Cryptocurrencies Price Prediction: Bitcoin, Ripple & Ethereum – Asian Wrap 19 May

|

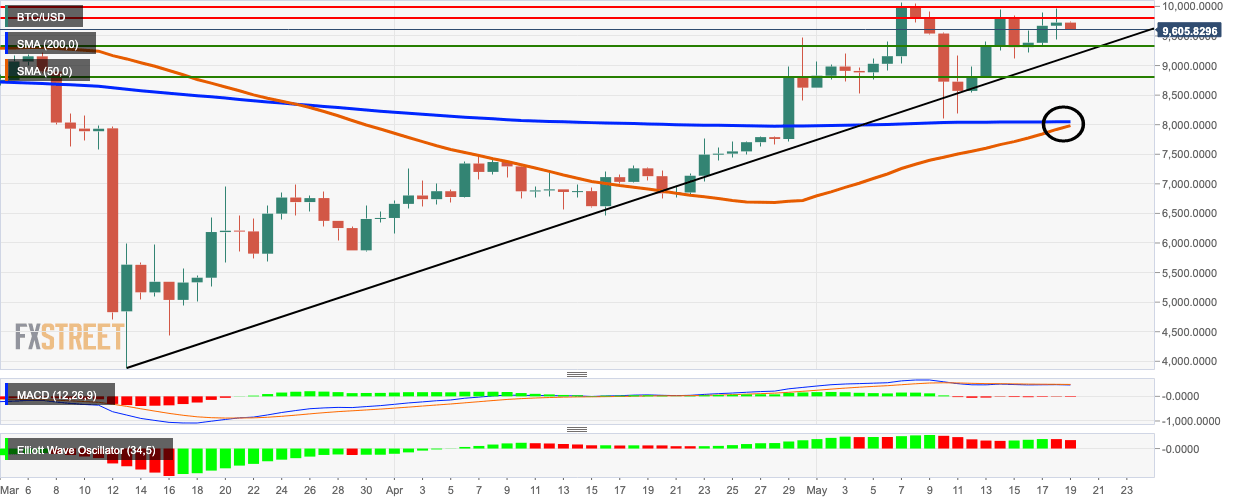

Bitcoin Price Analysis: BTC/USD bears take control after losing out of momentum near the $9,811.50 resistance level

BTC/USD dropped from $9,725,85 to $9,653.45 as the bears took charge after three straight bullish days. The SMA 50 is looking to cross above the SMA 200 and form the highly bullish golden cross pattern. The MACD shows sustained bearish momentum, while the Elliott Oscillator has had two straight red sessions.

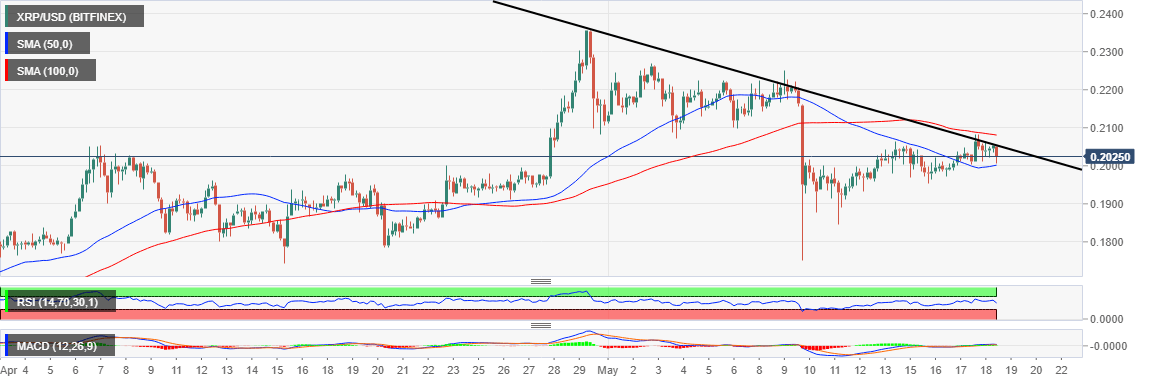

Ripple Price Analysis: XRP/USD dancing between the 50 SMA and the 100 SMA, $0.21 level is unbreakable

Ripple price is dealing with increased selling pressure just like other major cryptocurrencies in the market. The third-largest digital asset is trading 1.55% lower on the day. After opening the session at $0.2053 the price adjusted lower to $0.2008 (intraday low). At the moment XRP is doddering at $0.2020.

Ethereum Price Analysis: ETH/USD descending channel resistance breakout loses steam short of $220

Ethereum price recently broke out of a descending channel resistance in a bid to push further the recovery started after the nosedive to $175 support in May. The bullish momentum was particularly forceful especially when it came to penetrating the seller congestion at the 50 SMA and the 100 SMA in the 4-hour range.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.