BTC/USD Price Prediction: Price sandwiched between strong levels of support and resistance

|

- BTC/USD bulls still can’t breach past $4,000 as price stuck at $3,990.

- BTC/USD price is stuck in between strong levels of resistance and support which hampers further movement.

BTC/USD are struggling to breach past $4,000 as the price is stuck at $3,990. BTC/USD price is stuck in between strong levels of resistance and support which hampers further movement. There is only one significant level of resistance, so if the bulls can breach past that, they have a clear path till $4,500.

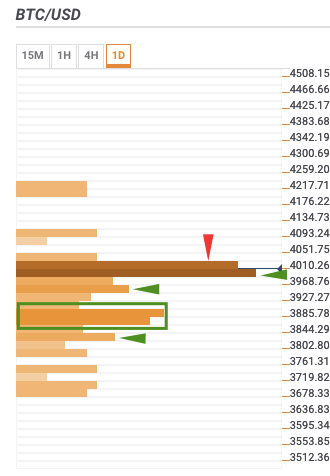

BTC/USD daily confluence detector

The BTC/USD daily confluence detector shows only one strong resistance level at $4,025. The confluence at that level is as follows - Hourly previous low, 10-day simple moving average (SMA 10), SMA 5, 15-min previous high, 4-hour Bollinger band upper curve, 15-min Bollinger band middle curve, daily Bollinger band upper curve, daily 23.6% Fibonacci retracement level, hourly previous high, 161.8% weekly Fibonacci retracement level, weekly pivot point resistance 2, and 15-min Bollinger band upper curve.

The resistance levels are at $3,975, $3,950, $3,845-$3,880, and $3,825. The confluences at those levels are:

- $3,975: SMA 10, 4-hour Bollinger band middle curve, SMA 50, SMA 200, hourly Bollinger band middle curve, SMA 100, SMA 5, 4-hour previous low, 15-min Bollinger band lower curve, daily 38.2% Fibonacci retracement level, monthly 23.6% Fibonacci retracement level, and 15-min previous low.

- $3,950: Daily pivot point support 1, daily previous low, SMA 5, and 4-hour Bollinger band lower curve.

- $3,845-$3,880: Weekly pivot point support 3, daily Bollinger band middle curve, monthly 38.2% Fibonacci retracement level, weekly 61.8% Fibonacci retracement level, SMA 100, and daily 161.8% Fibonacci retracement level.

- $3,825: Weekly 23.6% Fibonacci retracement level and weekly pivot point support 1.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.