Cryptocurrencies Price Prediction: Bitcoin, Ethereum & Bitcoin Cash – Asian Wrap 07 Aug

|

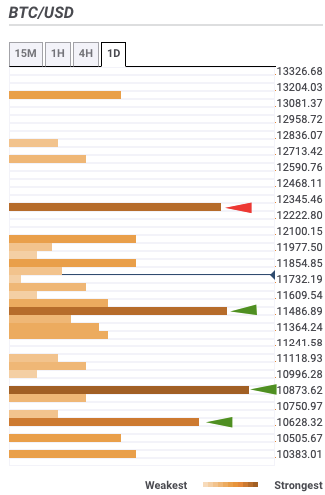

Bitcoin Price Forecast: BTC/USD bulls eke out an advantage to form bullish Doji pattern

BTC/USD bulls remained in control of the market for the second straight day. The price has gone up from $11,755.34 to $11,7757.44 to form a bullish Doji pattern. The daily confluence detector shows one strong resistance level at $12,300. This level has the one-month Pivot Point resistance-two, among others.

Ethereum gas fees are finally dropping after months, ETH/USD struggles to stay above $400

Ethereum gas fees appear to be dropping gradually as congestion on the network is finally clearing. A couple of days back, the average gas fee was between 30 and 40 Gwei. The minimum amount to get a transaction confirmed in less than 30 minutes was 6 Gwei, as per EthGasStation data.

Bitcoin Cash Market Update: BCH/USD rockets above $300 as $400 draws nearer

Bitcoin Cash is among the biggest winners in the cryptocurrency market on Friday. Besides bringing down the resistance at $300, buyers have extended the price action above $320. BCH/USD is teetering at $324 at the time of writing following consistent bullish action during the Asian session on Friday.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.