Dog-based meme coins DOGE and SHIB dip as bearish bets increase among traders

|

- Dogecoin price continued to decline on Monday after correcting more than 6% the previous week.

- Shiba Inu price trades in the red on Monday after declining almost 7% last week.

- DOGE and SHIB long-to-short ratio trades are below one, indicating more traders are betting for dog-based meme coins to fall.

Dogecoin (DOGE) and Shiba Inu (SHIB) prices continue to decline on Monday after correcting more than 6% in the previous week. DOGE and SHIB long-to-short ratio trades are below one, indicating more traders are betting for dog-based meme coins to fall.

Dog-themed memecoins face downlegs as bearish bets increase among traders

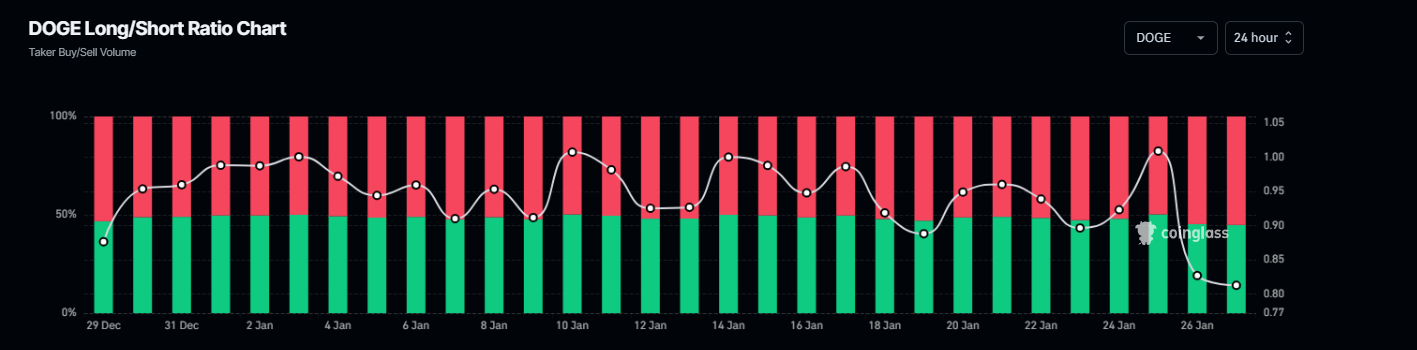

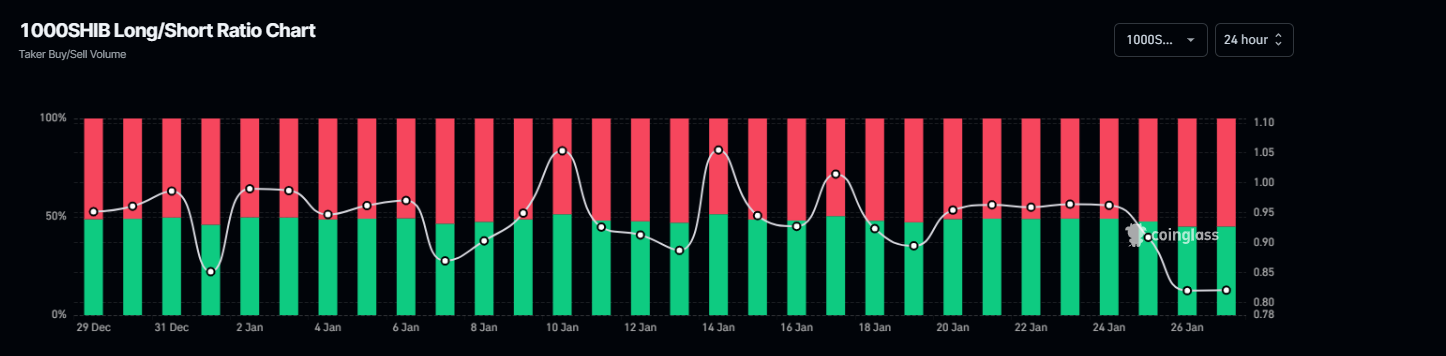

According to Coinglass’s data, the long-to-short ratio of dog-themed memecoins DOGE and SHIB reads 0.79 and 0.82, respectively. This ratio below one reflects bearish sentiment in the markets as more traders are betting for the memecoins to fall.

DOGE long-to-short ratio chart. Source: Coinglass

SHIB long-to-short ratio chart. Source: Coinglass

Dogecoin Price Forecast: DOGE shows signs of weakness

Dogecoin price faced rejection around its 61.8% Fibonacci retracement level on January 21 (drawn from the December 8 high of $0.48 to the December 20 low of $0.26) at $0.40, which declined 16.78% until Sunday. At the time of writing on Monday, it continues to trade down around $0.32.

If DOGE continues its correction, it could extend its decline to retest its December 20 low of $0.26.

The Relative Strength Index (RSI) indicator on the daily chart reads 40, below its neutral level of 50, pointing downwards, indicating bearish momentum. The Moving Average Convergence Divergence (MACD) indicator also shows a bearish crossover on Thursday, indicating a downward trend.

DOGE/USDT daily chart

Shiba Inu Price Forecast: Poised for a double-digit crash

Shiba Inu price broke and closed below its ascending trend (drawn from connecting multiple low levels since August 5) on Friday and declined 4.36% until Sunday. At the time of writing on Monday, it continues to trade down around $0.000018.

If SHIB continues its pullback, it could extend its decline by 12% to retest its November 3 low of $0.000016.

The RSI indicator on the daily chart reads 34, below its neutral level of 50, pointing downwards, indicating bearish momentum. The MACD indicator also shows a bearish crossover on January 20, indicating a downward trend.

SHIB/USDT daily chartRelated news

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.