Cryptocurrencies price prediction: Bitcoin Cash, Ripple & Ethereum Classic - Asian Wrap 03 Sept

|

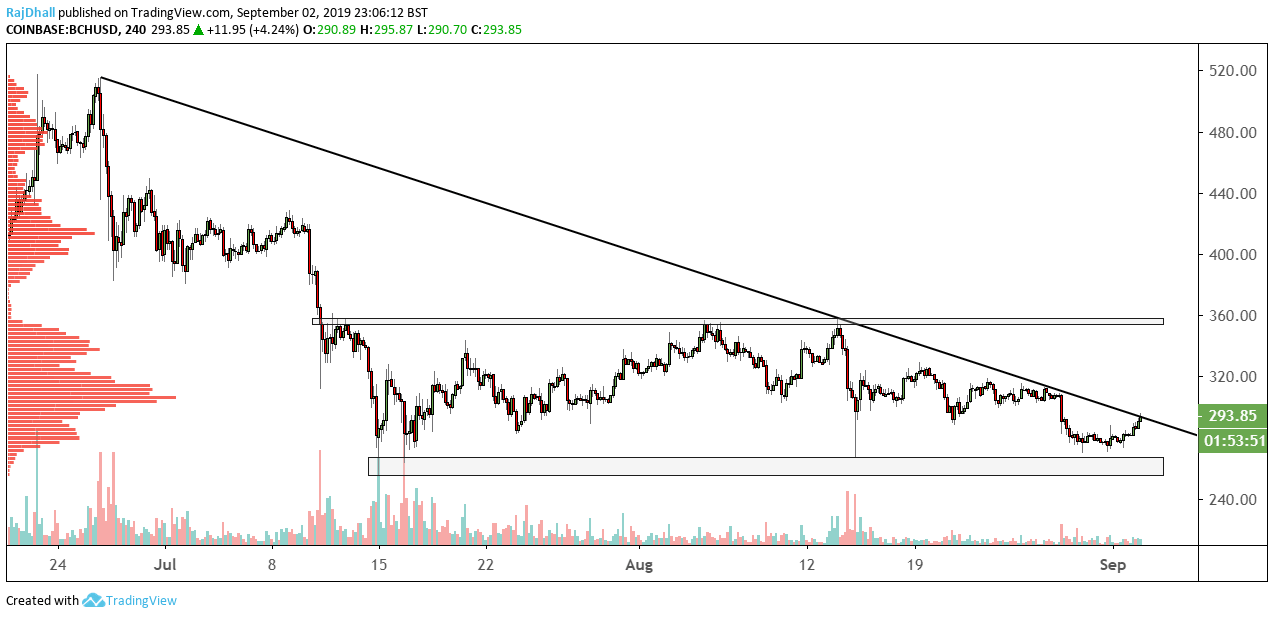

BCH/USD technical analysis: Bitcoin Cash breaks long term trendline from the on 4-hour chart

Bitcoin Cash is trading 4.4% higher today as general crypto sentiment carries all the major cryptocurrencies higher. The 4-hour timeframe has a trendline originating on 26th June, with a downtrend that spanned a full two months.

Ripple market overview: PNC bank formally joins RippleNet, XRP/USD breaks above downward trending line

A division of PNC bank had officially joined RippleNet to tap its blockchain solution for cross-border payments and settlements. PNC Treasury Management will be using Ripple’s technology to process international payments. This is a prominent indication of the use of blockchain in mainstream finance.

ETC/USD technical analysis: Ethereum is trading nearly 8% higher as we head to the Asian session

Ethereum Classic is having a great session today rising nearly 8% in line with the general positive crypto sentiment (1-hour chart above). ETC/USD has stopped ahead of the psychological 7.000 level as sellers come in to slow momentum.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.