Cryptocurrencies price prediction: Bitcoin, Ethereum & TRON – European Wrap – 24 March

|

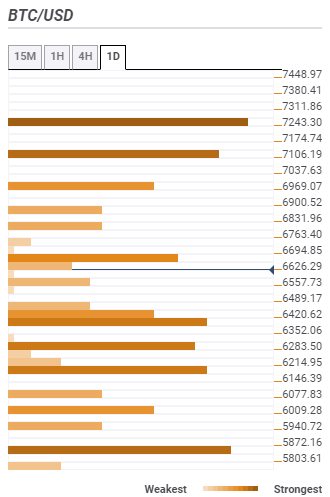

Bitcoin Price Prediction: Will BTC/USD surge above $7,000 confirm trajectory to $8,000? – Confluence Detector

Bitcoin price bulls are concentrating on one key resistance; $7,000. The surge on Friday last week pulled BTC/USD from lows under $5,500 to highs touching the coveted $7,000. However, the weekend action remained drab as the buyers lost traction amid increased bearish action. Various support areas were confirmed including $6,000, and $5,800. Bitcoin price commenced this week’s trading battling tooth and nail to force a reversal targeting $7,000.

Ethereum Price Analysis: ETH/USD settles above $140.00, indicators imply further recovery

ETH/USD hit the intraday high at $144.04 before retreating to $142.60. The-second largest digital asset is moving within a strong bullish trend on intraday charts, in sync with the market. On a day-to-day basis, ETH has gained over 15%. The bullish sentiments helped the coin to move outside the Bollinger Band on the 1-hour chart, which means the correction may be around the corner.

TRON Price Analysis: TRX/USD aims at $0.0120 amid global cryptocurrency recovery

TRX slipped to the 17th place giving way to Cardano's ADA, even though Tron's market value increased from $704 on Monday to $759 million by press time. TRX/USD has gained over 8% in the recent 24 hours amid the resumed recovery on the global cryptocurrency market. The coin is changing hands at $0.0113, off the recent high reached at $0.0115.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.