Cardano Price Prediction: ADA breaks out of critical pattern targeting a 90% move

|

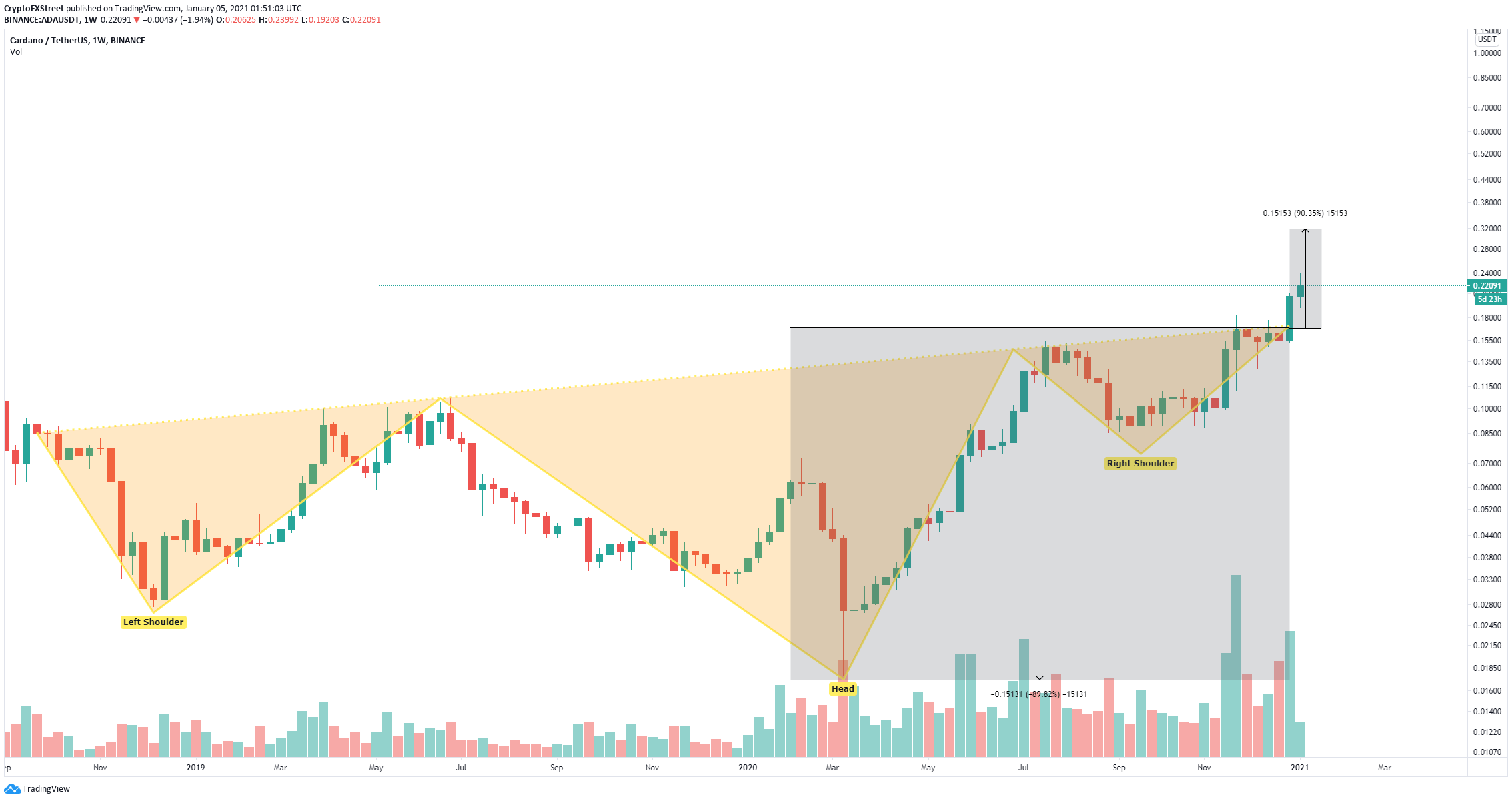

- Cardano price has been contained inside a long-term inverse head and shoulders pattern on the weekly chart.

- It seems that ADA has finally broken out of the pattern and aims for a 90% move to the upside.

Cardano was up by 35% in the past two days after a significant breakout from a crucial long-term pattern formed on the weekly chart. Bulls target a price of $0.32 in the medium term as the entire market has turned bullish.

Cardano price targets $0.32 with very little resistance above

The most significant pattern was the inverse head and shoulders on the weekly chart which has been broken. The next price target for the bulls is $0.32 which would be a two-year high, although the all-time high is set at $1.26.

ADA/USD weekly chart

The In/Out of the Money Around Price (IOMAP) chart shows lower resistance ahead in comparison to the support below. The most significant resistance area is located between $0.21 and $0.23. A breakout above this point will quickly push Cardano price towards $0.25.

ADA IOMAP chart

Bears hope to crack the crucial support area between $0.20 and $0.21 which would push Cardano price down to $0.187. The lowest bearish price target would be $0.168 which was the resistance neckline of the inverse head and shoulders pattern on the weekly chart.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.