DeFi collapse alert: Here’s how to safeguard your funds from failure of Ethereum Merge

|

- Ethereum blockchain is heading towards a complication with the approaching Merge.

- If the Merge fails, the DeFi ecosystem will be severely affected, users could suffer losses.

- An analyst identified the issues in the DeFi ecosystem and revealed a failsafe strategy to secure funds.

The Merge is a key event for the crypto ecosystem and the DeFi market, especially for cryptocurrencies like Polygon MATIC. An analyst determined the effects of the Merge and explained how users can protect their cryptocurrencies from the event.

Also read: Ethereum Merge knocking on the door, 30,000 blocks away

If the Merge fails, this happens next

The Ethereum Merge is a complicated event since the network is going through several changes. From change in consensus mechanism to how Ethereum is created, ETH holders will see several changes in the cryptocurrency’s ecosystem.

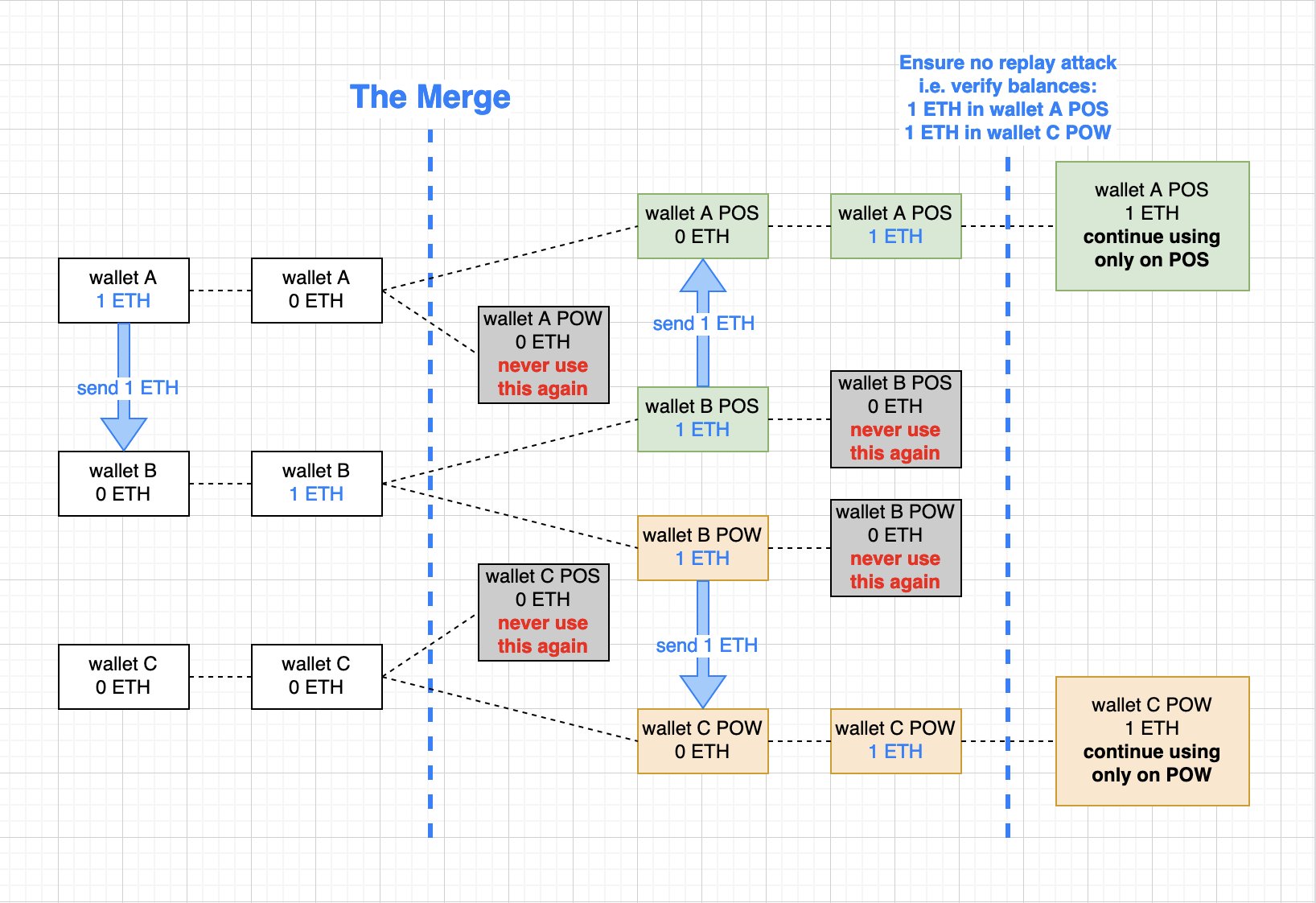

If the Merge fails, the DeFi ecosystem will be severely affected. Proponents believe this can be fixed by following a few simple steps to ensure safety of funds in DeFi. Elerium115, a pseudonymous crypto analyst identified a way for users to access both proof-of-work and proof-of-stake chains after the Merge.

Before the Merge, users should send funds from their main wallet to a temporary wallet. Before the Merge, users need to prepare an empty wallet to use on the Proof-of-Work chain, and the temporary wallet to use on the Proof-of-Stake chain.

This way two different wallets hold funds for two different Ethereum chains.

Post Merge scenarios

Since the upcoming Merge has the potential to disrupt the Ethereum lending market due to the airdrops. Therefore excessive borrowing from ETH lending pools could result in negative user experience.

Aave, Compound and “blue chip” DeFi lenders have voted to temporarily ban Ethereum lending in light of the upcoming Merge. Since the risks for lending protocols are high, users need to swap out their Ethereum derivatives for ETH.

Based on data from DappRadar, Ethereum’s market share in DeFi’s total value declined by 11% in August 2022. The Merge has raised alarms for holders in the crypto community and in order to ensure that they receive the airdrop for ETH PoW, there is a decline in inflow by users.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.