Cryptocurrencies Price Prediction: Bitcoin, Ethereum, & Cardano – Asian Wrap 01 Jun

|

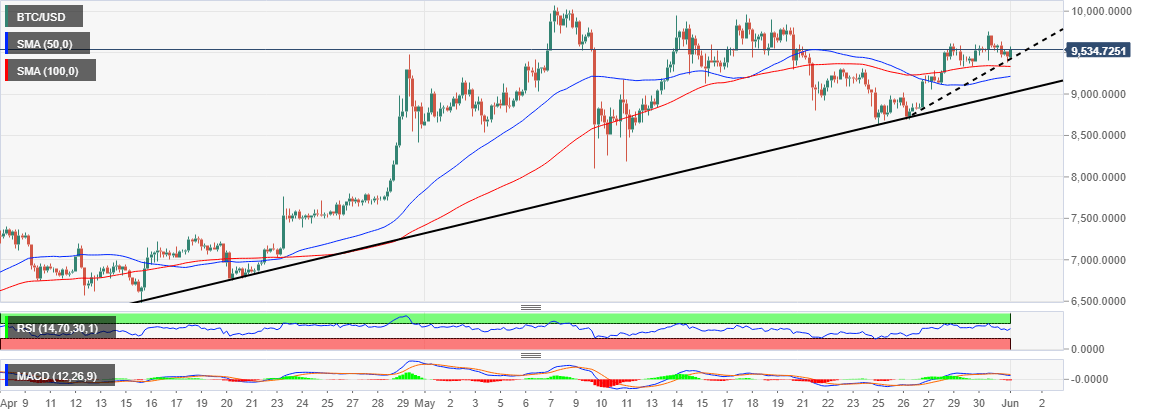

Bitcoin Price Analysis: BTC/USD bounces off $9,400 support after rejection at $9,700

The cryptocurrency market is in the green on Monday, during the Asian session. The largest cryptocurrency by market capitalization, Bitcoin is trading 1% higher on the day. BTC/USD opened the session at $9,446 and later adjusted upwards to the prevailing market value of $9,544.

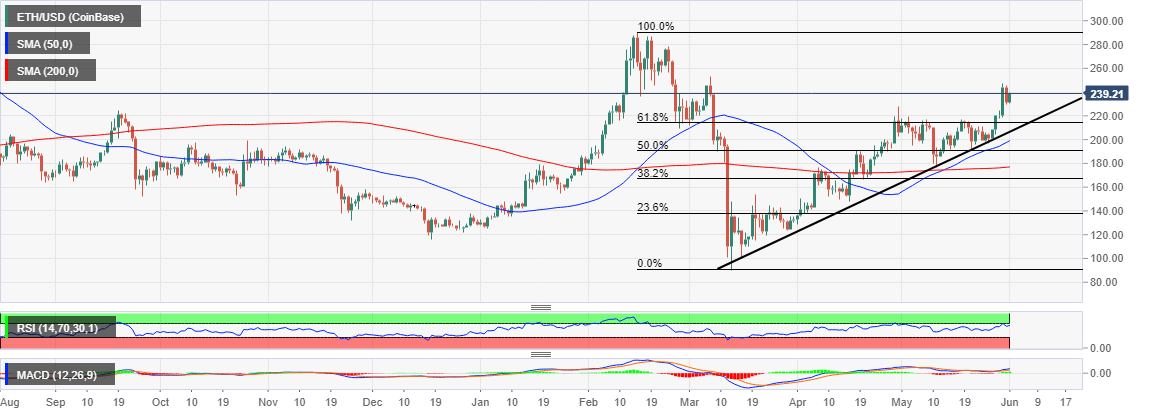

Ethereum Price Forecast: ETH/USD bulls focus on $300, breakout above $250 seems imminent

Ethereum is among the biggest single-digit gainers in the market on the first day of June. The price is trading 2.84% higher on the day. Ether started the trading on Monday at $231.55 and later scaled the levels towards $240. An intraday high has been formed at $239.73 but ETH/USD is teetering at $240.

Cardano Market Update: ADA/USD breakout from trendline support draws nearer to $0.1

Cardano continues to be one of the most active cryptocurrencies among the top 100. ADA/USD led crypto recovery last week to the extent of testing the critical $0.08. Although there was a brief break above $0.08, a reversal ensued leading to the retest of the support at $0.07.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.