Cryptocurrencies Price Prediction: Bitcoin, Dogecoin & Crypto – European Wrap 4 March

|

Bitcoin Price Forecast: BTC edges below $84,000 as US Crypto Strategic Reserve hype fades

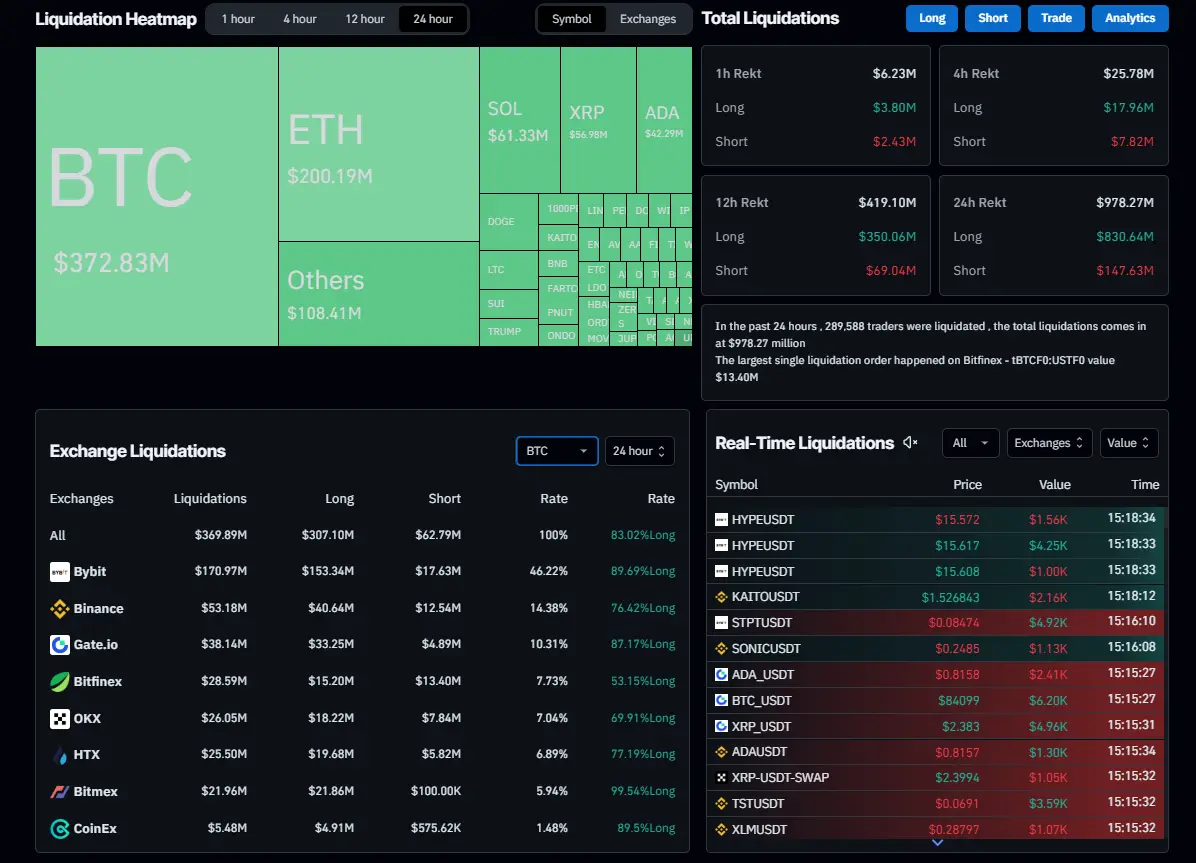

Bitcoin (BTC) price extends its decline on Tuesday, trading around $83,900 and erasing its weekend gains. US President Donald Trump’s announcement of the Crypto Strategic Reserve on Sunday was turned into a short-term “buy the rumor, sell the news” event and wiped 289,815 traders with over $978.62 million in the past 24 hours.

Dogecoin ETF faces SEC review amid growing market optimism

NYSE Arca has filed a 19b-4 with the SEC, seeking approval to list and trade Bitwise’s Dogecoin (DOGE) exchange-traded fund (ETF). This filing follows Bitwise’s earlier submission of an S-1 to the SEC. According to the filing, Coinbase Custody will manage the ETF's Dogecoin holdings, while the Bank of New York Mellon will oversee the cash assets and handle administration tasks.

Crypto could not hold up

Pressure in traditional markets has clipped the wings of the crypto market, which is almost back to the point from which Sunday's rally started. At the start of the day on Tuesday, it was capitalised at $2.76 trillion, having lost over 9% in the last 24 hours. The market fell under the 200-day average on increased momentum, and an attempt to rebound failed even with the help of cryptocurrency news.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.