Cryptocurrencies Price Prediction: Bitcoin Cash, Polkadot & UniSwap – Asian Wrap 29 Oct

|

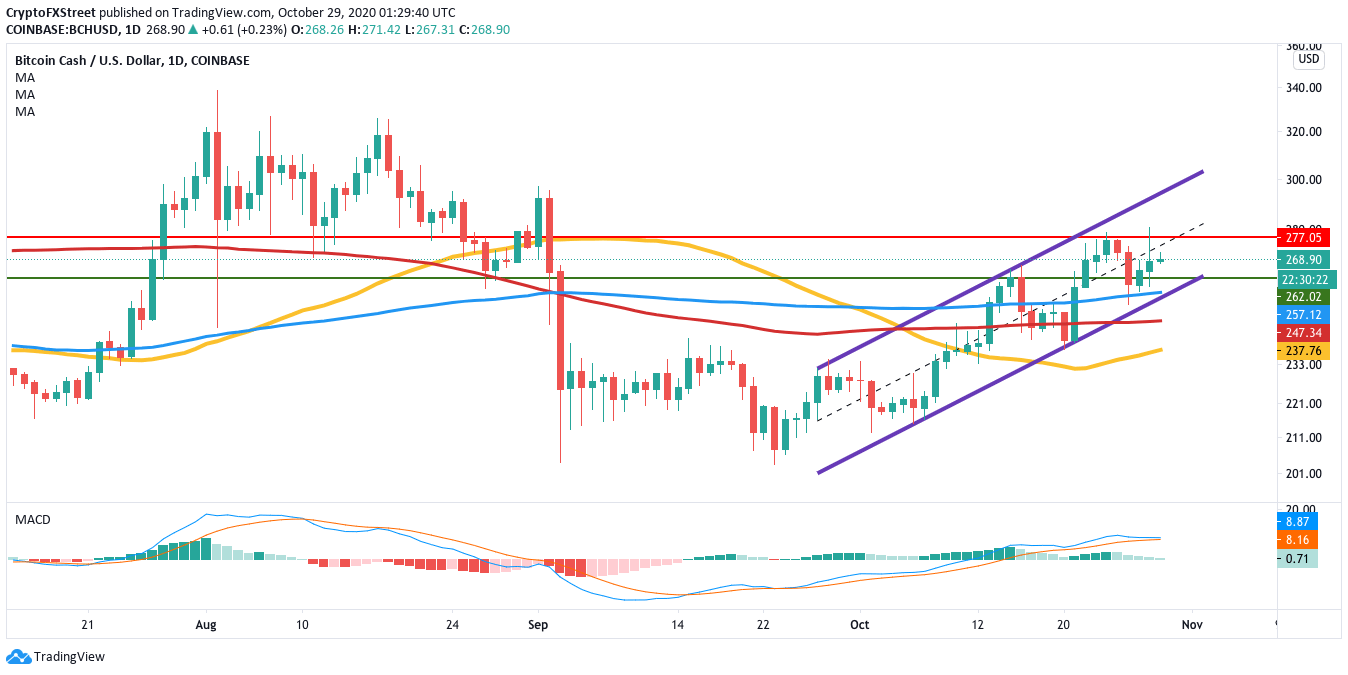

Bitcoin Cash Price Forecast: BCH’s path to $300 cleared up – Confluence Detector

After the price found support around $207, Bitcoin Cash has been trending upwards in an ascending channel formation. During this upward trend, the Bitcoin fork managed to cross the 50-day SMA ($238), 200-day SMA ($247.35) and 100-day SMA ($257.15). The MACD shows sustained bullish momentum.

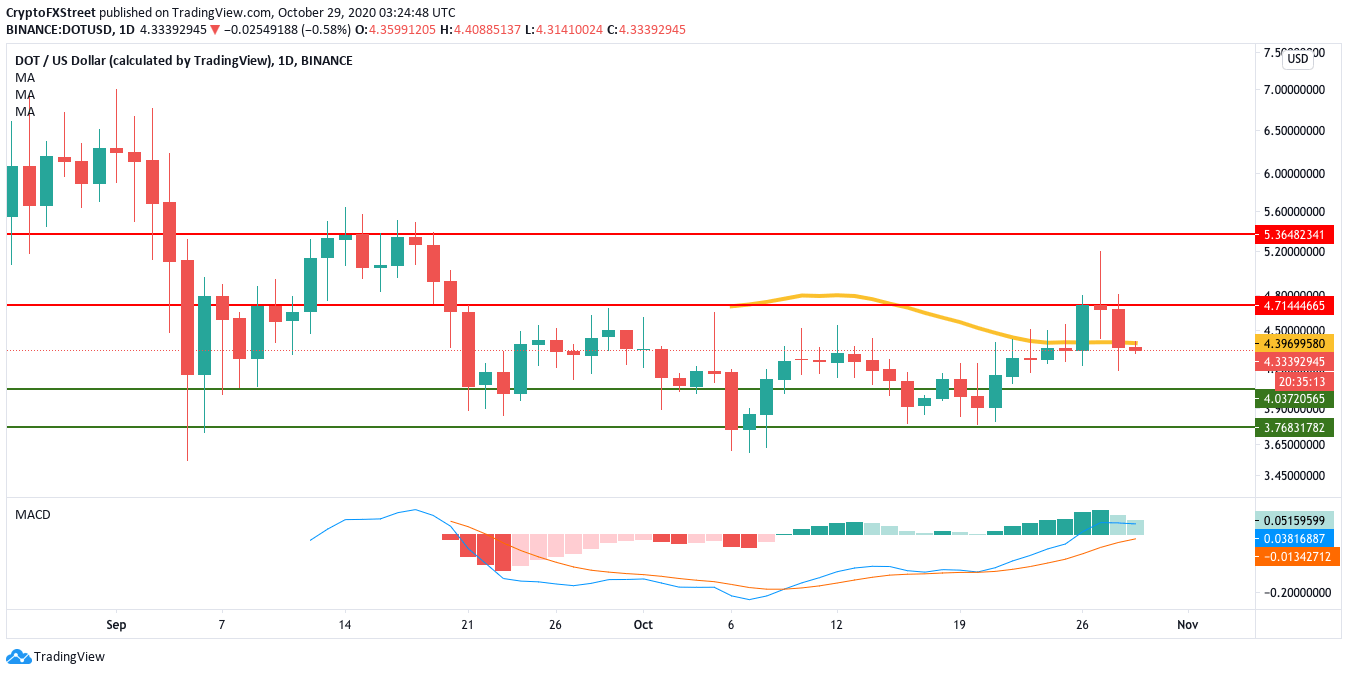

Polkadot Technical Analysis: DOT bears tighten their hold, price aims for $4

Polkadot has had three consecutive bearish days after encountering resistance at the $4.70 barrier. In the process, DOT managed to break below the 50-day SMA and is currently priced at $4.35. The sellers are looking to aim for the $4 support wall.

UniSwap Technical Analysis: UNI bulls aggressively fight for an upswing to $3.5

UniSwap recently revisited the crucial and robust support at $2.5 amid declines within a descending parallel channel. At the beginning of August, the recovery staged hit a barrier at $3.5, cutting short the bullish outlook. UNI/USD must break the descending channel middle layer resistance for gains above $3.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.