Dogecoin Price Prediction: DOGE bulls fall short, putting new highs in jeopardy

|

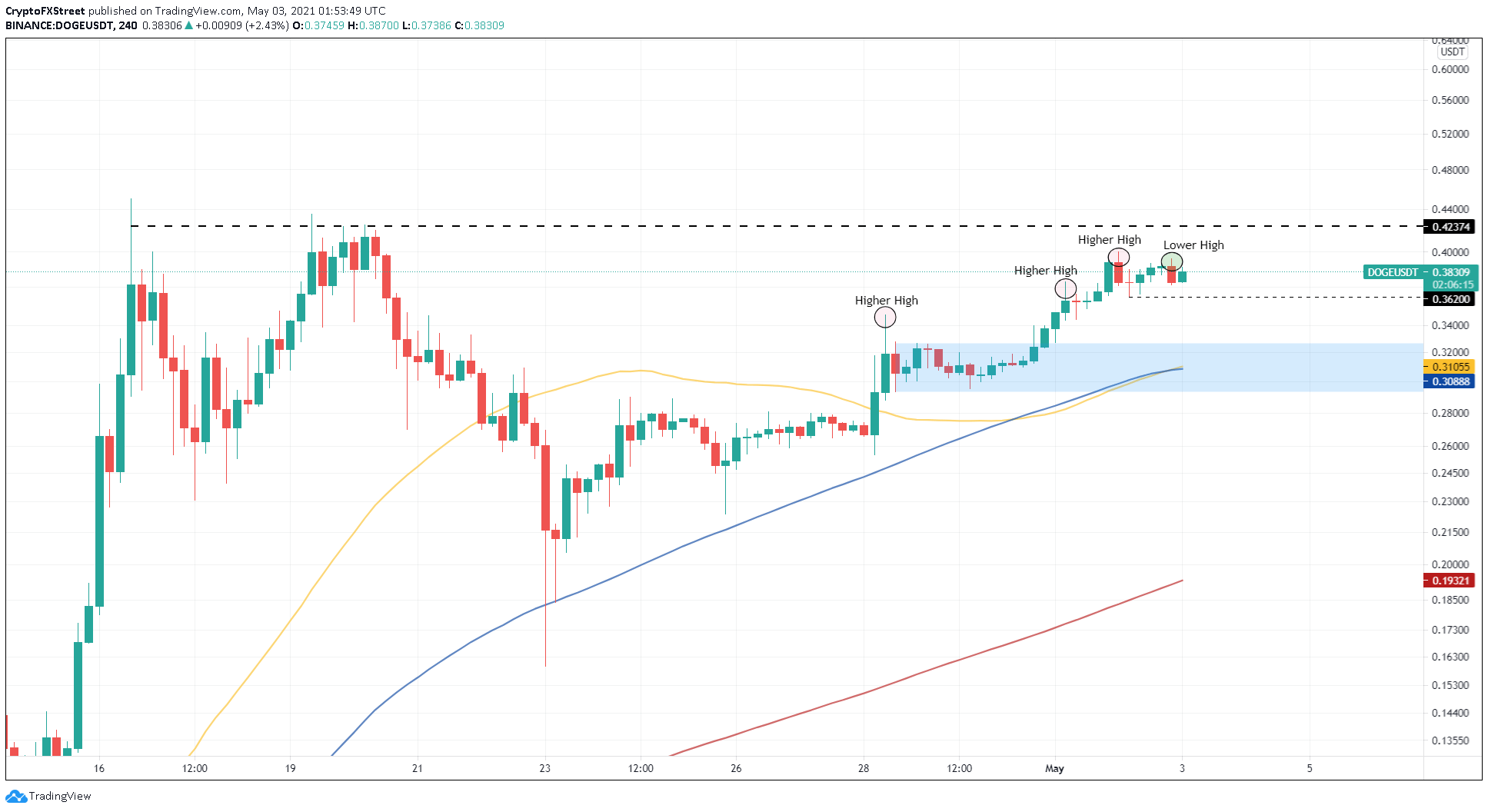

- Dogecoin price is currently hovering under a critical resistance level at $0.423.

- A string of higher highs was followed by a potential lower high, suggesting a waning bullish momentum.

- Two consecutive lower highs with a lower low would confirm a shift in trend.

Dogecoin price is at a make-or-break point, where a decisive close below a certain level would ignite a shift in momentum from bullish to bearish.

Dogecoin price at crossroads

On the 4-hour chart, Dogecoin price shows a slew of higher highs and higher lows being formed since April 28. As this meme-themed cryptocurrency approaches a stiff resistance barrier at $0.423, the outcome seems to be shifting toward the bears due to the formation of a lower high.

While the recent swing high is not set in stone, a decisive close below $0.362 will confirm that a downtrend is nigh.

If the second swing point is also a lower high, it will seal DOGE’s fate and result in a sell-off to the demand zone that ranges from $0.293 to $0.327.

Interestingly, the 50 and 100 four-hour Simple Moving Averages (SMA) at $0.31 and $0.30 are present around the lower end of this area of support. Therefore, investors could expect Dogecoin price to give the upswing narrative another chance.

DOGE/USDT 4-hour chart

Market participants should note that the current 4-hour candlestick has not closed yet. Therefore, a close above the previous high at $0.399 could render the bearish thesis null and void.

Moreover, Dogecoin price is known for its celebrity-induced pumps. Hence, if something similar were to happen, DOGE could ignore these bearish signals and pump higher.

The first target for buyers would be $0.423, followed by the all-time high at $0.45. Beyond this, the meme coin could surge nearly 40% to hit a new all-time high at $0.63.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.