Cryptocurrencies Price Prediction: Shiba Inu, Bitcoin & Ripple – European Wrap 26 March

|

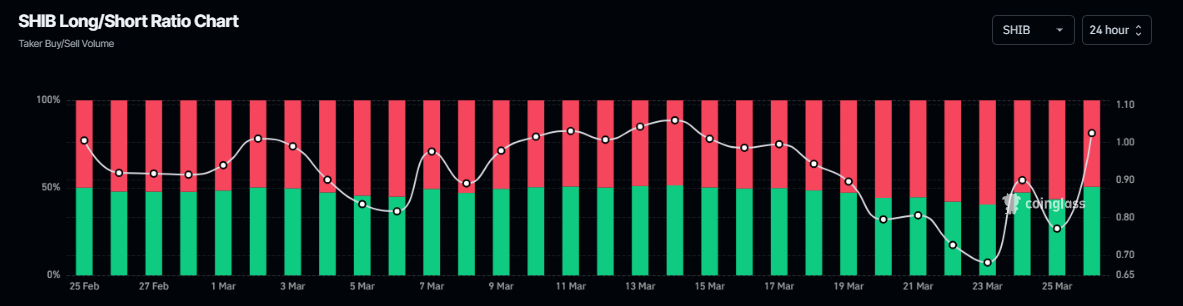

Shiba Inu Price Forecast: SHIB rallies as trading volume rises 228% amid increase in bullish bets

Shiba Inu (SHIB) price extends its gains by 8% and trades at $0.000015 at the time of writing on Wednesday, rallying over 15% so far this week. On-chain data shows that SHIB’s trading volume rose 228% in the last 30 days, bolstering the platform’s bullish outlook. Additionally, the technical outlook suggests a rally continuation as bullish bets increase among traders.

Bitcoin recovers above 87k – Can the rebound continue ahead of Liberation Day?

Bitcoin has extended its recovery from the 77k 2025 low, rising above the key 200-day moving average resistance to a 3-week high of 88.7k yesterday. Today, BTC continues to hold above 87k.

The recovery in Bitcoin has coincided with a solid rebound in the broader crypto market, with the total crypto market capitalization rising from $2.35 trillion on March 10 to $2.85 trillion today, representing a substantial $400 billion recovery.

Ripple plans US comeback after SEC case ends

Ripple CEO says U.S. growth is back on track after winning SEC case, with plans to work with banks and expand crypto payments under Trump-era policies.

Ripple CEO Brad Garlinghouse has shared that 95% of Ripple’s customers are based outside the US, but the company remains focused on expanding its presence in the American market. This renewed push follows a major legal win: the SEC dropped its lawsuit against Ripple, marking a significant milestone for both the company and the wider crypto industry.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

-638785895605546647-638785905325747046.png)