Cardano Price Prediction: ADA to rally another 175% as resistance weakens

|

- Cardano price continues its 2,300% bull run becoming the fourth-largest cryptocurrency by market cap.

- ADA has sliced through the $0.75 resistance level hinting at another leg-up on the horizon.

- On-chain metrics note a strong growth in user adoption, supporting the bullish thesis.

Cardano price has risen a whopping 2,300% since the COVID-fuelled market crash in March 2020. The extraordinary bull run pushed the so-called "Ethereum killer" higher in the market capitalization rankings.

Now, ADA is the fourth-largest cryptocurrency in the world as it gains visibility as a contender in the smart contracts industry.

Cardano price aims for higher highs

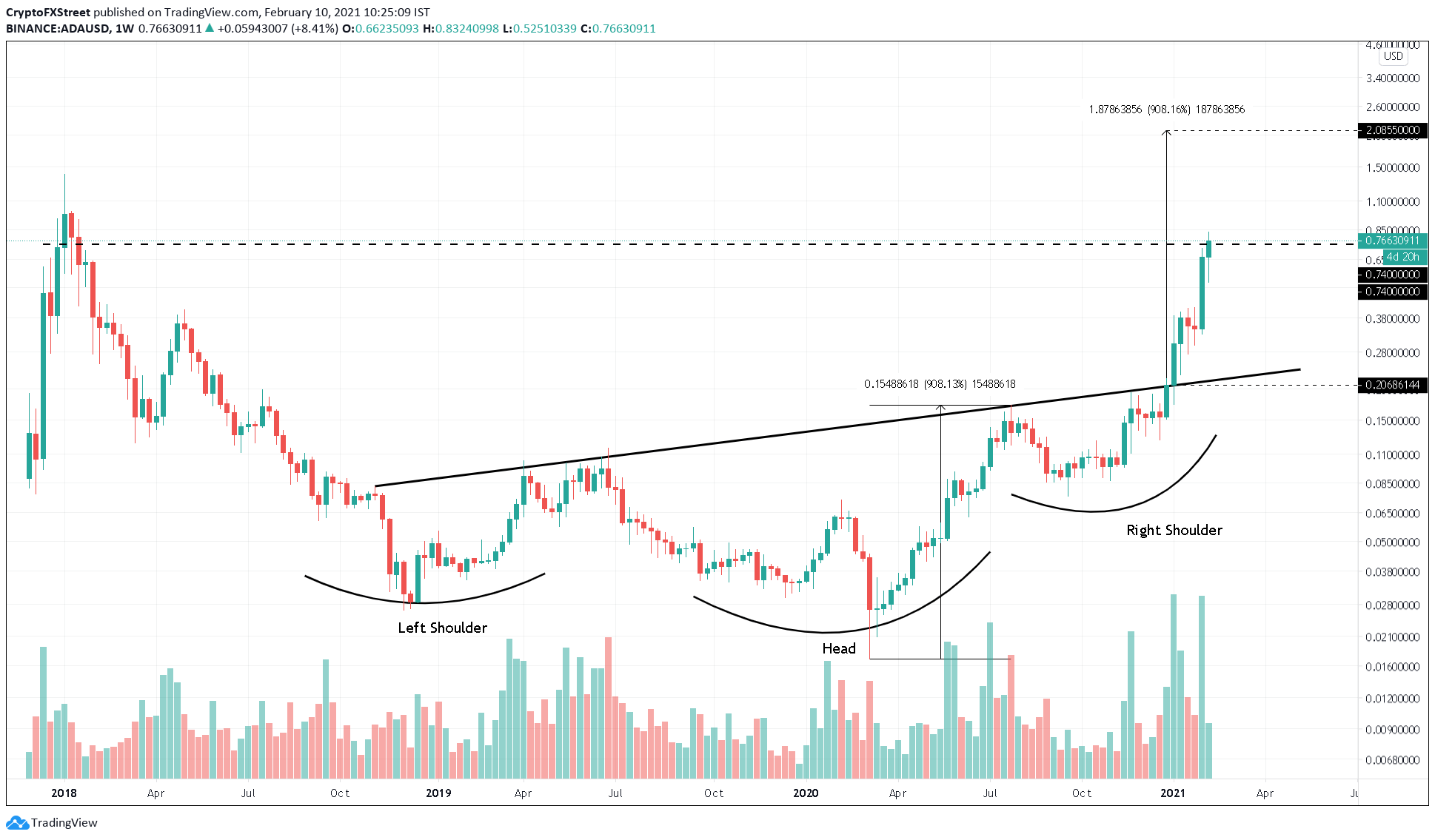

Cardano price confirmed a breakout of an inverse head and shoulder after its close above the pattern’s neckline on January 4. Since then, ADA has witnessed a 275% upswing in less than 35 days.

The reversal pattern forecasts that Cardano price could rise by another 170% to hit a target at $2.00.

ADA/USD 1-week chart

On-chain data adds credence to the bullish thesis. Indeed, Cardano’s network has seen a 130% increase in new users over the last month. Almost 50,000 new ADA addresses were created on February 9 alone.

The sudden spike in network growth indicates market participants are confident in Cardano’s future and don’t mind buying it at the current levels as they expect further growth.

Cardano Daily New Addresses chart

While demand is rampant, IntoTheBlock's In/Out of the Money Around Price (IOMAP) shows little to no resistance barriers ahead of Cardano price that will prevent it from achieving its upside potential.

Instead, the smart contracts token sits on top of stable support at $0.68. Here, 31,000 addresses are holding 3 billion ADA.

Cardano IOMAP chart

It is worth noting that a breach of the $0.68 support barrier could invalidate the bullish outlook. In such a case, investors may expect a drop to $0.42.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.