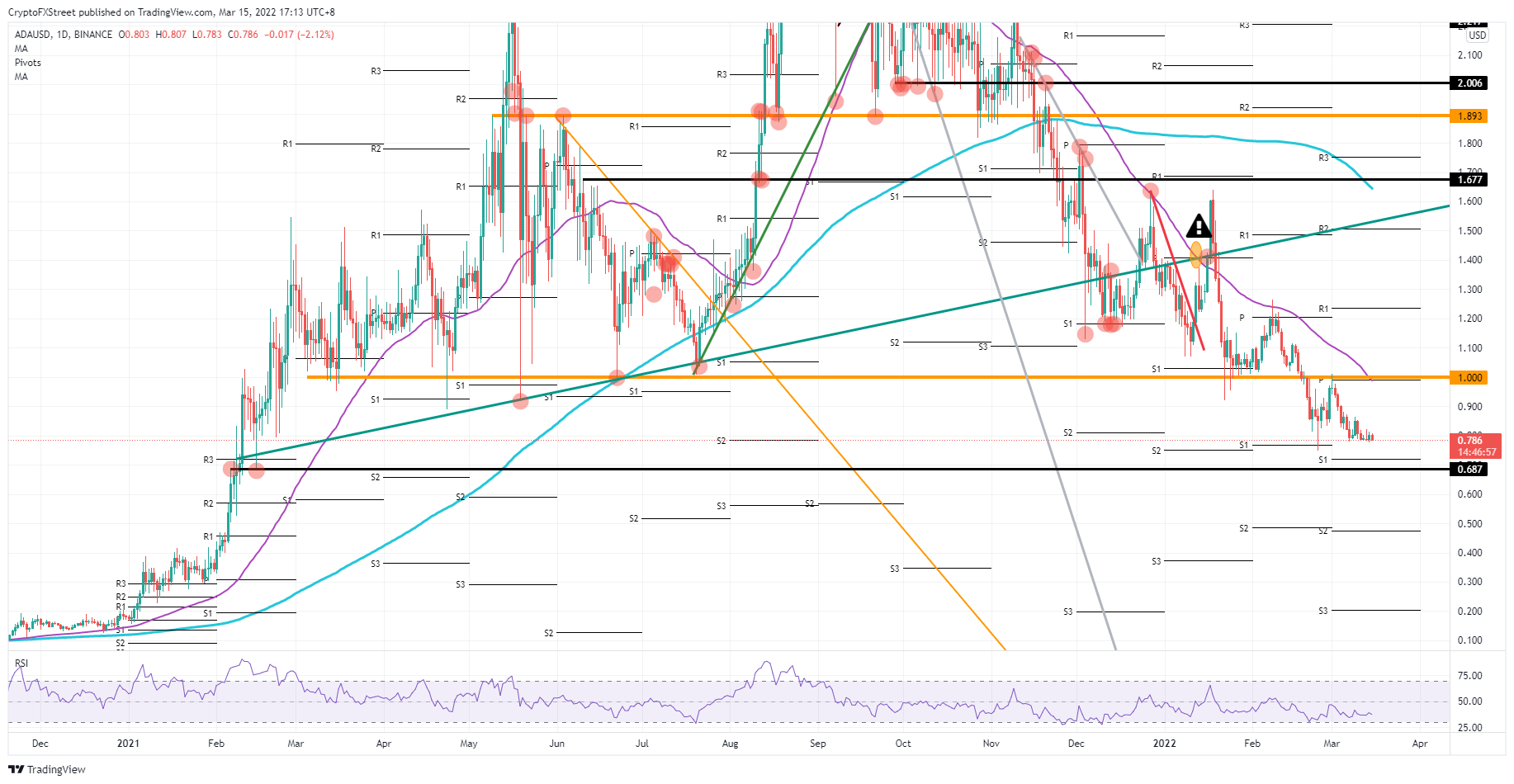

Cardano price shows incoming 15% correction

|

- Cardano price on the backfoot as price undergoes bearish squeeze

- ADA price action sees bears profiting from some open room still to go to the downside

- Expect to see pressure mounting, resulting in a possible 15% drop intraday to $0.687

Cardano (ADA) price is undergoing a classic technical squeeze to the downside as lower highs are pushing bulls against a floor, though that floor is holding for now. As the squeeze looks ready to break below current levels, expect to see a violent and quick drop that historically looks to complete a swing trade. Once the swing trade completes expect to see bulls coming in and performing a bounce-off as a prepositioning move for a bull run.

Also read: Gold Price Forecast: XAUUSD reaches fresh weekly lows near $1,900

Cardano price set to perform falling knife under massive bearish pressure

Cardano price is under siege by bears as they use a window of opportunity to push price action even further to the downside. Headwinds from stalled peace talks between Russia and Ukraine are only building the case for further bearish price action in ADA. With the Relative Strength Index (RSI) not in oversold territory yet, a window of opportunity is there for bears to squeeze out another 15% devaluation in price action.

ADA price action sees this pressure mounting as lower highs are formed against a flat bottom at $0.785. Expect to see a sharp break triggered by any form of negative headline coming out or the Nasdaq tanking by over 1% again. A break below $0.785 is not likely to see much support along the way until $0.720 at the monthly S1 support level. Perhaps more important is $0.687, a level that goes back to February 15, 2021, and will be the endpoint of a swing trade that lasted for over a year.

ADA/USD daily chart

Either the break, and then bounce off the monthly S1 support, or the $0.687 technical level could be levels that sees bulls returning to the scene. With the swing trade completed, a technical bounce-off would fit the narrative and have investors look beyond the current dire situation on the world stage to the potential that lies ahead, and a relief rally once a truce is signed and commitments have been made between Russia and Ukraine. A countermove would result in at least a return to $1.00, the monthly pivot and the 55-day Simple Moving Average as a counterweight to pause the bull rally from overheating.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.