Can the recent bounce be a sign of the bull trend revival?

|

The cryptocurrency market cannot revive the bullish cycle due to the ongoing bearish influence. However, some coins keep trading in the green zone.

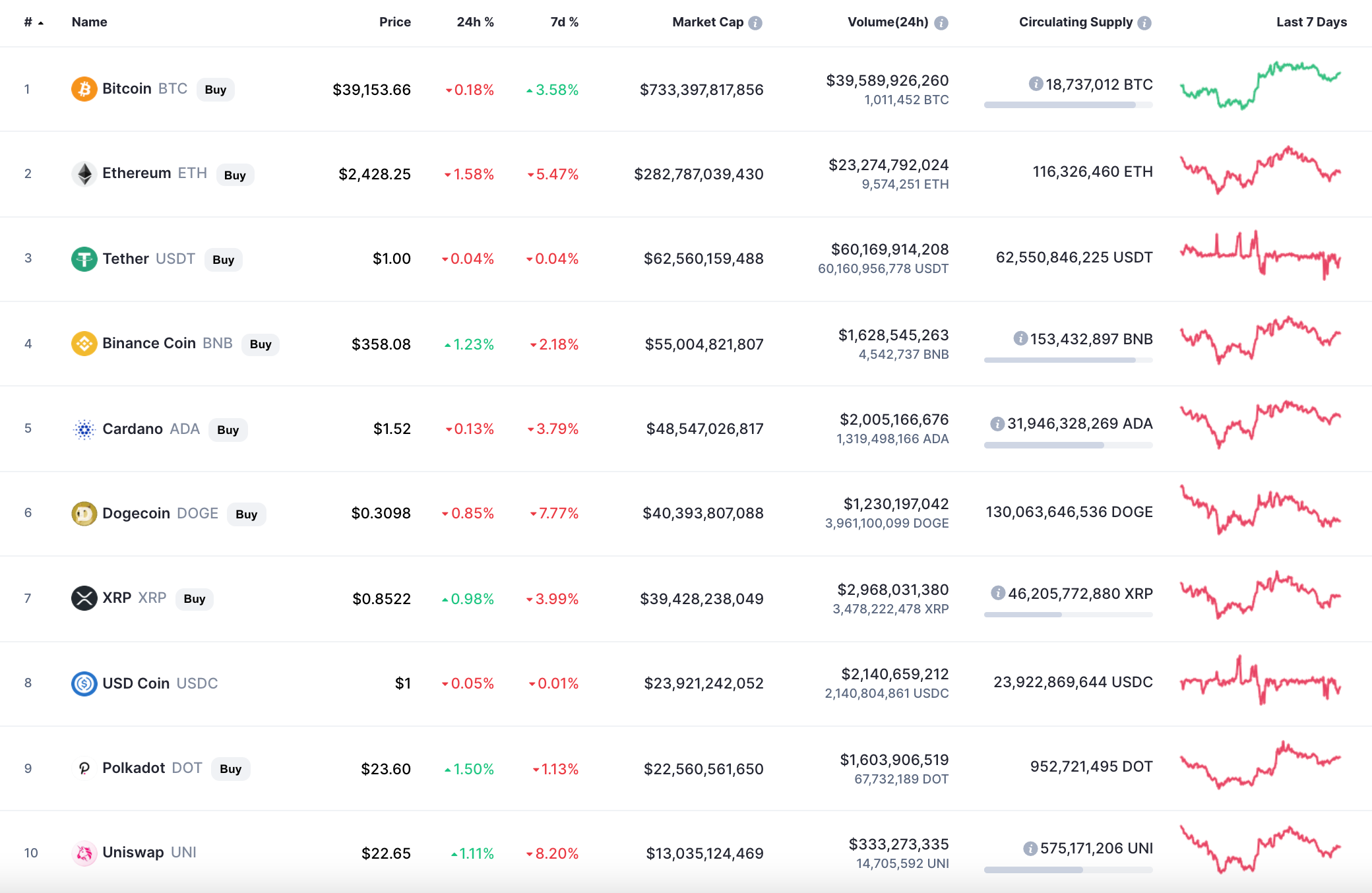

Top coins by CoinMarketCap

BTC/USD

Yesterday morning, the Bitcoin (BTC) price held in a tight consolidation with support at $39,600. After lunch, the pair fell out of the sideways range, and by the end of the day, the price sank to the support of $38,000.

BTC/USD chart by TradingView

There was no strong pressure from the bears, so the pair held above the four-hour EMA55. If today this moving average limits the decline, the price might recover to the level of $42,450 in the near future.

Bitcoin is trading at $38,690 at press time.

ETH/USD

Yesterday, sellers were able to overcome the support of the four-hour EMA55 and pulled the pair back to the $2,350 mark. The first attempts of buyers to return the pair to the area of average prices are visible this morning.

ETH/USD chart by TradingView

Despite a significant drawdown in price, one expects that in the near future Ethereum might recover above the resistance of $2,800 and test the psychological level of $3,000 by the end of the week.

Ethereum is trading at $2,378 at press time.

ADA/USD

The price of Cardano (ADA) has remained the same since yesterday.

ADA/USD chart by TradingView

Cardano (ADA) is neither bullish nor bearish from the mid-term scenario. The trading volume is low, which means that sideways trading is dominating at the moment.

If the altcoin slowly approaches the support level, bears might break it and get the price of ADA to the area around $1.

ADA is trading at $1.50 at press time.

BNB/USD

Unlike Cardano (ADA), Binance Coin (BNB) has shown a 1.23 percent increase.

BNB/USD chart by TradingView

Binance Coin (BNB) has successfully bounced off the support at $355, displaying the bulls' power. If buyers can fix above this level, there is a high chance to see a restest of the resistance at $397 within the next days.

BNB is trading at $355 at press time.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.