Chiliz Price Forecast: CHZ prepares to embark on 35% upswing

|

- Chiliz price is consolidating in anticipation of a volatile bull rally.

- A decisive close above the supply zone that ranges from $0.594 to $0.645 will signal the start of this uptrend.

- The bullish scenario will face extinction if the resistance level at $0.510 is shattered.

Chiliz price has surged exorbitantly since the sell-off witnessed in April. Now, CHZ is coiling up, preparing for blast-off.

Chiliz price eyes higher high

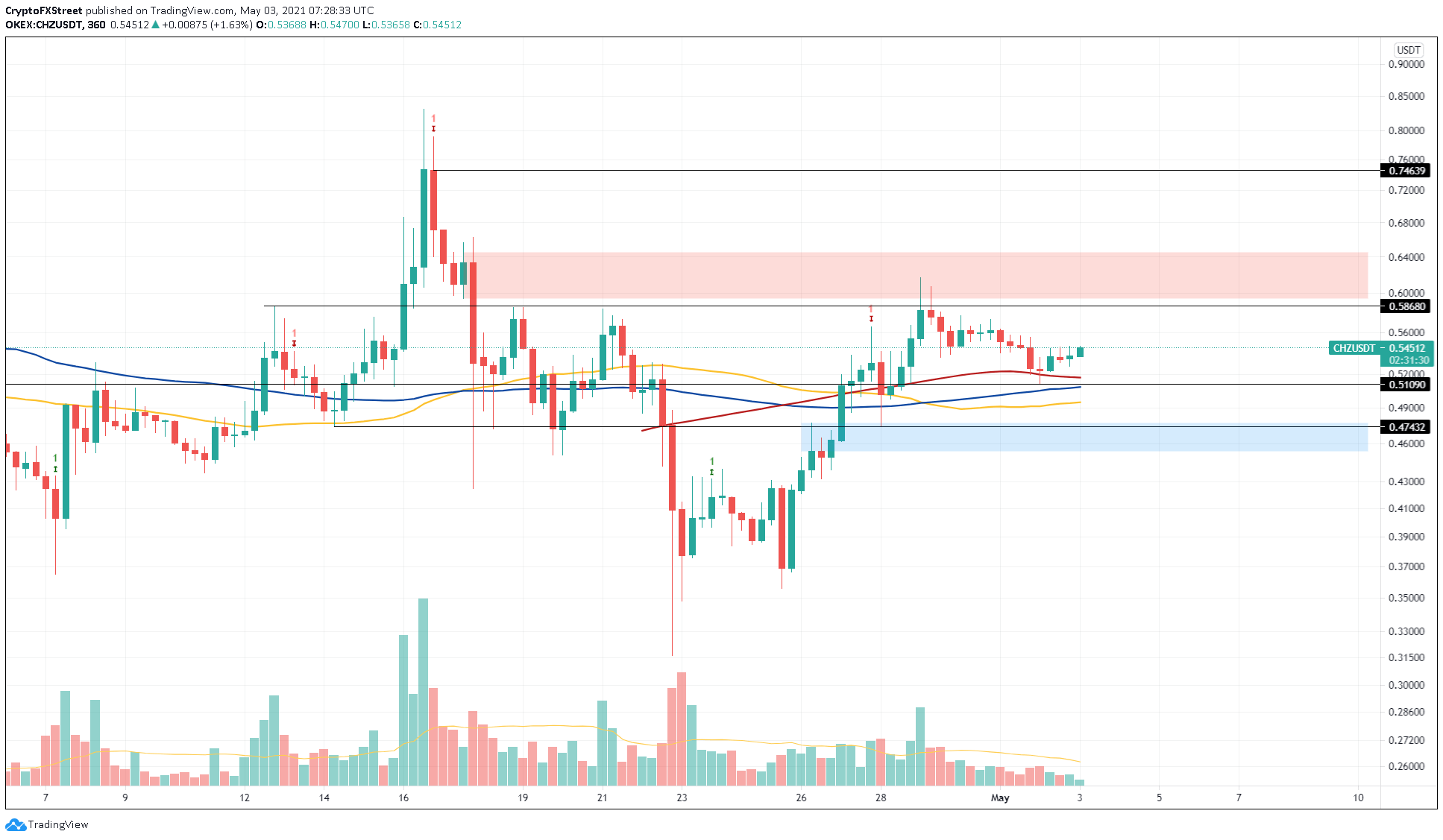

On the 6-hour chart, Chiliz price shows that it is undergoing a correction after rallying nearly 30% since April 28. After bouncing from the support level at $0.519, CHZ looks to breakout out of this consolidation and head higher.

A sudden spike in buying pressure will most likely push Chiliz price toward the supply barrier that stretches from $0.594 to $0.645. This area of resistance has rejected CHZ thrice from surging higher, depleting the sellers present here.

Therefore, if bid orders pile up, the upcoming surge will flip the said zone into support. Under these circumstances, Chiliz price will have a path of resistance to retest a pre-crash level at $0.746.

In total, Chiliz price could potentially surge 35% in the near future.

CHZ/USDT 6-hour chart

On the flip side, if buyers fail to slice through the said zone, another correction might ensue toward the support level at $0.510.

A breakdown of the cluster of 50, 100 and 200 Simple Moving Averages present between $0.517 and $0.495 will invalidate the bullish outlook.

If investors begin to panic sell here, then the demand zone that extends from $0.453 to $0.477 will be tested.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.