Chainlink price aims to hit $20 as it faces almost no opposition

|-637336005550289133_Small.jpg)

- Chainlink price has defended a crucial support level and aims for a new all-time high.

- The digital asset seems to be facing very low resistance above according to various metrics.

Chainlink bulls have bought the dip and defended the 26-EMA support level on the daily chart. The digital asset is on its way to crack $18.43 and ultimately establish a new all-time high above $20.

Chainlink price can quickly rise as whales have been accumulating

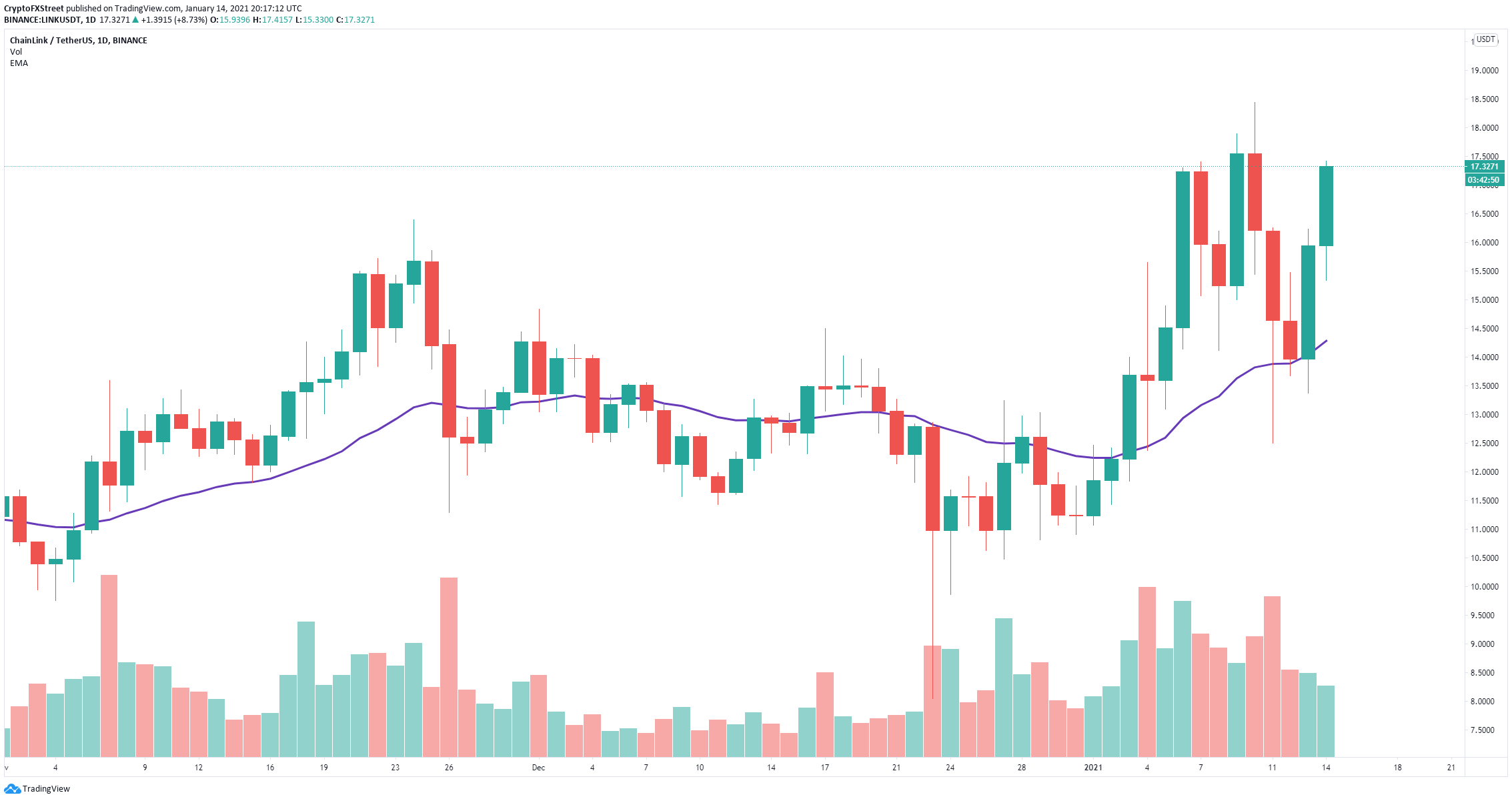

On the daily chart, Chainlink price fell as low as $12.5 on January 11, but investors quickly bought the dip pushing the digital asset to a price of $17.34 at the time of writing.

LINK/USD daily chart

According to the In/Out of the Money Around Price (IOMAP) chart there is practically no resistance above $16 but strong support on the way down which adds credence to the bullish outlook.

LINK IOMAP chart

Furthermore, the number of whales has continued to rise since December 2020. For instance, the amount of large holders with 10,000 to 100,000 coins increased from 2,812 on December 9, 2020, to 2,865 currently. Similarly, whales holding between 100,000 and 1,000,000 coins also continued to accumulate more Chainlink coins in the same time period.

LINK Holders Distribution chart

However, Chainlink had a lot of trouble in the past climbing above $17.5 which seems to be a robust resistance level. Another rejection from this point can quickly drive the digital asset down to $16.

LINK MVRV (30d) chart

The MVRV chart shows Chainlink has crossed into the danger zone which has been an accurate indicator of upcoming corrections in the past. We have seen similar levels in July 2020 and August 2020, right before major pullbacks.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.