Cryptocurrencies price prediction: Bitcoin, Bitcoin Cash & Ethereum – European Wrap – 20 December

|

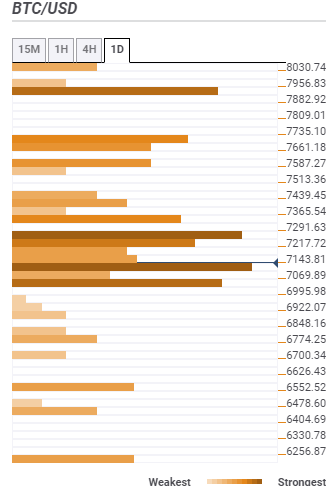

Bitcoin Price Prediction: BTC/USD at crossroads, is it $8,000 or $6,000 – Confluence Detector

Bitcoin seems to be marinating the next move targeting $8,000 before 2020. However, the sellers are leaving nothing to chance, in fact, they see Bitcoin losing the year close to $6,000. On the other hand, Bitcoin has proved that it has the ability to recover from extreme losses. Therefore, further losses ahead of the May 2020 halving is not causing too much panic across the landscape.

Bitcoin Cash Price Analysis: BCH/USD bulls wake in readiness for an action-packed weekend

Bitcoin Cash finally let go of the former strong support at $200. The breakdown plummeted below $190 (previous buy zone) and $180. Luckily the buyer congestion at $170 put an end to the declines and kick-started the ongoing bullish momentum.

Ethereum Price Analysis: ETH/USD sliding down on PlusToken liquidation concerns

Ethereum hit the recovery high at $134.50 and resumed the decline. At the time of writing, the second-largest digital asset is changing hands at $127.40, off the intraday low of $125.95. ETH/USD has lost about 1% of its value both on a day-to-day basis and since the beginning of the day.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.