Cryptocurrencies Price Prediction: Cardano, Curve DAO & Bitcoin – European Wrap 27 March

|

Cardano Price Forecast: ADA bulls target double-digit gains as bullish bets increase among traders

Cardano (ADA) price hovers around $0.74 at the time of writing on Thursday after a recovery of over 4% so far this week. On-chain data hints at a bullish picture as ADA’s stablecoin market cap rises while its bullish bets increase among traders.

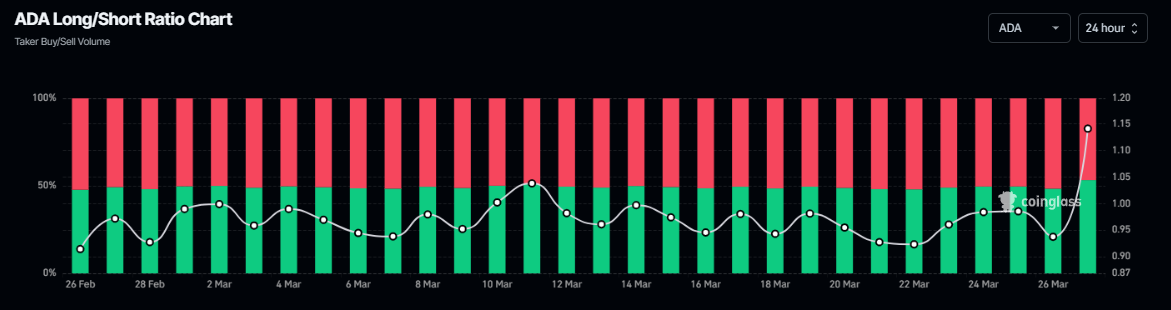

Coinglass’s long-to-short ratio data for Cardano reads 1.15, the highest level over a month. This ratio above one reflects bullish sentiment in the markets as more traders are betting for the asset price to rise.

Curve DAO rallies as developer activity hits new ATH

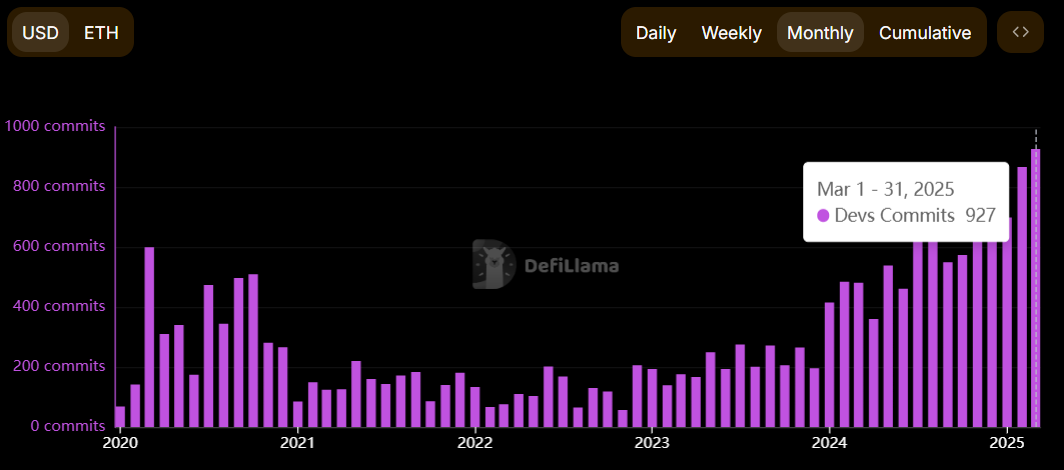

Curve DAO (CRV) price extends its gains by 8% and trades above $0.58 at the time of writing on Thursday, rallying over 15% so far this week. DefiLlama data shows that the CRV’s developer commits hit a new all-time high (ATH), surpassing 900 commits per month. The technical outlook suggests a rally continuation as CRV’s long-to-short ratio points to increasing bullish bets among traders.

Bitcoin Price Forecast: BTC range-bound as momentum indicator shows trader indecisiveness

Bitcoin (BTC) price hovers around $87,000 at the time of writing on Thursday, while its Relative Strength Index (RSI) indicators suggest indecisiveness among traders. Moreover, Glassnode reports that BTC trades in a range-bound market, as on-chain profit-and-loss-taking events are declining in magnitude, highlighting a weaker demand profile and less sell-side pressure.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.