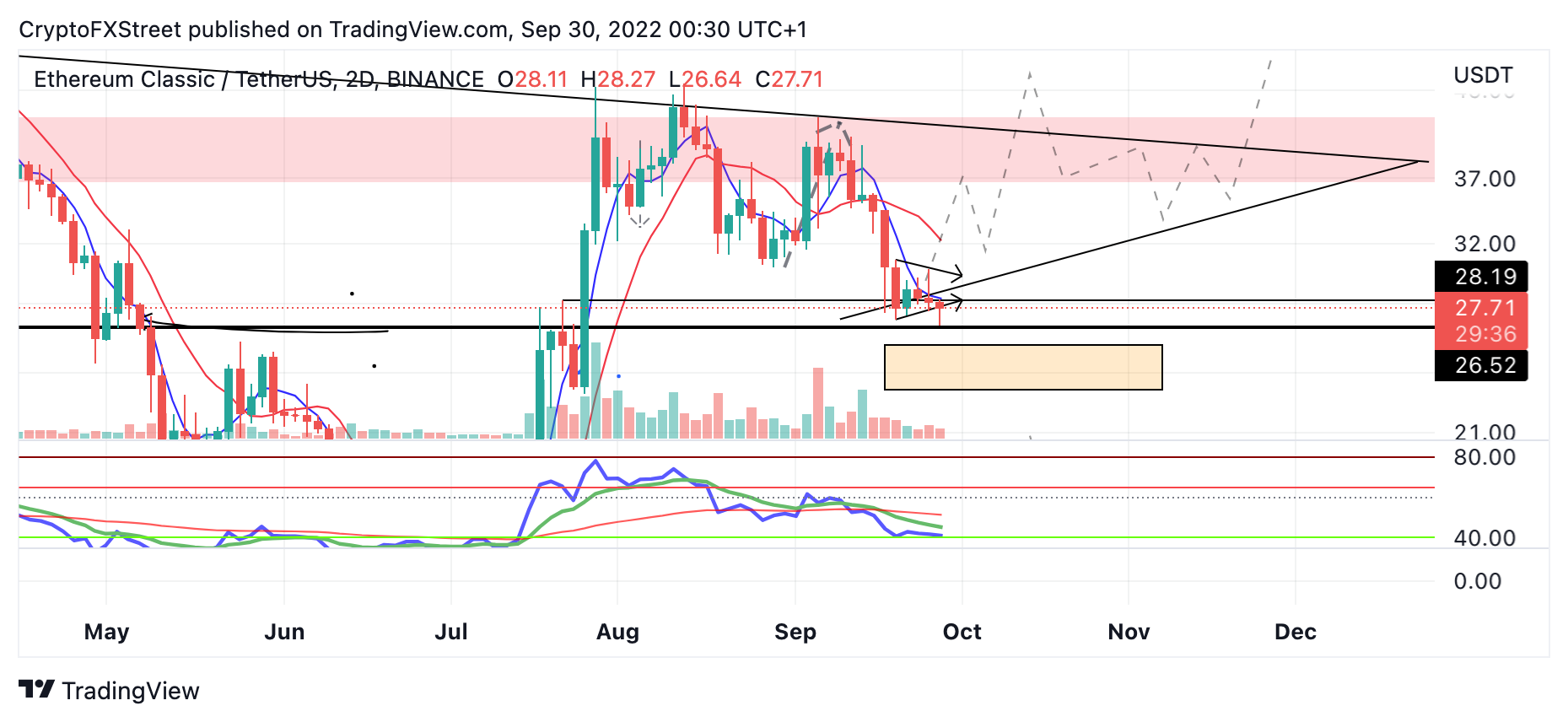

Ethereum Classic could see a spike to the upside. At the time of writing, the bulls are attempting to regain the support of the 8-day exponential moving average (EMA) but have not yet succeeded. Despite the rejection, the volume profile indicator shows a consistent tapered look during the current downturn, which suggests the trend may be weakening.

Ethereum Classic currently auctions at $27.65. The Relative Strength Index's reading is the most confounding evidence supporting the potential for a bullish reversal. On the 2-day chart, while a hammer is minutes away from being formed, a subtle bullish divergence is displayed. More importantly, the divergence is at the precise level where corrections must choose between a reversal or a continuation to the downside.

ETC USDT 2-Day Chart

Combining these factors, an Ethereum Classic pump should not be ruled off the table. Early confirmation of the trend reversal could occur if the bulls hurdle the 8-day EMA at $28.33. In doing so, the bulls could re-route, targeting the 21-day Simple Moving Average at $32.25. Such a move would result in a 17% increase from the current ETC price.

If the bears continue to reign, a 18% nose dive into the previous $23 congestion zone will likely occur. The failure to hurdle the 8-day EMA provokes this scenario.

In the following video, our analysts deep dive into Ripple's price action, analysing key market interest levels. -FXStreet Team

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.